Summary: The S&P 500 index tracks the performance of the 500 largest US companies based on factors such as liquidity and market capitalization. Thus, investing in this index, either by buying individual company stocks or purchasing index funds that mirror its performance, is one of the most conservative ways to quickly diversify your portfolio and gain exposure to some of the titans of the US economy. To invest in S&P 500 in Canada, investors can register an account at an online exchange platform like Interactive Brokers.

Best Platform for Worldwide Stock Trading & Investing

-

Highly trusted multi-asset broker with clients in over 200 countries

-

Trade on 150 markets globally from a single platform (stocks, ETFs, futures, currencies, crypto & more)

-

Low commissions starting at $0 with no platform fees or account minimums

-

Easily fund your account and trade assets in 26 currencies

-

IBKR pays up to 4.58% interest on cash balances of $10k or more

What is S&P 500?

The S&P 500 — or simply S&P or Standard & Poor’s 500, as it is often called — is a stock market index reflecting the performance of some 500 largest publicly traded US companies. The index comprises companies in various sectors of the economy, such as tech, finance, healthcare, etc. In fact, it covers around 80% of the market cap.

The index is meant to represent the overall health of the US equity market and the country’s general economy. Consequently, investors of all sports often use its performance as a benchmark for determining the health of the stock market overall. What’s more, those investing in exchange-traded funds (ETFs), for example, will know that they are usually meant to track and replicate the performance of the S&P 500.

How to invest in S&P 500 Canada: Step-by-step

Investing in stocks and shares of companies listed on the S&P 500 when abroad might seem complex, but it’s actually quite straightforward. Naturally, those who wish to ensure their investments are as fruitful as possible can seek professional assistance, but the most convenient approach to stocks for the average investor is to do it through an online exchange platform.

Nonetheless, convenience does not imply guaranteed profits and security. In other words, it’s essential that you approach the stock market with a clear mind and with an understanding of some of the potentially negative results. After all, it is your money that is at stake whenever you invest.

If you’re contemplating investing in the S&P 500 index in Canada, you can simply take the following steps:

Step 1: Find a broker

To invest in the S&P 500 safely and conveniently, the first step is to find a reputable, licensed broker. Various brokers cater to different trading strategies (e.g., buy-and-hold or day trading), but if you are new to investing, you’ll be better off looking for user-friendly platforms that tick the following boxes:

- Solid reputation: No matter your investment goals, look only for brokers with licenses provided by the Financial Conduct Authority (FCA), National Futures Association (NFA), Financial Industry Regulatory Authority (FINRA), etc.;

- Low fees and commissions: If you’re just starting, you’re probably wary of spending too much. Thus, try finding a broker that won’t charge you too much for their services;

- A good range of offerings: Even if you don’t plan on using them all now, the more investment instruments a broker offers (e.g., mutual funds, exchange-traded funds (ETFs), and options), the better;

- Solid customer support: There is nothing worse than being denied help when you need it the most, especially when your capital depends on it. So, make sure your broker of choice is going to be there when you need it;

- Top security: Cyberattacks are increasingly more common, so a serious approach to digital safety and security is mandatory.

Where to buy stocks

To invest in the S&P 500 in Canada, we recommend Interactive Brokers (IB), a regulated, well-known exchange with over 2 million registered users and all features discussed above. In addition, the platform offers features such as:

- Commission-free stock trading;

- Global stock-trading on 90+ market centers;

- Fractional shares;

- No minimum deposits;

- Additional income on fully paid shares;

- Lowest financing rates for margin accounts.

Best Platform for Worldwide Stock Trading & Investing

-

Highly trusted multi-asset broker with clients in over 200 countries

-

Trade on 150 markets globally from a single platform (stocks, ETFs, futures, currencies, crypto & more)

-

Low commissions starting at $0 with no platform fees or account minimums

-

Easily fund your account and trade assets in 26 currencies

-

IBKR pays up to 4.58% interest on cash balances of $10k or more

Step 2: Research the index

As mentioned, the S&P 500 index serves as the main benchmark tool for the entire stock market. Therefore, investing requires thorough preparation and extensive research if you want to make all the right choices.

First, it’s essential that you follow the performance of prominent companies in the index. Check out their earnings reports, read expert analyses, and keep up with any news that might be relevant. Since the index comprises some behemoths in virtually every sector, staying in the loop with the latest rumors and developments will not be a problem.

