Ethereum (ETH) performance against Bitcoin (BTC) is a leading indicator of market cycles and an altseason. Thus, cryptocurrency traders and investors constantly monitor the ETH/BTC pair for valuable insights.

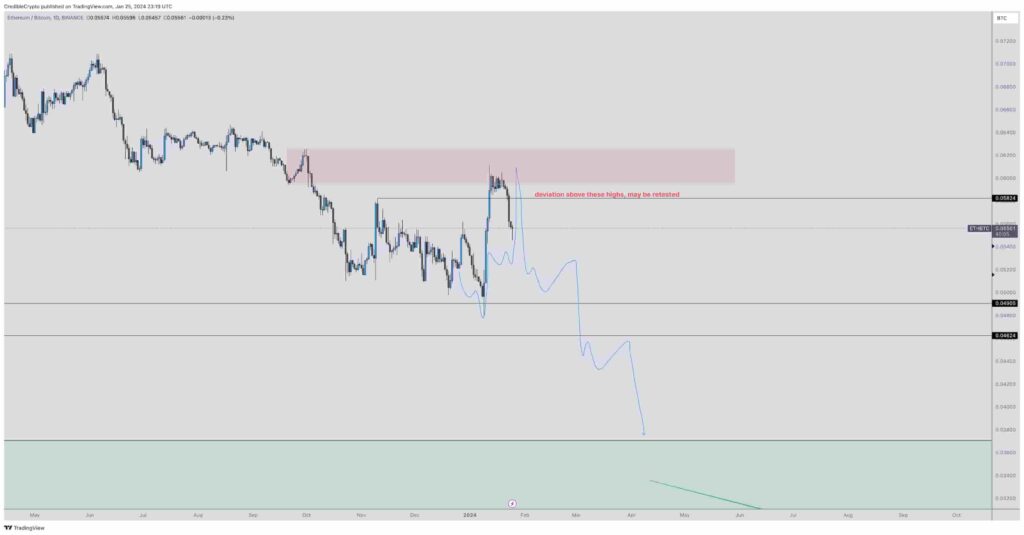

In particular, the well-known CrediBULL Crypto has his eyes turned to this pair and warns of a possible Ethereum sell-off. According to him, Ethereum has found a local top against Bitcoin in an expected deviation above previous highs.

CrediBULL Crypto posted this analysis on X (formerly Twitter) on January 25, quoting a previous post where he forecasted the deviation, as happened.

ETH/BTC analysis

Notably, the trader points to a breakout from the current support line at 0.04905 BTC per Ethereum. Furthermore, ETH/BTC should continue its downfall through 0.04624 BTC straight to a range below 0.03800 BTC.

CrediBULL Crypto explained ETH/BTC will only find a bottom once Bitcoin makes a new all-time high. Therefore, investors must be aware of “any bounces before that,” as they will most likely fade away, in his words.

Since posting, Bitcoin has already outperformed Ethereum by around 2%, validating the above analysis. However, the economic context is a key factor to consider. Moreover, the cryptocurrency market is unpredictable, and everything could change swiftly.

On the other hand, institutional investors are turning to Ethereum and showing support for altcoins and tokenization. Recently, Franklin Templeton backed ETH, SOL, and other cryptocurrencies focused on utility. In the meantime, BlackRock’s CEO shared his vision of tokenization while talking about an expected Ethereum spot ETF approval.

All things considered, it is possible that the ETH/BTC pair surprise technical analysts in the near future, depending on further developments involving institutions and the regulatory landscape. Investors must trade cautiously, keeping themselves updated on the adoption and demand for Ethereum or Bitcoin.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.