In January, Jim Cramer warned of a stock market pullback that came three months later, still holding gains against the warning. Since then, stocks have continued to grow with strong momentum despite recession signals that are now consolidating with economic data.

The S&P 500, the leading stock market index, was at around $4,765 on January 16 when the well-known investment commentator said the market was ready for a pullback, as reported by Finbold.

S&P 500 new highs and market pullbacks

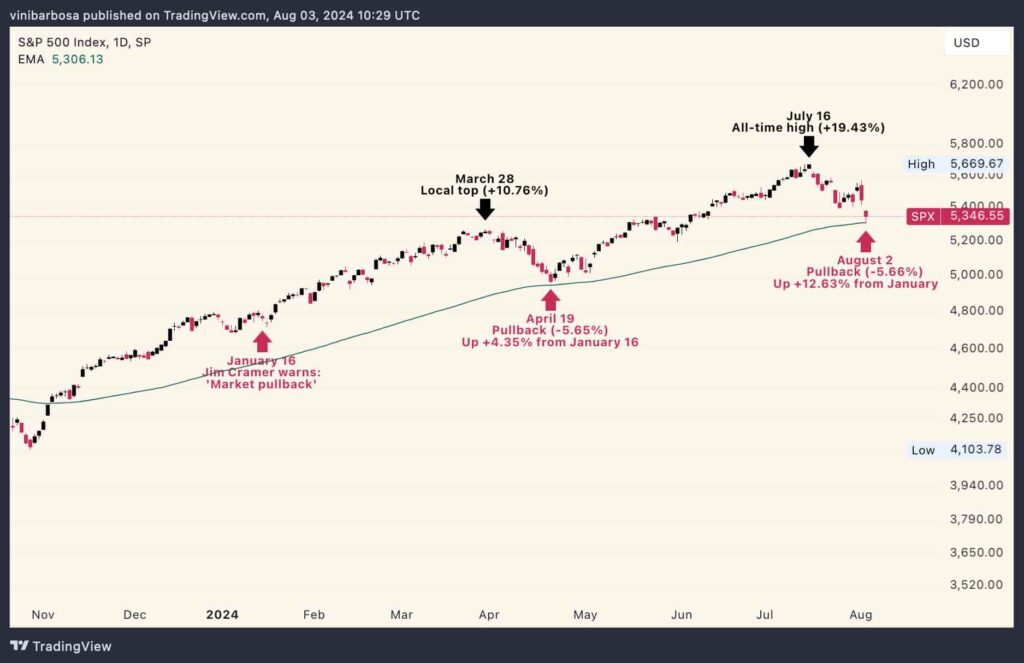

However, the index went straight up to a local top on March 28 with over 10% gains since the warning. It, indeed, experienced a pullback right after a brief consolidation, making a local bottom on April 19. At this point, the S&P 500 was down 5.65% in a pullback from March’s top, using the 100-day exponential moving average (1D 100-EMA) as support.

Interestingly, April’s pullback was still 4.35% up against Cramer’s warning, a situation that recently happened again. On July 16, the S&P 500 made an all-time high, up 19.43% since January 16, six months later.

This Friday, the market closed at $5,346.55, retracing 5.66% from the ATH while holding 12.63% gains against Cramer – again respecting the 100-EMA support, which will be put to the test next week.

Jim Cramer’s ‘market pullback’ warning

Jim Cramer hosts the Mad Money show on CNBC, where he warned about the upcoming market pullback early this year. Despite the warning, Cramer said he was not “a bear,” just foreshadowing a necessary correction on this occasion.

Essentially, the “market pullback” forecast was given from a short or mid-term trading perspective, considering the euphoria over some stocks.

“While I’m not a bear, we have way too many stocks that have gone parabolic, meaning they’re straight up, and they’re going straight up on nothing,” Cramer said. “They just keep rising as one analyst after another raises their price targets and really nothing more,” he continued.

It is also worth noting that investors usually receive Jim Cramer forecasts with a high level of skepticism. There is a play in the stock and cryptocurrency markets that encourage investors to do the opposite, as Cramer says.

Notably, the joke even took the form of a financial strategy known as “Inverse Cramer,” betting oppositely to his analyses. In April, Finbold reported the “Inverse Cramer” strategy was up 5.16% year-to-date, suggesting a winning strategy.

Now, the stock market awaits to see if the S&P 500 will hold the 100-day EMA support. If the index respects this key level, stocks can continue the ongoing uptrend. However, recent economic data in the United States point to the country being officially in a recession, raising uncertainties.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.