Moreover, since all the companies in the index are publicly traded — otherwise, they would not even be listed — they are under obligation to disclose all important info to the investing public. That means a lot of experts are going to have their takes on all the data, so you should alwaysbe on the lookout for some golden nuggets of wisdom they might provide.

Further, make sure you have a clear understanding of the companies’ long-term plans, performance, financial health, stock market history, etc. Naturally, you should also keep track of the market and see how it develops as a whole. In short, the more info you can gather, the better your investment position is going to be.

Step 3: Determine how much you want to invest

One of the fruits of your research should be the knowledge of how much money you are willing to invest.

To determine that more quickly, take into account your budget, goals, and the current state of the index. Keep in mind that S&P 500 funds can be relatively more expensive. To avoid paying higher prices, you can invest in individual companies at a lower cost. This method might be preferable if you’re looking to quickly diversify your portfolio or get exposure to a specific sector by investing in a well-performing company.

Note

Step 4: Fund your account

Once you’ve settled for a solid broker, you can register an account and start adding some funds to it. Most platforms nowadays offer users a number of available payment methods. With Interactive Brokers, for example, you can transfer funds from your bank account, use a Wire transfer, scan a check, etc., or you can link your account to a third-party payment service, like PayPal or Interac e-Transfers.

Step 5: Place your order

When you fund your account, you can start investing. If you’ve selected Interactive Brokers as your exchange, simply:

- Log in on the Interactive Brokers website;

- Look for an index fund that tracks the S&P 500, e.g., Fidelity 500 Index Fund (FXAIX);

- Submit the trade.

Alternatively, you can buy individual stocks in companies in the S&P 500 index.

Top 5 Companies in the S&P 500

| Company | Sector | Revenue Q4 2024 |

| Amazon.com (AMZN) | Commerce | $620 B |

| Apple (AAPL) | Information technology | $391 B |

| Berkshire Hathaway B (BRK-B) | Finance | $370 B |

| Alphabet (GOOGL) | Information technology | $339 B |

| Microsoft (MSFT) | Information technology | $254 B |

Step 6: Monitor your investment

The S&P 500 index features a wide range of companies in diverse sectors. Since their combined performance is what makes the index go around, you’ll have to actively engage with your investment and keep track of the index’s performance.

For starters, try following global economic news and listening to what experts have to say on various platforms and social media. Moreover, since the S&P 500 index pretty much stands for the economy of the entire country, you should stay up-to-date with potentially relevant news outside the stock market.

