In 2020, US markets witnessed unique patterns due to the combination of the COVID-19 pandemic and a highly polarized election. Analyzing the effects of that year can offer investors insights into how the 2024 election will affect the stock market. While no election’s market impact is identical, certain trends, behaviors, and lessons from 2020 could repeat.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

The 2020 elections

The 2020 US elections featured a tense race between Donald Trump and Joe Biden. With contrasting policies on taxes, trade, and healthcare, both candidates created significant uncertainty, leading to increased market volatility.

As election night unfolded, delayed results and concerns over a contested outcome kept investors on edge, reflecting the stock market’s sensitivity to political shifts.

How the election affects the stock market

Leading up to elections, investors typically respond to campaign promises, economic forecasts, and anticipated policy changes. The market can react strongly to speculation about tax policies, regulatory changes, and government spending. And as the election date draws near, market movements often become more pronounced, with higher trading volumes and more pronounced swings.

As such, we can conclude that the factors driving this pre-election volatility include:

- Policy uncertainty: Investors brace for potential shifts in tax rates, government spending, and regulations;

- Sector-specific anticipation: Certain sectors, such as healthcare, energy, and finance, could face specific policy changes that cause distinct movements.

In 2020, the market experienced a significant dip and recovery as investors weighed the impacts of COVID-19 alongside election uncertainties. The run-up to the election highlighted that investors often hedge their bets, leading to a broader sell-off in high-risk assets and a move toward safer investments.

Post-election stock market performance

Election results can lead to major shifts in policy, and the stock market usually reacts quickly. Investors often see immediate movements as markets attempt to price in the new administration’s policy stance. However, the real impact on post election stock market performance tends to unfold gradually as policies take shape.

Key factors influencing post-election market reactions:

- Transition policies and initial actions: Markets react to the new administration’s first 100 days, providing clues about how aggressive or conservative policies might be;

- Policy on trade and international relations: Global stocks can react to changes in trade policy, while domestically, certain industries may either thrive or falter.

Key legislative wins, such as the Inflation Reduction Act and the Bipartisan Infrastructure Law, provided substantial support and funding for renewable energy projects. As a result, the sector experienced record growth, with solar and wind energy leading the way.

On the other hand, traditional oil and gas industries experienced uncertainty as investors adjusted to possible regulatory changes.

While US oil and gas production surged under both the Trump and Biden-Harris administrations, the focus on reducing fossil fuel use and transitioning to renewable energy created some uncertainty for the sector. Policies aimed at reducing carbon emissions and promoting clean energy led to concerns about future regulations and their impact on oil and gas operations.

| Period | Market behavior | Key factors |

| 3 months before | Increased volatility, sell-offs | Uncertainty around COVID-19 policies and economic plans |

| Election week | Sharp spikes and dips | Anticipation of outcome, fears of contested results |

| 3 months after | Gradual stabilization, sector shifts | Policy clarifications, stimulus expectations |

How will the 2024 election affect the stock market?

Looking ahead, investors can draw from 2020’s lessons to prepare for election impacts on their portfolios. While it’s impossible to predict every market move, certain patterns tend to recur in election years.

Historically, specific sectors react predictably to different administrations. Here’s how upcoming elections might impact various sectors based on potential policy shifts:

- Healthcare: Changes to insurance policies or pharmaceutical regulations can lead to rapid stock movements;

- Technology: Tech companies, especially large platforms, often face increased regulatory scrutiny depending on the administration’s stance;

- Energy: Renewable energy stocks may gain under policies supporting green infrastructure, while fossil fuels could see the opposite effect.

For investors, understanding these trends means keeping a close eye on Donald Trump’s and Kamala Harris’s campaign platforms and potential policies that may affect their portfolios.

