Just days before the United States launched strikes on Iranian targets, several American lawmakers made notable trades in defense stocks.

The U.S. attack, carried out early Sunday, targeted three Iranian sites and marked a significant increase in support for Israel’s efforts against Iran’s nuclear program.

The following are among the Congress trades of defense stocks standing out.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Defense stocks preferred by U.S. Congress members

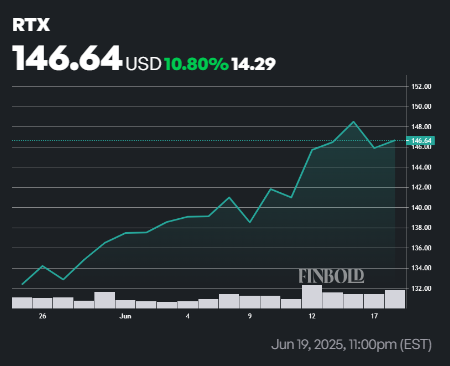

Among the lawmakers, Senator John Boozman purchased Raytheon Technologies (NYSE: RTX) shares on May 30. He disclosed this transaction two weeks later, on June 15. The trade, worth between $1,001 and $15,000, has already been profitable, with Raytheon shares rising 7.44% to $146.64.

Senator Markwayne Mullin, a Senate Armed Services Committee member, also bought shares of L3Harris Technologies (NYSE: LHX) on May 13. This purchase, valued between $15,001 and $50,000 and disclosed on June 11, has outperformed others. LHX is up 14% and is currently trading at $249.

On the other hand, Representative Gil Cisneros, who serves on the House Armed Services Committee, also invested in the sector. On May 30, he purchased shares of Northrop Grumman (NYSE: NOC) in a trade worth between $1,001 and $15,000. He disclosed this on June 6. The investment has gained 2.67%, with NOC now priced at $497.

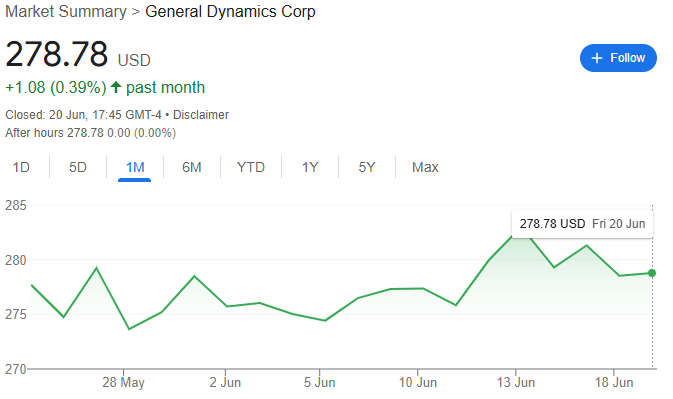

Lastly, Representative Julie Johnson, new to trading defense stocks and a House Committee on Foreign Affairs member, purchased General Dynamics (NYSE: GD) shares on May 2. Her trade, valued between $1,001 and $15,000, was disclosed on June 13. Though it’s a smaller gain, the stock has risen 2.1% and is now trading at $278.

Suspicious Congress transaction

Since tensions between Israel and Iran escalated, defense stocks have surged, supported by their role in military operations. This surge comes even as broader markets remain unstable due to increasing geopolitical uncertainty.

Overall, the timing of these trades has raised concerns about possible insider information use. While there is no evidence of wrongdoing, these transactions will likely raise suspicion.

Featured image via Shutterstock