There are various ways in which profitable companies can return money to their shareholders, the most common of which are dividend payments. An alternate way is stock buyback (or share repurchasing), in which a company reacquires its own stock. In this guide we will look at the ins and outs of a share repurchase, why a company might choose to do that and how it benefits investors.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

What is a stock buyback?

Much like a dividend, a stock buyback is a way to return capital to the shareholder. A dividend is essentially a cash bonus equal to a percentage of an investor’s total stock value; however, a stock buyback will require the investor to surrender stock to the company to receive cash. Those shares are then removed from circulation and taken off the market.

How does a stock buyback work?

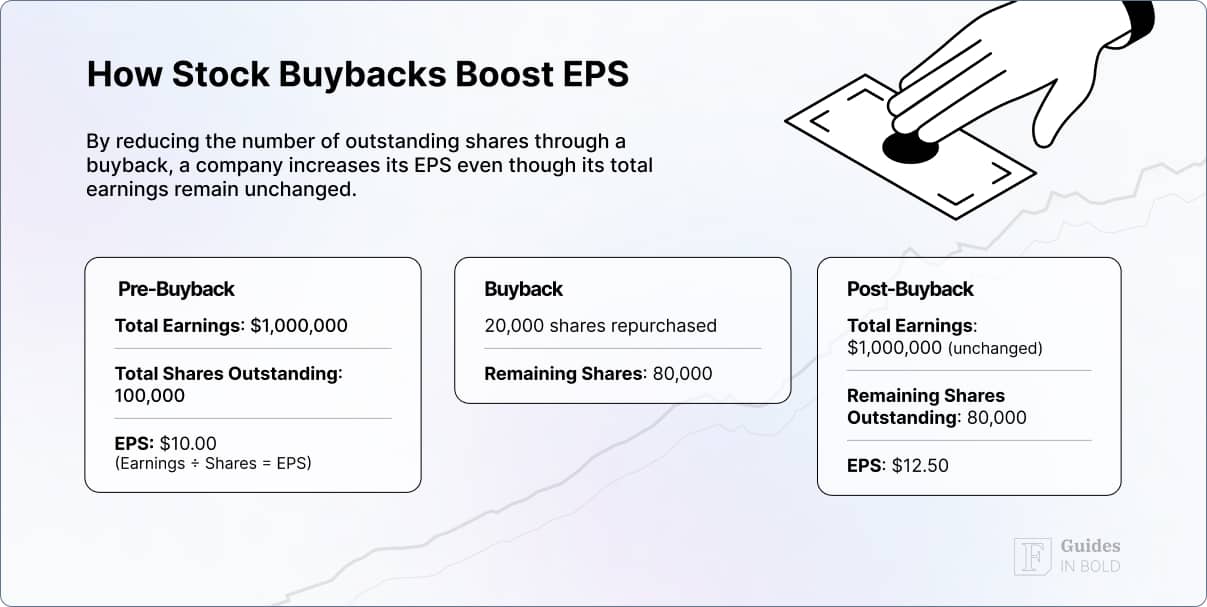

Simply put: stock buybacks improve a company’s financial ratios (used by investors to determine the value of a company). By repurchasing its stock, the company decreases its outstanding shares on the marketplace, without actually increasing its earnings. Therefore enabling it to increase its metrics, the most important of which is EPS (earnings per share).

Stock buyback example

Does stock buyback affect EPS?

EPS divides a company’s total earnings by the outstanding shares, the fewer the shares, of course, the higher the earning per share – a higher number points to a more robust financial position.

By reducing the number of outstanding shares through a buyback, the company increases its EPS, even though total earnings remain unchanged.

Why would a company buy back its own stock?

