Palantir’s (NYSE: PLTR) share price continues to make headlines, with technical indicators now highlighting a possible path to $100.

This bullish run and outlook coincide with the American software company’s facing questions regarding its valuation.

PLTR ended the last trading session at $65.77, gaining almost 10% for the day, even as the general stock market traded in the red. The impressive performance is reflected in the year-to-date gains, with the stock up 296% in 2024.

PLTR’s path to $100

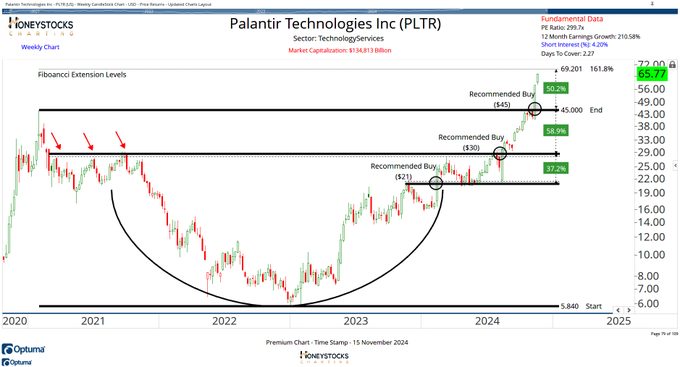

Stock trading analyst Sammy McCallum noted that PLTR is likely heading toward the $100 record high, with key Fibonacci levels marking important milestones along the way, the expert said on November 16.

McCallum highlighted the significance of the $69 level, derived from Fibonacci extension patterns, as the next major resistance. This level follows an impressive breakout above prior resistance zones at $21, $30, and $45. The bullish “cup-and-handle” formation supports the possibility of further gains.

“Fibonacci Level at $69 is the next big level of interest for me… through that, it’s probably a race to $100,” he said.

Indeed, Palantir has been on an upward tear since the company reported its Q3 earnings. For the quarter ending September 2024, Palantir posted 30% year-over-year revenue growth, exceeding guidance and achieving balanced growth across both commercial and government segments.

The gains accelerated after the firm, which has benefitted from the artificial intelligence (AI) boom, capitalized on the post-election rally.

This week’s momentum was accelerated after the software giant announced plans to move its listing from the New York Stock Exchange to the tech-heavy Nasdaq. The move is viewed as beneficial for the company, thanks to the advantages associated with Nasdaq listings.

Considering the company’s bullish guidance for the fourth quarter, there appears to be more room for PLTR’s upside potential. Palantir projects revenues between $767 million and $771 million. Revenue guidance was raised between $2.805 billion and $2.809 billion for the full year.

Concerns over PLTR’s valuation

Despite these impressive elements, the question remains about the stock’s relation to the company’s valuation. The valuation debate is heating up, as Palantir’s current market cap of nearly $150 billion is considered very high against its $2.6 billion in annual revenue.

To this end, some sections of the markets believe PLTR is trading in a bubble that is likely to burst.

This debate has split Wall Street analysts on PLTR’s outlook. For instance, Jefferies’ Brent Thill downgraded the stock from ‘Hold’ to ‘Underperform,’ with a price target of $28, citing concerns about the sustainability of its current rally.

Mizuho analyst Matthew Broome noted that “valuation cannot and should not be irrelevant,” setting a bearish outlook with a price target of $37.

However, Dan Ives from Wedbush remains optimistic. He views Palantir as a leader in the AI revolution and likens the stock to the ‘Messi of AI.’

In summary, Palantir’s strong rally reflects optimism about its AI potential. Still, concerns over its high valuation and mixed analyst opinions highlight the risks ahead that investors should take note of.

Featured image via Shutterstock