As the stock market keeps reaching new highs, it appears that the overall economy might be struggling. This raises concerns about whether US government agencies are adequately prepared for potential challenges, especially as they contend with significant losses.

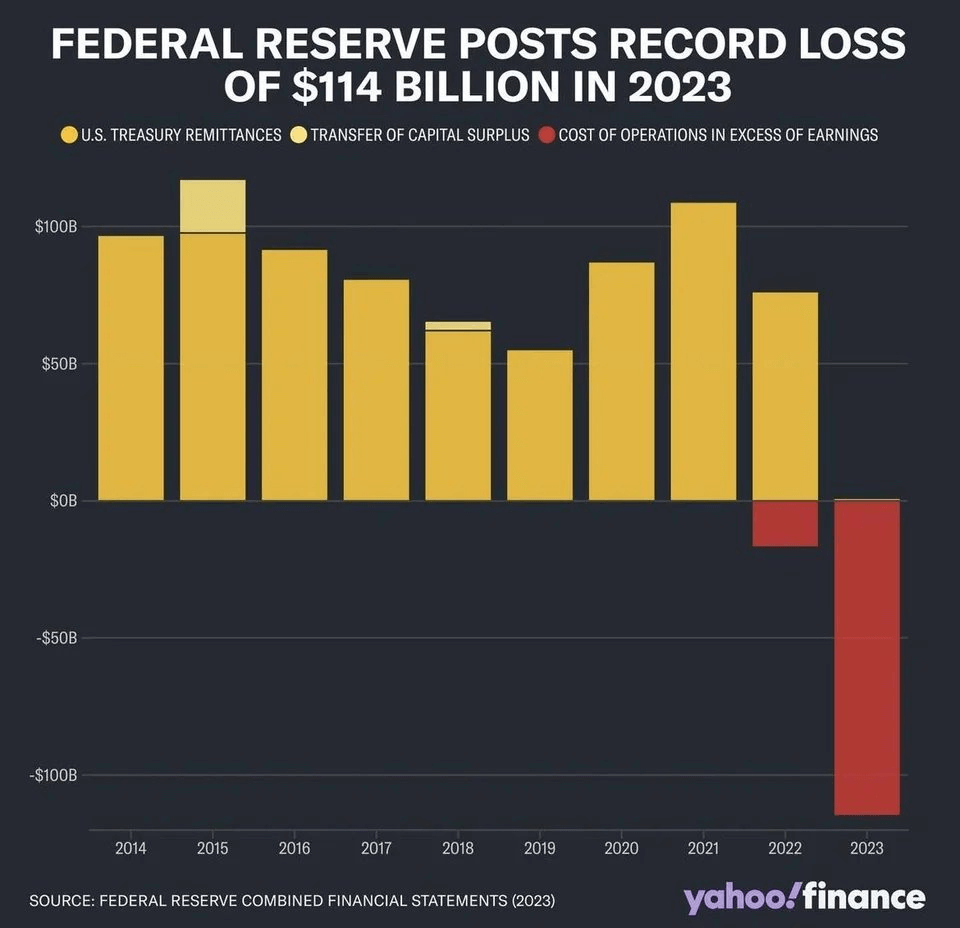

Specifically, the Federal Reserve, responsible for ensuring the safety and stability of individual financial institutions while also monitoring their collective impact on the broader financial system, reported its highest-ever annual loss of $114 billion in 2023.

It’s worth noting that the Federal Reserve doesn’t rely on congressional appropriations for funding. Instead, its operations are mainly financed by the interest earned on the securities it holds. These securities are obtained through the Federal Reserve’s open market operations.

What caused FED losses in 2023?

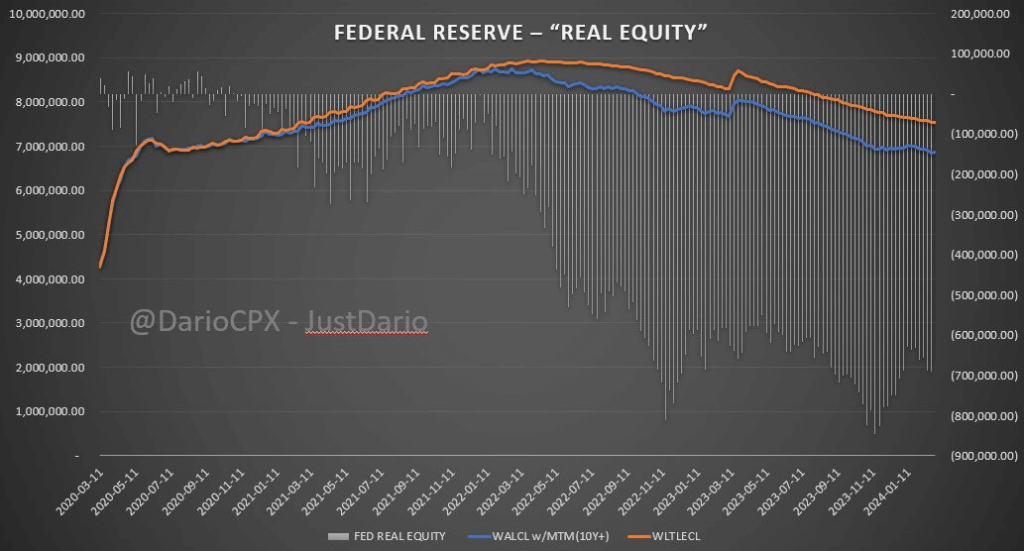

Although the Federal Reserve cannot experience a liquidity crisis due to its inherent nature, it remains susceptible to insolvency. Currently, the Federal Reserve faces insolvency, which can be explained through its financial structure.

Notably, all FED liabilities share a common characteristic: their short maturity, rendering them immune to nominal value reduction in the face of increasing interest rates. However, the Federal Reserve’s assets exhibit a contrasting sensitivity to interest rate fluctuations due to their significantly longer durations.

For instance, approximately $3.9 trillion in assets possess maturities exceeding 10 years. This imbalance between short-term liabilities and long-term assets has contributed to the Federal Reserve’s record annual loss in 2023, highlighting its current insolvency.

Why is this important for the stock market?

Investors may be curious about how these factors impact the stock market. Generally, if the broader economy experiences a downturn, the stock market tends to follow suit.

Another crucial consideration is the solvency of the Federal Reserve, which currently appears non-existent. In a worst-case scenario where multiple banks default, the Federal Reserve may be unable to bail them out, triggering a domino effect across the financial sector.

Additionally, interest rates play a pivotal role: when the Federal Reserve lowers interest rates, the stock market typically rises, whereas when it raises interest rates, the stock market tends to decline.

Given the considerable debt, there’s increased scrutiny on operations, workforce, and the quality of analysis. Lower balances necessitate reduced spending, which directly impacts quality across these areas.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.