A company might choose to buy back its own stock for several reasons:

- Optimal use of cash reserves: A company may determine that stock buybacks offer a better potential return to shareholders compared to other investment opportunities;

- Market perception: A reduction in the number of available shares can lead to a higher share price if the market views the buyback as a smart move that is in the company’s best interest;

- Undervalued stock: Management may believe their company’s stock is undervalued and that a buyback will signal confidence to the market;

- Counteracting dilution: To offset the dilution effect from employee stock option plans (ESOP), a company may repurchase shares;

- Control and influence: By reducing the number of shares on the open market, the company’s existing management can increase its control and reduce the likelihood of hostile takeovers;

- Financial ratio improvement: Reducing the number of outstanding shares can improve financial ratios such as EPS, which may make the company look more attractive to investors;

- Attracting and retaining talent: Offering stock options is a way to attract and retain employees, and buybacks help manage dilution from these options;

- Shareholder preference: Some shareholders may prefer buybacks over dividends as a method of profit distribution due to personal or institutional tax considerations;

- Signal to investors: A buyback can act as a signal that the company believes its shares are undervalued, conveying a positive outlook to investors;

- Flexibility: Unlike dividends, which once initiated are expected to be maintained or grown, buybacks offer a one-off return of cash, providing companies with greater financial flexibility;

- Debt-Equity Management: Companies may use buybacks to adjust their debt-to-equity ratio, particularly if they wish to take on more debt for strategic reasons and want to maintain a certain target ratio.

Other uses for excess capital include:

- Paying cash dividends to shareholders;

- Reinvesting in the company to grow their business operations, e.g. buying new equipment or property; investing in research;

- Acquiring another company or business unit.

Recommended video: Stock Buybacks – The Good And The Bad Explained

How to make a buyback?

There are two ways companies conduct a buyback: a tender offer or through the open market.

- Tender offer – a public solicitation to all shareholders that they offer their stock for sale at a specific price range during a specific time frame. Often set at a higher price per share than the company’s current stock price to incentivise selling.

- Open market – buying shares at market value on the open market, though prices can often soar up after the announcement since this is seen as a positive indicator.

How is stock buyback beneficial for investors?

Unlike cash dividends, stock buybacks do not offer an immediate, direct benefit to shareholders. However, investors do benefit from a company’s stock repurchase as the goal/outcome is generally to raise the company’s stock value. As fewer shares circulate on the market, the more a share is worth.

In addition, shareholders pay income tax on stock dividends, stock buybacks, on the other hand, are taxed at a lower capital-gains tax rate. As such, shareholders do not owe taxes on capital gains resulting from stock buybacks until they realize those gains, meaning when they sell the shares. If the investor of the stock holds onto those shares, they can avoid paying taxes on the gains for years or decades.

Still, using this tool does not come without risks. Sometimes a mere announcement of a company’s plan to repurchase its shares, skyrockets the stock price. Other times, however, a shift in the market as the company is repurchasing its shares, can compromise the share value.

All in all, though, a share repurchase program will likely improve the stock’s price over time. Not only because of the reduced reserve of the shares but also because it boosts some of the metrics that investors use to evaluate a company.

Why are stock buybacks bad?

There is some valid criticism about the fact that companies often repurchase their shares after a period of great financial success, typically at a time of high valuation. A company in that situation could end up buying its shares at a price peak, settling for fewer shares for its money, and leaving less in the reserve for when business slows.

Investors should also be wary if the buyback seems to be motivated by the board’s desire to manipulate valuation metrics.

What is more, some companies will borrow money to fund a stock buyback, and a debt-based stock buyback can negatively influence a company’s cash flow. Indeed more than half of all buybacks are financed by debt.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.

Do stock buybacks benefit the economy?

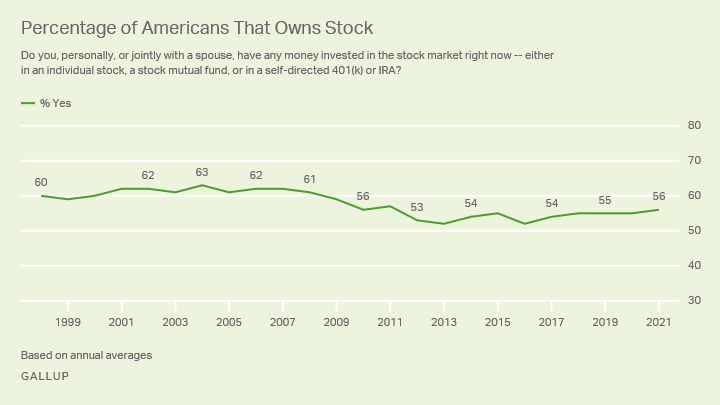

Stock buybacks are often seen as a win for shareholders, as their primary effect is to increase stock value. With over half (56%) of US citizens owning stock in some capacity—whether through pensions, 401(k)s, or personal investment accounts—higher stock prices can provide significant benefits to a broad range of people. However, the true impact of buybacks on the broader economy is more nuanced.

