In recent years, Disney (NASDAQ: DIS) stock has struggled, experiencing a significant decline and dropping below the $80 mark, the lowest level in almost a decade. However, things have taken a turn in 2024.

The last two financial quarters have delivered impressive results, allowing DIS shares to regain some lost ground. This positive trend has instilled confidence among analysts, who are optimistic about the upcoming quarterly report, which will be released on May 7.

Despite setbacks, DIS stock has recently performed well, surpassing analyst expectations and driving up targets. The average price target is set at $128.93, a further 13% upside from current price levels.

What are analysts’ expectations for Disney in Q2?

Disney is scheduled to announce its earnings for the second quarter of fiscal 2024 on May 7 before the market opens. Investors will closely watch for growth in streaming subscribers as Disney aims to make its streaming business profitable.

Analysts predict Disney’s revenue for the quarter to be $22.08 billion, slightly lower than the previous quarter but higher than the same period last year. Net income is expected to be $1.97 billion, down from the first quarter but higher than the second quarter of 2023.

Diluted earnings per share (EPS) are projected at $1.09, compared to 93 cents in the same period last year.

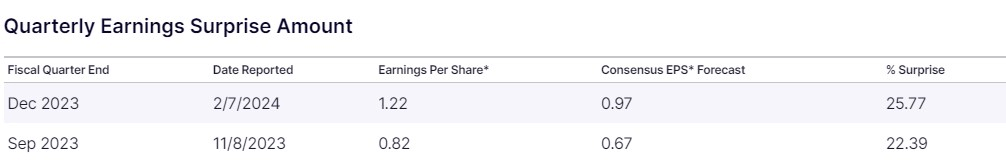

It is important to note that analysts had refrained from high expectations in the previous quarters, which has only aided Disney in easily beating expectations by more than 20%.

Previous earnings call brought hefty gains to DIS stock

The earnings calls on November 8 and February 7 boosted DIS shares by 6.91% and 11.50%, respectively, catching investors’ attention for the upcoming Q2 earnings report and its impact on DIS stock.

If there’s positive news, DIS stock could extend its recent gains by 0.91% in the current trading session and by 0.58% over the past five days.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.