General Electric (NYSE: GE) stock price surged almost 33% in the last month alone amid prospects for a substantial increase in free cash flows. The stronger than expected September quarter results and a rosy outlook for the upcoming years added to investors’ sentiments.

Besides the latest gains, the shares of the industrial conglomerate remained under pressure in the past two years due to Jeff Immelt’s strategy of expanding the business model to energy and financial markets.

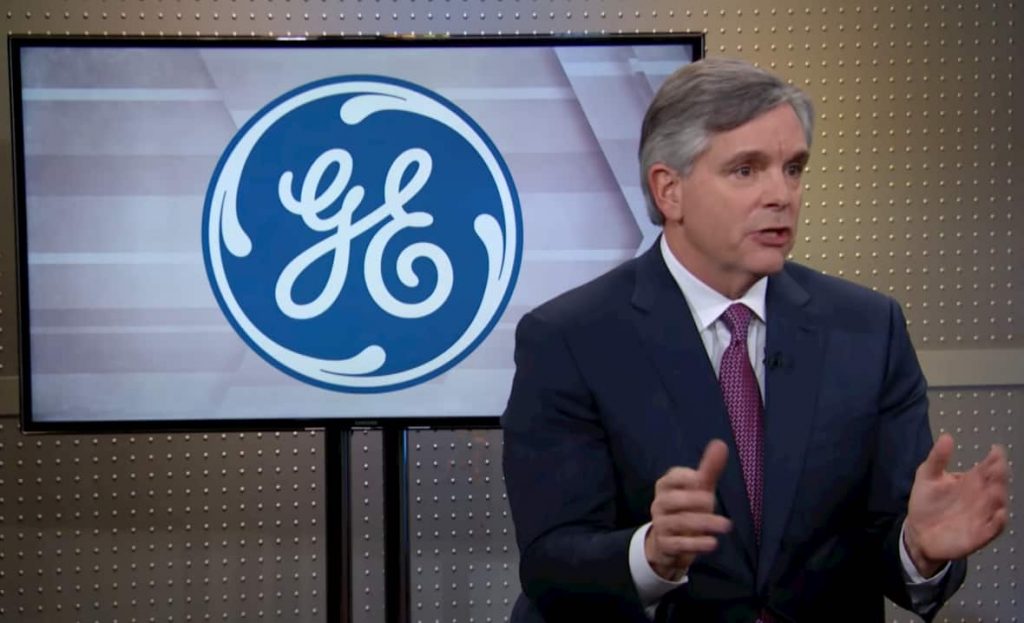

CEO Larry Culp’s strategy turned things around

After the retirement of Jeff, the appointment of Larry Culp as CEO of General Electric turned things around for GE shareholders.

Culp’s strategy of selling non-core business while moving funds towards industrial business helped in strengthening the balance sheet and cash flows. The company has repaid almost $11.7 billion of debt since the beginning of this year while its free cash flows also turned positive.

The company has generated $514 million in industrial free cash flows in the latest quarter, with expectations that free cash flows will stand around $2.5 billion in the fourth quarter.

“We are improving our profit and cash performance with organic margin expansion in every segment except Aviation, though orders more broadly remain under pressure,” CEO Culp said.

Although the company’s aviation business, which is the largest business segment, has been struggling due to pandemic, it still topped analysts’ expectations for a loss in the September quarter. Its adjusted earnings per share came in around $0.06 in the September quarter.

Even bears applauded Culp’s performance

The market pundits have appreciated the strategy of lowering costs, selling the non-core business, and expanding high margin industrial businesses.

Long time bears like J.P. Morgan’s Stephen Tusa says GE’s cash flow performance has been stronger than expectations. Meanwhile, Bank of America’s analyst Andrew Obin has provided a Buy rating, as the analyst is bullish on valuations, operations improvements, and medium-term free cash flow trajectory.

Related video: General Electric CEO Larry Culp on third-quarter earnings beat

Featured image via CNBC Mad Money