Although the larger part of the cryptocurrency sector seems to be slowing down its previously accumulated (massive) gains, some of its assets might just yet make an impressive bullish recovery and more – one of them being XRP, at least in the view of a number of crypto and finance experts.

Indeed, Markus Thielen, head of research at the crypto analytics platform 10X Research, observed in a recent report that Bitcoin (BTC) is targeting $57,000 as its next resistance, with the increasing “odds for another leg being higher,” contributing to a healthy structure of the crypto market.

As he further explained, “Bitcoin is the critical directional influencer,” arguing that the likes of the XRP token, Ethereum (ETH), and other major digital assets will likely take the cue from the flagship decentralized finance (DeFi) asset and rise and fall with its movements.

Bullish signs for XRP

According to Ben Weiss, the CEO of Bitcoin ATM operator CoinFlip, things are looking bullish for the above assets, particularly considering the anticipated Bitcoin halving event that many expect will trigger a strong rally for the price of the maiden crypto. As he stressed:

“Bitcoin prices are rallying, innovations are expanding globally ahead of the election year, and the upcoming Bitcoin halving.”

Moreover, Anthony Scaramucci, the founder of hedge fund Skybridge Capital and crypto industry enthusiast who served as the White House Communications Director, noted that investors worried they might have missed out on a good opportunity with Bitcoin back over $50,000 should not be because:

“Interest rates falling, spot [exchange-traded funds (ETFs)] driving billions in new flows, halving two months away. Face-ripping rally incoming IMO.”

At the same time, crypto analyst Dark Defender observed that the relative strength index (RSI) for the Bitcoin-XRP trading pair on the weekly chart matched the one witnessed in the 2017 and 2021 bull runs, and XRP could soar to as high as $2 in 2024, as Finbold reported on February 19.

XRP price analysis

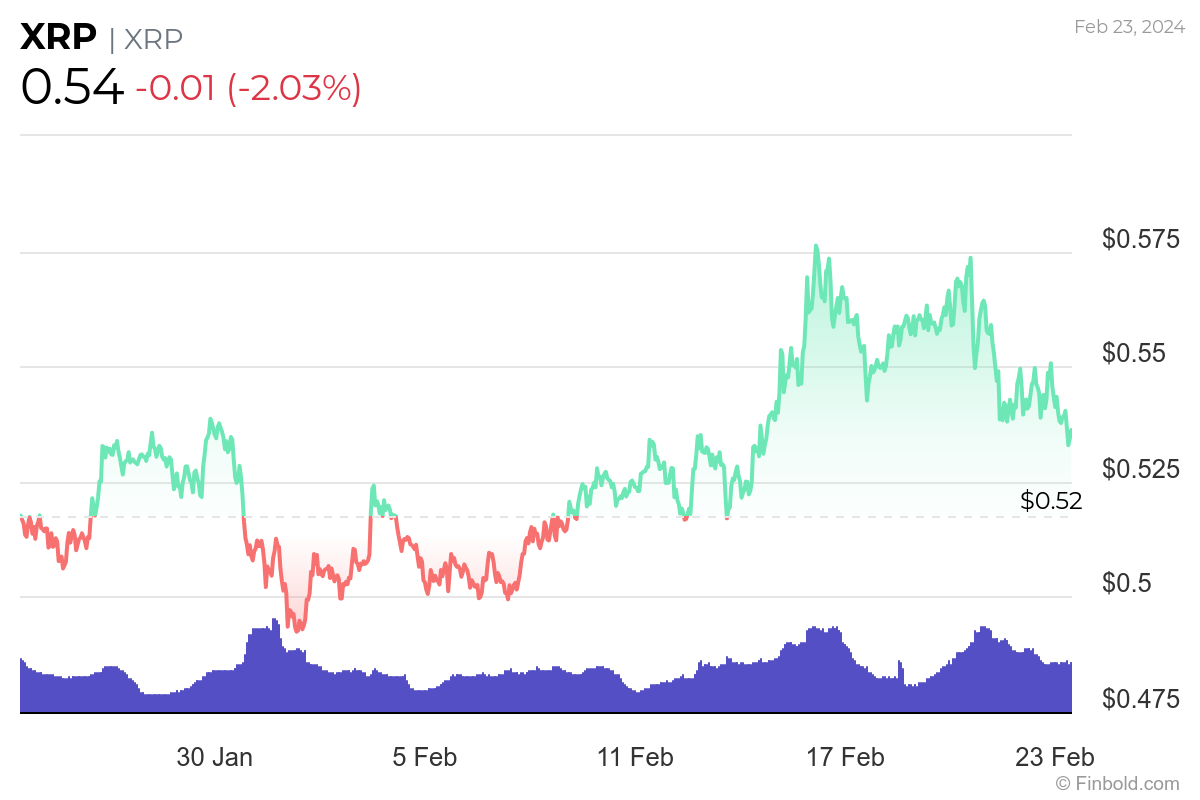

For now, XRP is changing hands at the price of $0.536, recording a slight decline of 2.03% in the last 24 hours and dropping 4.90% across the previous seven days while still holding onto the 4.31% gain on its monthly chart and advancing 36.05% over the year, as per data on February 23.

All things considered, Bitcoin has long demonstrated its influence on the price of other digital assets, including XRP, particularly evident in the fact that it has doubled its value since this time last year, pulling the price of XRP with it and stirring hopes of it crossing the $1 level in 2024.

However, it is important to remember that things in this sector can often be volatile and fall victim to various unexpected outside and inside factors, so caution, in-depth research, and risk analysis are essential before investing a significant amount of money in any digital asset.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.