Although the recent record-breaking rally of the S&P 500 has prompted multiple Wall Street strategists to raise their bets on its future performance, those at JPMorgan Chase (NYSE: JPM) stand firmly by their last year’s prognoses, even warning about the possibility of an even worse outcome.

Indeed, as opposed to many of his peers, JPMorgan’s Dubravko Lakos-Bujas has shared a more depressing forecast, focusing on the risks “hovering in the background,” which outnumber the sources of upside and could strike at any moment, according to a report on March 27.

Stock market crash incoming?

Specifically, the Wall Street giant’s chief global equity strategist told clients in a webinar that excessive crowding in the market’s best-performing stocks was increasing the risk of an imminent correction and they might end up “stuck on the wrong side” of the momentum trade when it eventually cracks.

Furthermore, as Lakos-Bujas explained in more detail, this correction might unfold suddenly, as an unstoppable avalanche of events, one domino falling immediately after the other, catching investors unawares, and it wouldn’t be the first time:

“It just might come one day out of the blue. This has happened in the past, we’ve had flash crashes. (…) One big fund starts de-levering some positions, a second fund hears that and tries to re-position, the third fund basically gets caught off guard, and the next thing you know, we start having a bigger and bigger momentum unwind.”

In particular, such a rush into popular momentum stocks like the Magnificent Seven, typically ending with a correction, has occurred three times since the global financial crisis, and the analyst pointed out the declines of Tesla (NASDAQ: TSLA) and Apple (NASDAQ: AAPL) after a strong 2023.

Moreover, Lakos-Bujas stressed that, “historically, whenever you had such a high degree of crowding, it was a question of weeks before the momentum factor faced a big fat left tail unwind,” advising clients to carefully consider the best stocks to buy now.

Wall Street bets on S&P 500

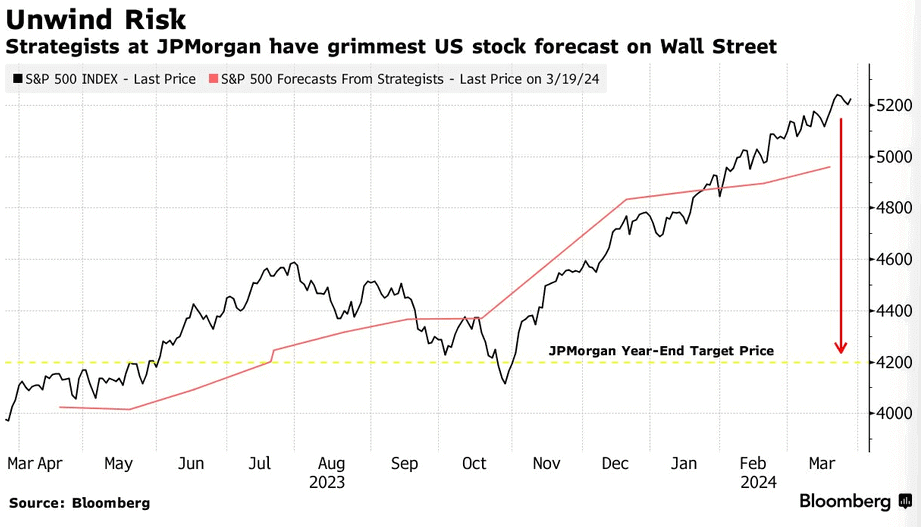

As a reminder, JPMorgan currently holds the lowest year-end target on the S&P 500 index funds among the big Wall Street banks, predicting it would close 2024 at 4,200 points, as opposed to, for instance, Oppenheimer and Société Générale suggesting a new all-time high (ATH) of 5,500.

Earlier, Finbold reported on Wall Street’s price targets for the S&P 500, which also saw Bank of America (NYSE: BAC) increase its target from 5,000 to 5,400, Barclays from 4,800 to 5,300, Goldman Sachs (NYSE: GS) from 4,700 to 5,200, UBS from 4,700 to 5,200, RBC from 5,000 to 5,150, and Wells Fargo from 4,625 to 4,900.

Meanwhile, the S&P 500 index at press time stood at 5,248.49 points, suggesting an increase of 0.86% on the day, a slight decline of 0.09% across the previous week, and a 3.53% gain on its monthly chart, consistently climbing this year and peaking at new ATHs.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.