Investment tips for election cycles

Election uncertainty can cause erratic swings, hence, diversification across sectors can provide a buffer against volatility. However, individual investors should also:

- Focus on long-term gains: Short-term market reactions may seem extreme but tend to stabilize. Long-term investors should avoid overreacting to day-to-day fluctuations;

- Use tools to monitor politicians and institutional moves: Institutional investors, company insiders, and politicians play a significant role in market stability. Monitoring their actions, especially during election years, can give retail investors valuable insights. Finbold Signals, for instance, provides real-time updates and helps investors follow trends, making it easier to navigate election-year markets.

Receive Signals on US Senators' Stock Trades

Stay up-to-date on the trading activity of US Senators. The signal triggers based on updates from the Senate disclosure reports, notifying you of their latest stock transactions.

How political cycles shape the stock market

A 2023 study by Eric B. Yiadom, Valentine Tay, Courage E.K. Sefe, Vivian Aku Gbade, and Olivia Osei-Manu examined how political events, particularly elections, influence stock market performance. It analyzed investor reactions to pivotal news and how these reactions shape market behavior.

By employing a generalized method of moments (GMM) analysis, the research investigated the impact of electioneering activities and changes in government on key stock market indicators.

The findings suggest that while electioneering activities have a generally positive impact on the stock market, a change in government can negatively influence market performance.

“Electioneering activities generally have a positive impact on the performance of the stock market, whereas a change in government has a negative impact.” — Yiadom, Tay, Sefe, Gbade, and Manu

The bottom line: Key takeaways from 2020’s election year

As an investor, you don’t need to feel uncertain every election year. Namely, by observing market responses and applying insights from past elections, it is possible to approach these cycles with confidence. Of course, this is if you:

- Anticipate volatility: Elections often bring swings, but these movements are generally temporary, so avoid panic-selling based on immediate reactions;

- Watch policy trends: If you invest heavily in a specific sector, understand how each administration’s policy platform may affect that sector.

As history shows, elections introduce short-term market noise, but markets tend to find their balance over time. By taking a disciplined approach and leveraging available resources, you can turn the 2024 election into an opportunity rather than a disaster.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

FAQs

How do elections affect the economy?

Elections can increase stock market volatility due to uncertainty around policy changes. Investors typically react to campaign promises, especially around tax, regulatory, and spending policies, which influence sectors differently depending on the candidate’s stance.

What were the major factors that influenced market behavior during the 2020 elections?

In 2020, the combination of the COVID-19 pandemic and a polarized political climate heightened market volatility. Investor sentiment fluctuated based on anticipated policies regarding healthcare, stimulus spending, and economic recovery.

How did the stock market react after the 2020 election?

The market initially experienced volatility but stabilized as the new administration’s policy directions became clearer. Certain sectors, like renewable energy, saw gains due to anticipated policy support, while others adjusted to potential regulatory changes.

What to invest in before an election?

A prudent approach involves diversifying across sectors to manage election-related risks. Focus on a long-term view to avoid overreacting to temporary market swings and, instead, consider how potential policy changes may impact economic growth over time. This strategy helps investors stay resilient through election uncertainty.

Which sectors tend to react the most during elections?

Healthcare, energy, and technology sectors are especially sensitive to elections due to the potential for regulatory changes. For example, renewable energy stocks may benefit under administrations favoring green policies, while tech companies may face increased scrutiny.

How will the 2024 election affect the stock market?

The 2024 election may introduce market volatility due to policy uncertainties, as investors anticipate potential shifts in taxes, regulation, and spending.

