Although the declines in the United States stock market seem to be slowing down, analysts at Goldman Sachs (NYSE: GS), particularly the global investment banking giant’s tactical specialist Scott Rubner, believe that the pullback is far from over and more dips could be in store.

As it happens, Rubner was talking to the bank’s clients who asked if the recent pullback indicated a sufficient reduction in equity exposure last week, to which he said “my reply is no,” adding that Goldman clients have been reducing exposure on any uptick in stocks, according to a report on April 23.

Furthermore, the expert stressed that Goldman’s trading desk has estimated that commodity trading advisers (CTAs), who have been acting in line with the momentum through long and short bets in the futures market, will sell stocks by default over the next week regardless of the markets’ direction.

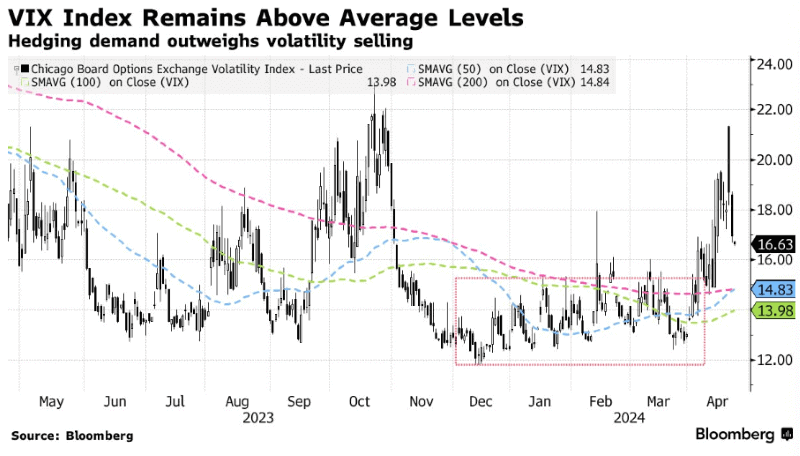

High volatility in stock market

In addition, Rubner observed that the large clients’ demand for puts and hedging now surpassed volatility strategies for the first time in 2024, suggesting that they were getting ready for more stock dips, reflected in the VIX (volatility index) spiking above 20 points last week and staying well above the 2024 average.

On top of that, Rubner warned about the poor liquidity in the stock market, which has declined by 66% since the start of April as a measure of S&P 500 E-Mini Futures’ top-of-book, options positioning for dealers, as well as a lack of retail demand for bullish calls after the US tax day on April 15.

JPMorgan’s bleak prognoses

As a reminder, chief market strategist at JPMorgan Chase (NYSE: JPM) Marko Kolanovic earlier shared a bearish forecast for stocks despite a temporary stabilization in the market triggered by positive earnings results due to high inflation, overly optimistic outlook, and declining prospects for rate cuts.

Moreover, Kolanovic’s colleague Dubravko Lakos-Bujas warned about the massive stock market sell-off, focusing on the risks “hovering in the background” that far outweighed the positive sources and could strike at any moment due to excessive crowding, as Finbold reported.

Meanwhile, the S&P 500 index was at press time standing at 5,070.55 points, suggesting an increase of 1.20% on the day, gaining 0.025% over the week, and a decline of 2.83% over the past month, according to the most recent chart data retrieved on April 24.

In conclusion, the above information seems to spell more trouble for the stock market, although the tides can sometimes turn unexpectedly for the better, so doing one’s own research and weighing all the risks is critical before investing a significant amount of money in any asset.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.