Major Wall Street firms are increasingly warming up to cryptocurrency, as evidenced by their stakes in the spot Bitcoin (BTC) exchange-traded fund (ETF).

Specifically, financial filings indicate that major firms have made substantial bets on BlackRock’s (NYSE: BLK) Bitcoin ETF. This shift aligns with the product’s original goal of attracting institutional capital, particularly from influential players.

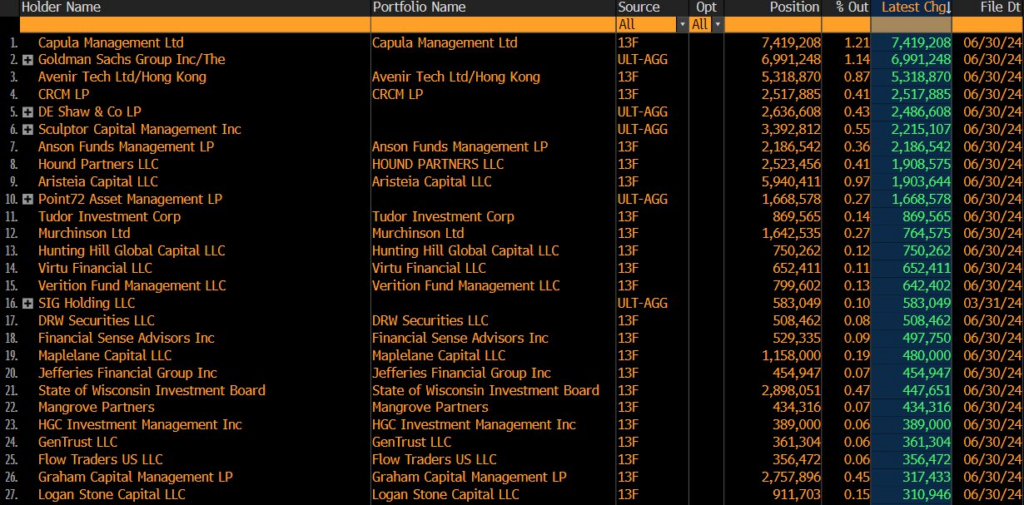

Key investors include Capula Management which has emerged as the largest holder with 7,419,208 units, marking a significant increase in its stake. Goldman Sachs Group (NYSE: GS), follows closely, holding 6,215,241 units, with a recent addition of 4,719,208 units.

Similarly, Avenir Tech Ltd/Hong Kong and CRKN LP have also shown strong involvement, holding 5,248,160 and 4,720,656 units, respectively. Avenir Tech Ltd notably increased its position by 2,485,065 units of the iShares Bitcoin Trust. .

The involvement of other financial heavyweights, such as D.E. Shaw & Co LP—now holding 3,481,208 units after a significant increase of 1,906,065 units—further underscores the widespread interest. On the other hand, Sculptor Capital Management LP now holds 2,100,656 units, reflecting an impressive increase of 1,905,856 units, while Anson Funds Management LP added 1,800,656 units, bringing its total to the same amount.

Overall, the cumulative increase among the top 20 holders in BlackRock’s Bitcoin ETF amounts to 34,109,929 units.

Implication of Wall Street involvement in Blackrock ETF

This influx suggests a growing belief in Bitcoin’s potential to maintain and even increase its value over time. These funds, managing billions of dollars in assets, see Bitcoin as an opportunity to balance their portfolios with a calculated dose of risk.

Additionally, BlackRock, the world’s largest investment firm, offers these entities a regulated, institutional-grade entry into the cryptocurrency market, which could pave the way for further institutional adoption.

The surge in ETF units comes despite Bitcoin’s recent price volatility, which briefly saw the cryptocurrency drop below the $50,000 mark. This confidence could catalyze other financial institutions to embrace digital assets as part of their investment strategies.

As of now, Bitcoin is trading at $59,394, reflecting a modest gain of about 0.2%.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.