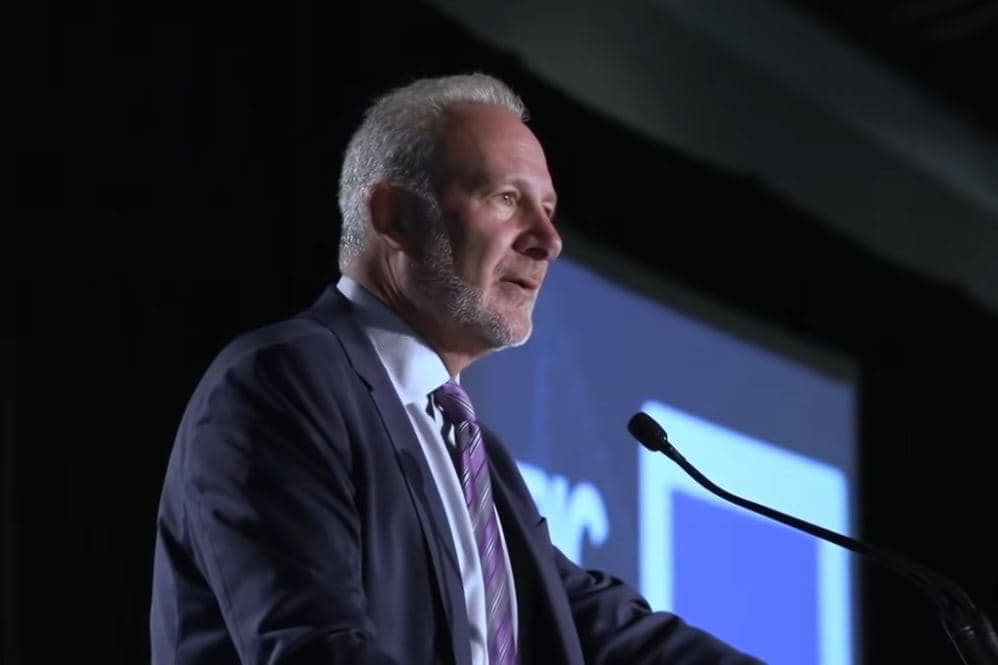

Renowned American economist and ardent gold advocate Peter Schiff recently shared his skepticism about Bitcoin’s (BTC) surge, attributing it to a “speculative frenzy around spot Bitcoin ETFs.” Schiff went on to predict a “spectacular crash” for the leading cryptocurrency.

In the same period, gold reached a new pinnacle of nearly $2,150, with Schiff deeming it “far more significant” than Bitcoin surpassing $40,000.

Yet, the bullion witnessed a significant crash in the coming days, erasing all its recent gains and dipping below the $2,000 mark. This abrupt turn of events prompted social media mockery, with some traders humorously linking gold’s decline to Schiff’s remarks, reminiscent of similar reactions to Jim Cramer‘s predictions.

At the time of publication on December 12, gold prices were sitting around $1,983, approximately 7% down from its all-time high.

Gold technical analysis

Gold’s abrupt nosedive came after the bears had taken the upper hand.

In the near term, sellers will likely attempt to push the precious metal down to a key support area of around $1,978. However, how the bullion actually reacts to its recent price correction will be closely monitored by analysts to better inform their forecasts for 2024.

Losing this area could drive the bullion down to the confluence support zone formed by 100-day and 200-day moving averages (MAs), located at $1,952 and $1,941, respectively.

On the upside, the yellow metal faces near-term resistance lines at $1,986 and $2,009, followed by another one at $2,041.

Clearing these hurdles would allow bulls to attempt to drive gold to a new peak.

Meanwhile, Bitcoin was changing hands at $41,860 at press time, up 1.53% on the day and down over 3% in the past week. The flagship cryptocurrency retreated from its recent 18-month high of over $44,000 amid what analysts consider a short-term correction.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.