Gold prices are currently navigating just under the $2,400 mark, struggling to regain momentum amidst a complex backdrop of U.S. economic indicators and Federal Reserve expectations.

Early Wednesday, the precious metal attempted another push toward this key level, influenced by a minor pullback in U.S. Treasury yields and the U.S. Dollar.

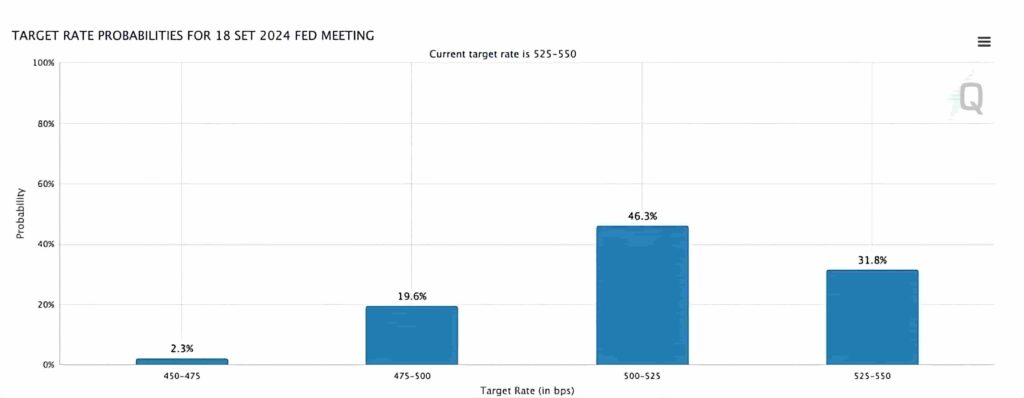

With the CME FedWatch tool indicating a 62% probability of a rate cut by September (NASDAQ: CME), gold investors remain hopeful amidst ongoing geopolitical tensions, particularly in the Middle East.

This shift is further amplified by the innovative uptake of gold beans by young Chinese investors and HSBC’s pioneering launch of the HSBC Gold Token, a digital foray that could reshape access to gold investments for retail investors worldwide, aligning with broader trends towards asset tokenization and digital finance.

Market dynamics and Fed impact

The recent price actions reflect investors’ hesitation amid conflicting signals. On one hand, geopolitical tensions, notably involving Iran, have heightened the appeal of gold as a safe haven.

The U.S. has announced new sanctions targeting Iran’s missile and drone program, which sustains the underlying geopolitical risks influencing gold prices.

On the other hand, comments from Fed Chair Jerome Powell have tempered expectations for rate cuts. During a discussion at the Wilson Center’s Washington Forum, Powell highlighted persistent inflation concerns, suggesting that the Fed may maintain current interest rates longer than previously anticipated.

The analysis by James Bennett on TradingView explores the recent bullish trend in gold prices and predicts potential further gains. Looking ahead, Bennett anticipates a continued uptrend from $2,373, targeting $2,431.

Technical analysis

XAU/USD 5 day Chart. Source: TradingView

As of April 17, 2024, Gold (XAUUSD) has demonstrated a bullish trend over the past 30 days, reflecting strong market sentiment and continued investor interest in gold as a safe-haven asset.

Technical analysis highlights that gold prices are challenging the $2,400 resistance amid a backdrop of easing U.S. Dollar and Treasury yields.

The Relative Strength Index (RSI) is bullish, positioned around 50, suggesting upward potential if prices break above the $2,396 trendline resistance.

Key resistance lies at the recent peak of $2,432, with further upside targets at $2,450.

As global economic indicators and central bank policies continue to unfold, gold remains a focal point for investors navigating the complex interplay of inflationary pressures, currency dynamics, and geopolitical uncertainties.

The coming weeks will be crucial in determining whether gold can reclaim its recent highs or if the consolidation phase will extend further

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.