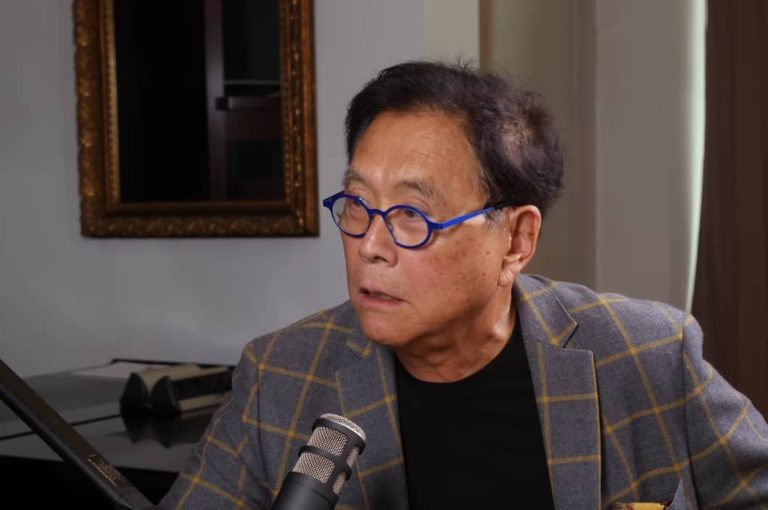

With investors hoping for a rally in both the equities and cryptocurrency market, the author of the personal finance book “Rich Dad, Poor Dad” Robert Kiyosaki believes there is room for a further market correction.

According to a tweet by Kiyosaki, the asset market, especially for Bitcoin and real estate, is about to burst, and prices will crash further. Kiyosaki noted that he is getting ready to make profits with the projected bubble while calling on investors to prepare for what he termed “the greatest sale on Earth.”

“FAVORITE 4 LETTER WORD is not F word or S word. Favorite 4-letter word is SALE. Asset Bubble found a Pin. Asset prices crashing. In cash position waiting to pick up bargains especially in real estate and Bitcoin. Fed is “F”ed. Do not miss the GREATEST SALE on EARTH. Take care,” said Kiyosaki.

Kiyosaki’s asset choices for a market crash

Notably, Kiyosaki remains bullish on Bitcoin and has long predicted a market bubble burst. He has previously urged investors to prepare for the biggest crash in the world while promoting the accumulation of specific assets, including Bitcoin, real estate, silver and gold, at bargain prices.

As reported by Finbold in May, Kiyosaki warned of a potential World War while advising investors to save gold, silver, Bitcoin, food, guns, and bullets.

“May 23, 2022: DAVOS, Switzerland IMF warns world faces greatest financial challenges since WWII. Global disaster has been coming for years. Desperate leaders will do desperate things. World War coming? God have mercy on us. Save gold, silver, Bitcoin, food, guns, and bullets,” he said.

His warning correlates with the general market turmoil for equities and cryptocurrencies amid a high inflationary environment.

Market records slight gains

In the wake of his projection, the cryptocurrency market has made slight gains recording an influx of capital, with Bitcoin attempting to sustain gains above $20,000.

Besides Kiyosaki, other analysts believe that the market correction is near the end, and cryptocurrencies will emerge on top. According to Senior commodity strategist at Bloomberg Intelligence, Mike McGlone, if the stock market continues to struggle, Bitcoin and gold might stand out as the best-performing assets in H2 2022.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.