At a time when the stock market has been weighed down by bearish investor sentiment regarding the impact of the DeepSeek artificial intelligence (AI) model, gold has quietly been making moves to new highs.

Notably, most equities opened the new week with significant losses amid fears that the Chinese AI model’s reported ability to offer impressive performance at lower costs could dampen investment in the growing sector.

Now, the precious metal, on the other hand, seemingly ignored the DeepSeek volatility, targeting new highs at the $2,800 spot. As of press time, the yellow metal was valued at $2,757 per ounce, gaining almost 0.65% in the last 24 hours. In the past year, gold has rallied by over 35%.

Investors will target the $2,762 resistance as a key hurdle if the current bullish level is maintained. On the downside, $2,747 is a crucial support to watch out for.

Gold has partly gained strength amid uncertainties surrounding President Donald Trump’s proposed tariffs, which could trigger a global trade war, boosting its safe-haven appeal.

Trump aims to impose tariffs on imported computer chips, pharmaceuticals, and steel to encourage U.S. production. His inflationary policies further enhance gold’s appeal to cautious investors.

Is gold sending a message?

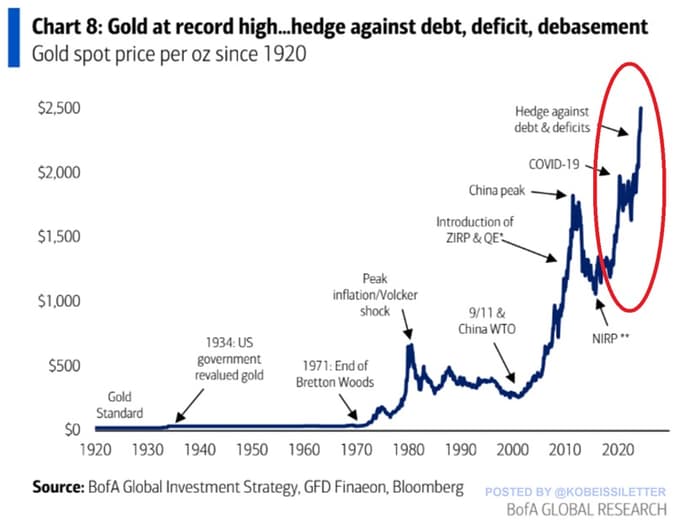

Now, amid this gold price momentum, which has extended from 2024’s run, analysis by the financial commentary platform The Kobeissi Letter, in an X post on January 28, suggested that the metal’s move might be sending a message, considering it has defied historical trends.

For instance, gold has maintained an upward trajectory despite significant headwinds like the U.S. Dollar hitting a 52-week high and the 10-year Treasury yield breaking above 4.80%. Historically, these factors would weigh heavily on the yellow metal, making its current trajectory all the more remarkable.

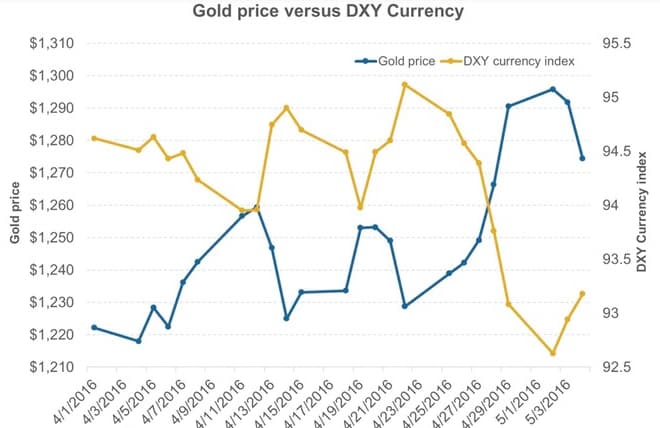

The platform noted that, traditionally, gold and the U.S. Dollar move inversely. A stronger dollar makes gold more expensive for foreign investors, typically driving prices down.

However, in the current setting, gold is bucking this trend. Even as the U.S. Dollar strengthens, gold has surged—a sign that investors seek a hedge against rising uncertainty.

Drivers of gold price gain

The Kobeissi Letter highlighted several elements likely contributing to gold’s current movements. For instance, while the U.S. faces the threat of stubborn inflation and record deficit spending, China faces deflationary pressures.

Both scenarios create global economic uncertainty, pushing investors toward safe-haven assets like gold.

At the same time, these fundamentals are playing out as the market anticipates the next Federal Reserve policy meeting. Speculation around interest rate policy and its impact on broader equity market volatility has only strengthened gold’s position as a hedge.

Indeed, it’s worth noting that gold’s run in 2024 was targeting the $3,000 high before cooling down after the Fed initiated an interest rate cut.

At that point, some market players had cautioned that the metal’s rally, defying market trends, was signaling a possible approaching black swan event.

Featured image via Shutterstock