Shortly after the expiration of a six-month lockup period on the stocks of Donald Trump’s social media company, Trump Media & Technology Group (NASDAQ: DJT), meaning he can now sell them, their price has resumed its decline and is threatening to enter the single-digit territory if it continues.

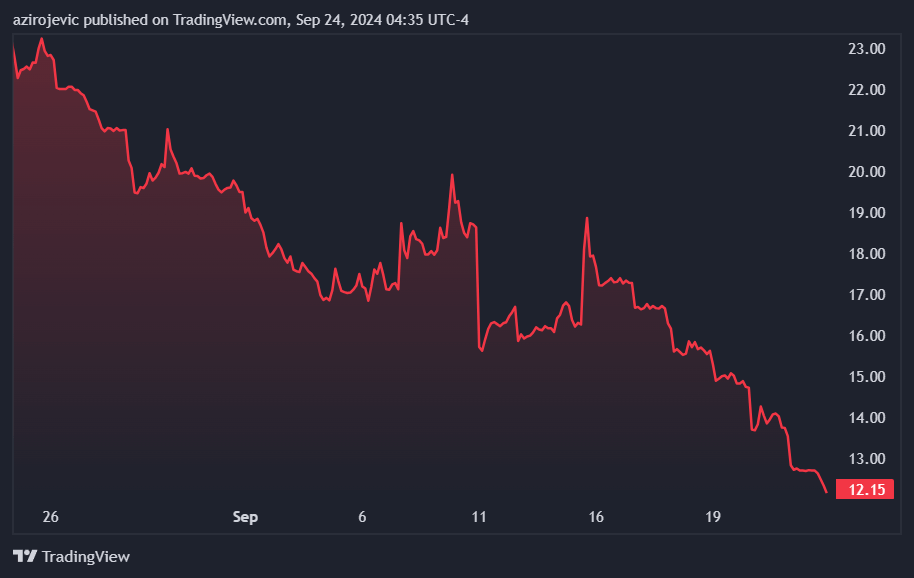

Specifically, the six-month lockup period on DJT stock held by insiders, including the former United States President, the company’s directors and officers, and certain other securityholders, expired at the end of the trading day on September 19, and the stock dropped 18.07% since.

That said, the dip happened despite Trump promising he had no intention of selling his stake in the company, which currently amounts to about 60%, after the lockup period expires, sparking a recovery momentum in DJT stock price. Still, the market’s optimism seems to have been only temporary.

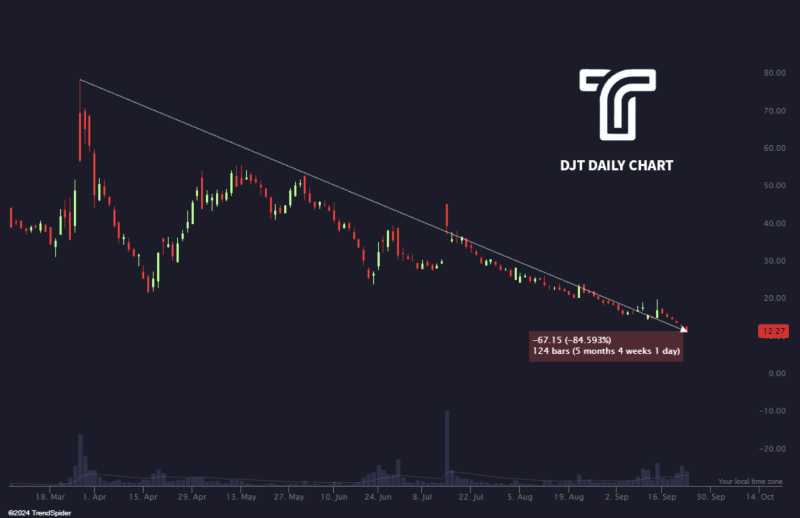

As it happens, the Trump Media stock’s most recent decline has contributed to the continuation of the descending trendline that extends from the high of $75 in mid-March to its current point in September, as per the chart shared by the analytics and trading platform TrendSpider in an X post on September 23.

Trump Media & Technology Group stock price analysis

Indeed, as the chart shows, during this period, DJT stock has steadily trended downwards, interrupted by an occasional short-lived bullish attempt, but ultimately rejecting at each of these attempts, failing to reverse the trend, and declining nearly 85% since the year’s high in mid-March.

For the time being, there does not seem to be any significant upward movement noticeable for Trump Media & Technology Group stock, and its price appears to be heading toward very low levels, possibly even to single digits, indicating continuous weakness and distress, and not showing any significant support level.

At press time, the price of DJT stock stood at $12.15, reflecting a 10.33% decline on the day, dropping 28.53% across the week, losing a whopping 46.90% in the past month, and accumulating a year-to-date (YTD) dip of 31.12%, according to the data retrieved by Finbold on September 24.

DJT stock forecast 2024

Meanwhile, news and developments related to the Republican presidential hopeful seem to be directly impacting the price of his company’s stock, and therefore, its investors and holders might greatly benefit from Trump’s potential victory in November against Democratic nominee Kamala Harris.

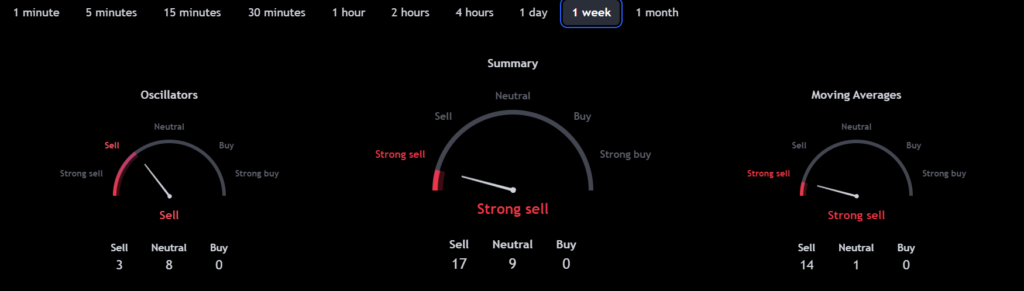

However, at the moment, the market seems to be bearish on his stock, suggesting a ‘strong sell,’ based on 17 ‘sell’ suggestions, nine ‘neutral’ recommendations, and with no ‘sell’ calls on the one-week sentiment gauges summary, taking into account its current technical indicators.

In fact, the stock’s simple moving averages (SMA) and exponential moving averages (EMA) on multiple observed time periods, as well as the moving average convergence divergence (MACD), are all indicating a ‘sell,’ with relative strength index (RSI) pointing at a ‘neutral.’

All things considered, Trump Media stock seems to be in trouble, but considering its movements often correspond with Trump-related news, impactful events surrounding the former President, including his potential re-election, could spell price recovery.