One clear benefit of buybacks is that the money returned to shareholders through these programs or dividends does not vanish from the economy. Instead, it often gets reinvested into growing businesses or used to finance emerging technologies. By providing liquidity to investors, buybacks can stimulate additional economic activity and innovation indirectly.

That said, critics highlight significant concerns about how stock buybacks allocate resources. Between 2003 and 2012, S&P 500 companies spent 54% of their earnings on buybacks—funds that could have been used for research, innovation, or workforce development. While buybacks can deliver immediate value to shareholders, they may also undermine long-term growth by prioritizing short-term financial gains over sustainable investments.

Moreover, while stock ownership is relatively widespread, its distribution is far from equal. The wealthiest 10% of households own approximately 93% of all stocks, whereas the bottom 50% hold only about 1%. As a result, the benefits of buybacks disproportionately accrue to those at the top of the economic ladder, widening the wealth gap and leaving the majority of Americans with little direct financial gain.

Another issue is the potential for buybacks to act as a form of financial engineering. By reducing the number of shares outstanding, buybacks artificially boost EPS, creating the appearance of stronger performance without addressing underlying business fundamentals. While this can satisfy shareholders in the short term, it may leave companies ill-prepared to navigate future challenges, such as economic downturns or the need for significant innovation.

In conclusion

All in all, a share repurchase will always grow the value of the company’s stock and therefore be beneficial to the shareholders. However, as an investor it is important to understand the motives of such a move, so the true value of the company can be determined.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Frequently Asked Questions about Stock Buybacks

How does stock buyback work?

A stock buyback occurs when a company buys back its own shares from the marketplace. This reduces the number of outstanding shares, often aiming to increase the value of remaining shares and improve financial ratios like earnings per share (EPS).

Why do companies buyback stock?

Companies buy back stock to reduce the number of outstanding shares in the market, which can increase the stock’s value and improve financial metrics like earnings per share. This strategy can also signal management’s confidence in the company’s future and return excess cash to shareholders.

What happens to share price after buyback?

After a buyback, the share price can potentially increase because the outstanding shares in the market decrease, which improves earnings per share ratios. However, the actual impact on share price can vary depending on several factors, including the market’s perception of the buyback’s rationale.

Do I have to sell my shares in a buyback?

No, you are not obligated to sell your shares in a buyback. Companies typically offer to purchase shares back at a premium to the current market price, but it is up to the shareholder to decide whether to accept the offer.

Is stock buyback good or bad?

Whether stock buybacks are good or bad depends on the context and the outcomes sought. Buybacks can be good if they return excess cash to shareholders, increase shareholder value, and signal confidence in the company’s valuation. However, they may be considered bad if they are used to artificially inflate stock prices, mismanage capital, or neglect investment in the company’s growth. Ultimately, whether a buyback is good or bad must be evaluated on a case-by-case basis, taking into account the company’s financial health, the timing of the buyback, and the broader economic conditions.

What are some stock buyback rules?

Stock buybacks are governed by regulations to ensure fairness and transparency, including specific rules on buyback methods, timing, and disclosure. Companies typically must follow SEC Rule 10b-18, which sets guidelines to limit market manipulation and ensure the repurchases are conducted at times and prices that do not unduly influence the stock price.

What are private company stock buyback rules?

In private companies, stock buybacks are typically governed by the company’s own buy-sell agreements and internal policies, rather than public market regulations. These rules can include stipulations on the conditions under which buybacks occur, pricing methods for the shares, and how the buybacks are funded, all of which are often outlined in the company’s bylaws or shareholders’ agreement.

Highly Rated Stock Trading & Investing Platform

-

Invest in stocks, ETFs, options and crypto

-

Copy top-performing crypto-traders in real time, automatically.

-

0% commission on buying stocks - buy in bulk or just a fraction from as little as $10. Other fees apply. For more information, visit etoro.com/trading/fees.

-

eToro USA is registered with FINRA for securities trading.