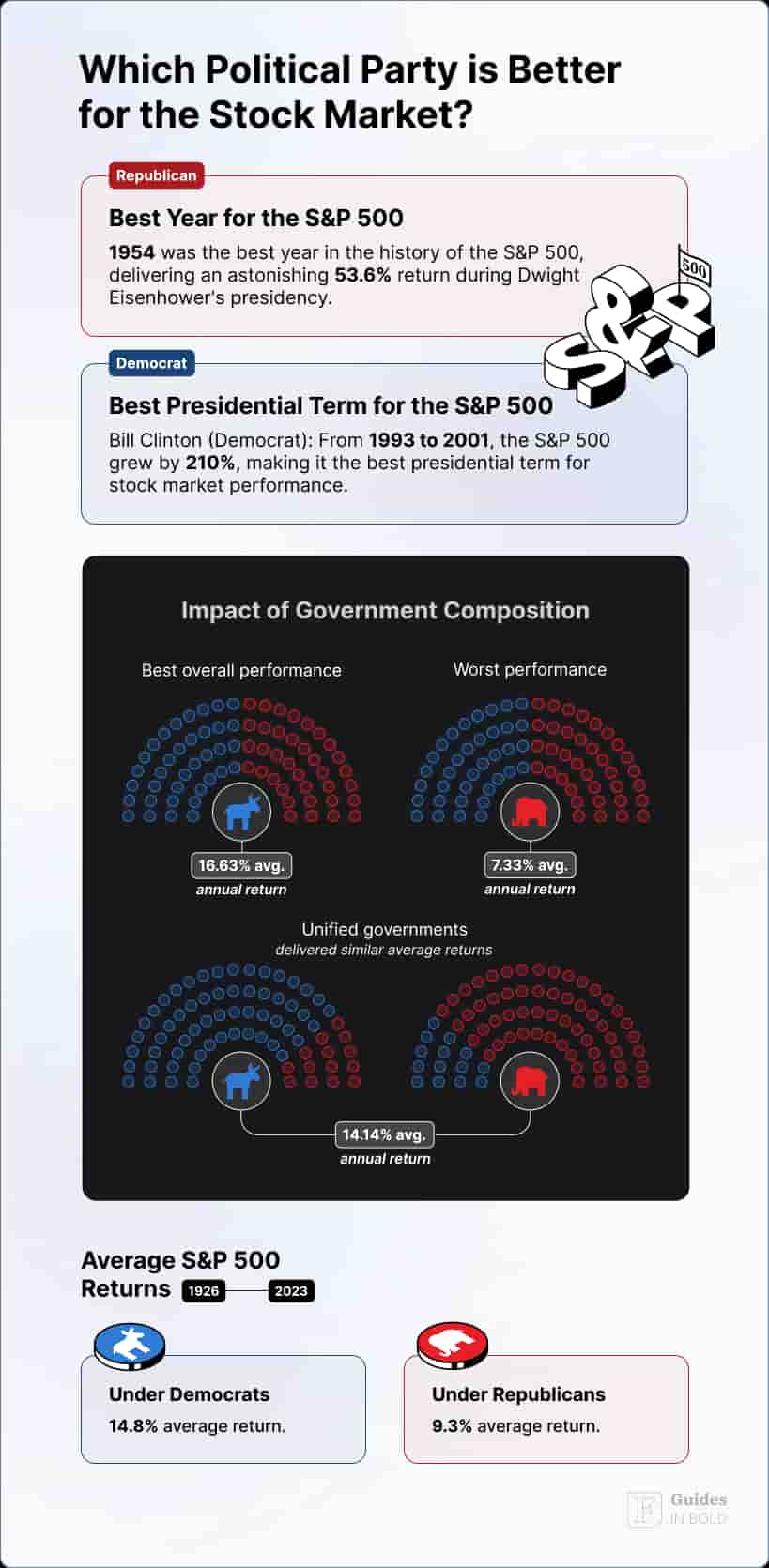

Which political party is better for the stock market?

Historically, the stock market has performed well under both Democratic and Republican administrations, though each party tends to impact specific sectors differently. Republican policies often favor lower taxes and deregulation, benefiting financials, energy, and defense sectors, while Democratic policies may boost healthcare, renewable energy, and infrastructure through increased spending and regulatory support. However, overall market performance relies more on broader economic factors, like inflation, interest rates, and global conditions, than on the party in office alone.

Are election years good for the stock market?

Election years typically bring volatility, but historically, markets tend to recover and stabilize post-election as policy directions become clearer.

What stocks do well in election years?

Defensive stocks, like utilities and consumer staples, often perform well due to their stability, while sectors like healthcare and energy can see fluctuations based on anticipated policies.