With uncertainty regarding the United States economy’s next trajectory, an expert has warned that the Federal Reserve’s intervention might not be sufficient.

Particularly, macroeconomist Henrik Zeberg, in an X post on July 3, warned that the Fed’s response to the ‘slowing economy’ is significantly delayed, setting the stage for the largest economic crash since 1929.

Zeberg highlighted his concerns about the Federal Reserve’s focus on inflation, which he argues is a lagging indicator in the business cycle.

The expert predicted that the Federal Reserve’s eventual infusion of liquidity will temporarily send the market into a blow-off top—a sharp and unsustainable rally—before a significant recession sets in during the fourth quarter of 2024.

“Fed will come to the rescue – but they are already way too late. Geniuses are looking at “inflation”, which is a lagging indicator in the Business Cycle. <…>. Largest Crash since 1929 ahead!,” he said.

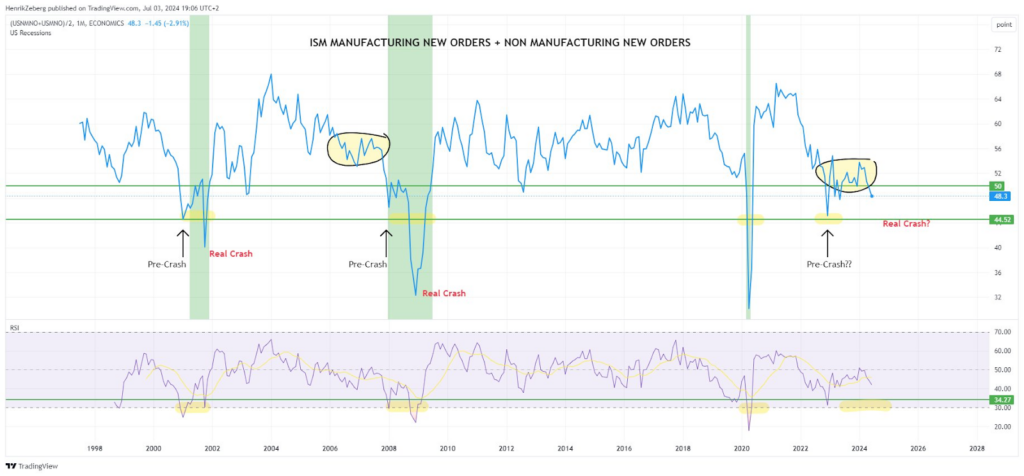

Non-manufacturing new orders indices indicator

Notably, Zeberg based his projection on the United States non-manufacturing new orders indices, which reveal a pattern that precedes significant market downturns. This highlights similarities between past economic crashes and current trends.

Data shared by the analyst identified periods preceding significant crashes, followed by sharp declines. These pre-crash phases are characterized by dropping new order indices, indicating a slowdown in economic activity.

In the present context, the data shows a similar emergence of a pre-crash pattern. The indices have been trending downward, indicating a slowdown in new orders in both manufacturing and non-manufacturing. This aligns with Zeberg’s prediction that the economy is already decelerating.

Notably, the Relative Strength Index (RSI) during previous pre-crash periods dipped below 50, signaling weakening momentum. Currently, the RSI is again hovering around the same critical level, suggesting that market momentum is waning.

Markets blow-off top

Zeberg’s prediction of a blow-off top before a major crash illustrates a sharp but short-lived uptick following the Federal Reserve’s intervention. This phenomenon was also observed before previous major downturns, where temporary liquidity infusions led to brief market rallies before subsequent crashes.

It’s worth noting that Zeberg has maintained that the US economy is primed for a recession in the second half of 2024. As reported by Finbold, the economist warned that before the recession hits, there may be a temporary market rally affecting the stock and the crypto sector.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.