Generating steady income from rentals and a historical resilience in the face of economic adversities make real investment trusts (REITs) a viable choice for growth investors and those hedging against inflation. While residential REITs may be the most familiar type of REITs, medical and healthcare REITs can also be one of the most profitable additions to your investment portfolio.

This particular medical REIT has shown resilience and solid financial performance in 2023, and it expects the upward trend to continue in the future, with plans to expand. Today, we’ll cover the most promising medical REIT to invest in right now.

What is a medical REIT?

As financial assets, REITs provide investors with access to real estate appreciation without actually owning the property. Due to their unique structure, REITs are obliged to pay no less than 90% of their profits to shareholders as dividend yields, which can serve as a reliable source of regular passive income.

COVID-19 has had a profound and transforming impact on healthcare, with the acute need for better and more efficient facilities continuing even after the pandemic passed. Virtual healthcare and digital trends are on the rise, as well as the general need for the better quality of facilities. Furthermore, the increasing demand for skilled labor force and more focus on ESG factors is also a major factor. Ultimately, all REITs, including medical and healthcare, are also affected by the rising mortgage rates.

However, this healthcare asset seems to have a solid pulse of the future and keeps performing well and growing all the same. We present you with Sabra Health Care REIT (NASDAQ: SBRA), one of the best performing medical REITs right now.

What is the best medical REIT?

As of 2024, Sabra’s portfolio includes 378 properties, including 43 leased and 61 managed senior housing facilities, 18 behavioral health units, 241 skilled nursing and traditional care facilities, and 15 specialty hospitals and related properties, mostly across the United States with some properties in Canada.

At the moment, the company has a market capitalization of $3.25 billion. It trades on the NASDAQ stock exchange under the SBRA ticker symbol.

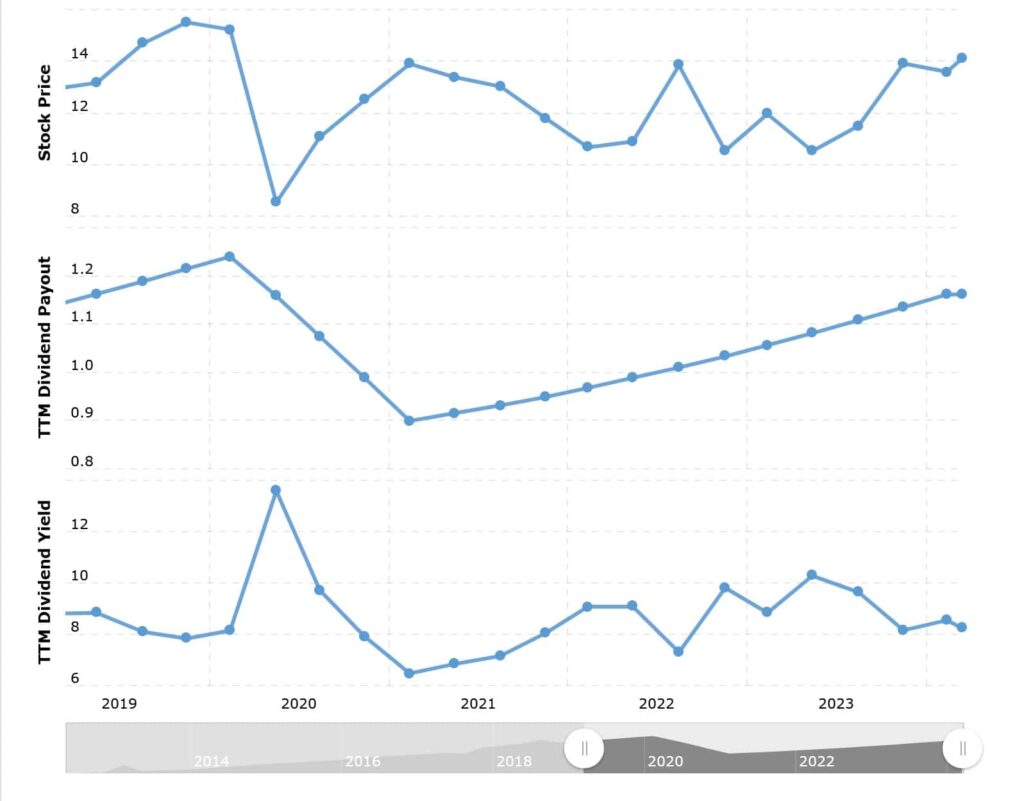

Sabra Health Care REIT stock price today

Sabra Health Care REIT finances

The company has presented a successful Q4 2023 report to investors and the public, showing enduring resilience and experiencing growth in the previous year.

Sabra Health Care REIT’s report demonstrated a net income of $0.07 per diluted common share for Q4 2023, with funds from operations (FFO) reaching $0.30 and adjusted funds from operations (AFFO) hitting $0.32 per diluted common share.

The numbers also show increased occupancy and rent coverage, especially in its senior housing and skilled nursing segment. Furthermore, the company expects to outperform its pre-COVID-19 levels, estimating growth in funds from operations.

Last but not least, Sabra Health Care secured a partnership with Ignite Medical Resorts and acquired two skilled nursing facilities, which goes in line with the company’s strategic trajectory for the near future.

Sabra Health Care REIT dividend yield

The company also declared its quarterly dividend payment of $0.30 per share, which projects an annual dividend payment of $1.20 per share. Therefore, Sabra Health Care REIT annual dividend yield as of March 2024 is a commendable 8.49%.

The challenges in front of the company

Although very positive, the future is not a mere breeze: Sabra Health Care will have to confront issues plaguing the rest of the healthcare REIT sector, such as fierce competition, labor cost increases, skilled workforce shortage, and regulation. The company’s profitability will hinge on the careful alignment between its goals and potential pitfalls.

Is Sabra Health Care REIT a good investment

Sabra Health Care REIT has witnessed steady growth and a balanced approach between expansion and providing value for its shareholders amid the period when medical REITs rose to prominence as one of the most profitable financial assets of its kind on the market.

While future performance is in the hands of the company only, the current financial indicators will please many investors. However, remember to do your own research and find out whether Sabra Health Care REIT would be a valuable asset to your portfolio.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.