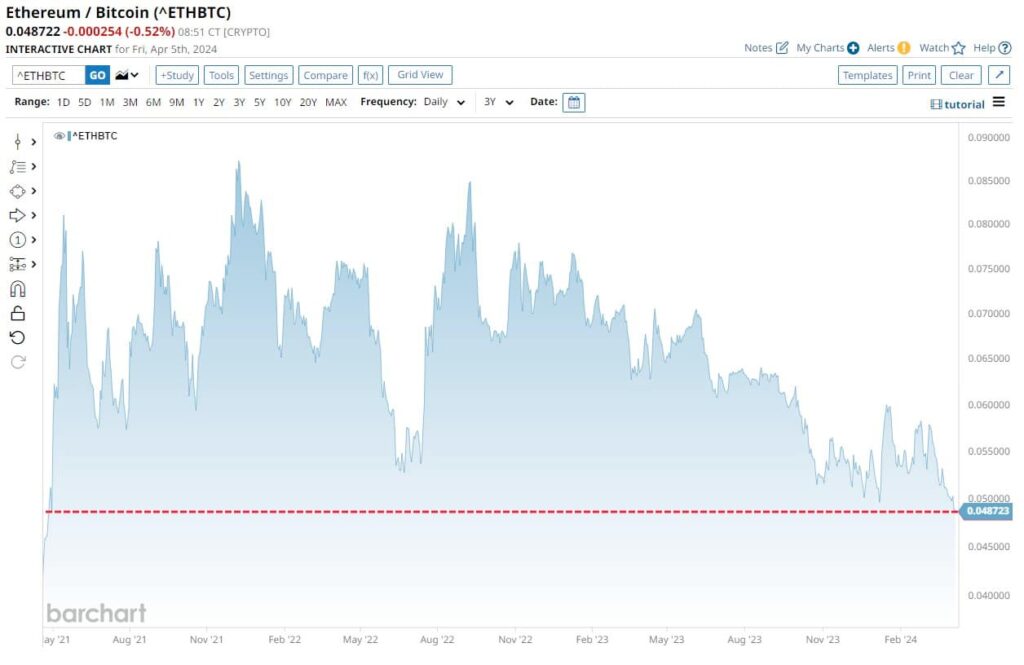

Ethereum (ETH) has reached its lowest value against Bitcoin (BTC) in a 3-year time frame, worth 0.04872 BTC. This 3-year low ETH/BTC exchange rate challenges what Ethereum enthusiasts call “the flippening.”

Barchart noticed the new record lows and reported about it on April 5, sharing a daily price chart for ETH/BTC. On that chart, we see Ethereum breaking this time frame’s previous low of January 2024 against Bitcoin.

Notably, these are part of a visible downtrend that came from September 2022 after the cryptocurrency market crash. During the crash, Ethereum massively dropped against Bitcoin, reaching the period’s previous lows at 0.04908 BTC.

Ethereum vs. Bitcoin analysis and the flippening

This mid-term price action has raised questions about Ethereum’s ability to surpass Bitcoin’s market cap. An expected event that is commonly known as “the flippening,” backed by the idea that ETH can be a better store of value than BTC, due to supposedly better economic fundamentals and demand.

While some cryptocurrency traders see the new 3-year low as a signal that “the flippening” will not happen anymore, others look at it as a buying opportunity. Matt’s Investing Journey commented with this optimistic bias in Barchart‘s post.

“Buying opportunities are coming soon.”

In this context, Finbold zoomed out the ETH/BTC chart, looking at monthly candles throughout the pair’s history.

Historically, every time Ethereum crossed the 0.04880 price level against Bitcoin, it rallied to higher grounds. Moreover, the current level made significant support for ETH/BTC, also igniting price surges after hitting this mark.

In particular, this happened in April 2017, November 2017, May 2021, and June 2022. All key moments for cryptocurrencies, resulting in gains as high as 200% for Ethereum against Bitcoin, rewarding ETH investors.

All things considered, the recent downtrend is strong evidence of Ethereum losing its value against Bitcoin in the past three years. However, it is also a historical indicator that ETH could soon outperform BTC’s mid-term results if the trend reverses.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.