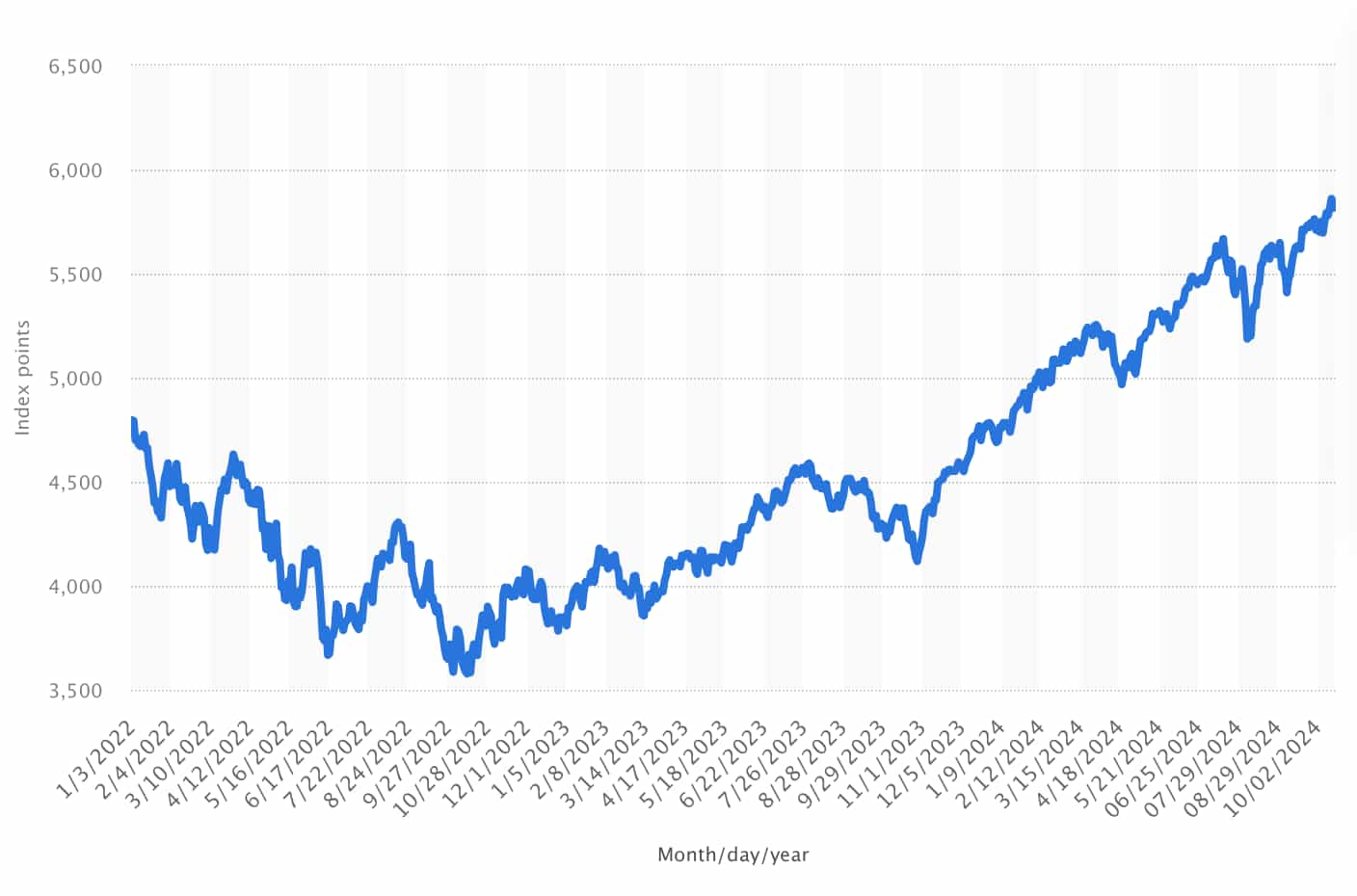

S&P 500 index price today

How to invest in S&P 500 Canada safely

The world of investing can be complex and highly dynamic, meaning due diligence is key to avoiding some of the common investing mistakes that plague the market and hinder new and seasoned investors alike. To make sure you’re safe, you can start by:

- Doing a lot of research, both on the market and the index itself;

- Trading with a clear goal only and never basing your decisions on emotions and hype;

- Diversifying;

- Creating a safety fund.

Pros and cons of investing in S&P 500 in Canada

Pros

- Availability: By investing in S&P 500, you can easily invest in a large number of companies at once without having to research individual stocks;

- Good for diversification: In essence, when you invest in an S&P 500 index fund, you gain exposure to 500 companies;

- High performance: S&P 500 companies include Apple, Microsoft, Amazon, and other giants of virtually every industry.

Cons

- The index comprises US companies only;

- It doesn’t give investors the freedom to invest in smaller companies;

- Since the index is intrinsically tied to the market, you can’t outperform it with your investment;

- The index can change in unfavorable ways, demanding a change in your investment strategy.

Best Platform for Worldwide Stock Trading & Investing

-

Highly trusted multi-asset broker with clients in over 200 countries

-

Trade on 150 markets globally from a single platform (stocks, ETFs, futures, currencies, crypto & more)

-

Low commissions starting at $0 with no platform fees or account minimums

-

Easily fund your account and trade assets in 26 currencies

-

IBKR pays up to 4.58% interest on cash balances of $10k or more

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs on how to invest in S&P 500 Canada

Can you invest in S&P 500 in Canada?

Yes, you can invest in the S&P 500 index in Canada. To do so, register an account at a well-regulated platform such as Interactive Brokers.

How to invest in S&P 500 in Canada?

To invest in the S&P 500 in Canada, either buy an index fund that tracks its performance or invest in individual companies that make the S&P 500 index.

Is investing in S&P 500 in Canada safe?

Investing in S&P 500 in Canada is safe, provided you do it via regulated online exchanges like Interactive Brokers.

Best Platform for Worldwide Stock Trading & Investing

-

Highly trusted multi-asset broker with clients in over 200 countries

-

Trade on 150 markets globally from a single platform (stocks, ETFs, futures, currencies, crypto & more)

-

Low commissions starting at $0 with no platform fees or account minimums

-

Easily fund your account and trade assets in 26 currencies

-

IBKR pays up to 4.58% interest on cash balances of $10k or more