The stock market has recently experienced a tumultuous period, fueled by persistent inflation and escalating geopolitical tensions in the Middle East.

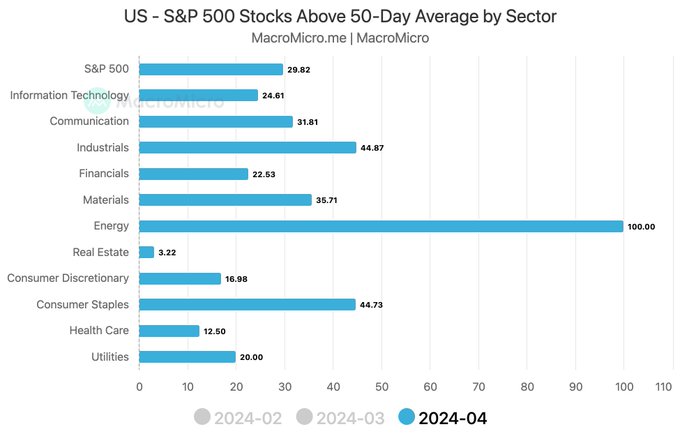

As different equities navigate this period of uncertainty, the energy sector stands out. It demonstrated resilience by continuing to trade above the 50-day moving average (MA) in April 2024.

According to data provided by MacroMicro on April 17, the energy sector’s ability to trade above this level sharply contrasts with the broader market, where only about 30% of stocks maintain this bullish indicator.

Picks for you

Drivers of energy stocks growth

It’s worth noting that the energy sector has experienced a resurgence as investors capitalize on rising oil prices and a robust domestic economy while hedging against inflationary pressures. Particularly in the US, crude oil has seen growth driven by an unexpectedly strong economy and concerns over escalating conflicts in the Middle East.

The surge of energy stocks presents a stark contrast from the previous year when the industry lagged behind the broader market due to concerns about weakening global demand.

At the same time, the Organization of the Petroleum Exporting Countries (OPEC) is expected to bolster crude prices through production cuts, a factor likely to stimulate growth in energy stocks. Notably, in March, several OPEC nations announced an extension of the voluntary production cut of 2.2 million barrels daily into the second quarter of 2024.

Other inflation hedges

Meanwhile, the sector is viewed partially as a hedge against inflation, which is considered stubbornly high and threatens to dampen the broader stock market. This could potentially influence Federal Reserve interest rate decisions.

The search for an inflation hedge has also been evident in precious metals, with gold notably standing out and hitting new record highs. Traditionally, gold is considered a safe haven during inflationary periods.

As the energy sector continues to gain momentum, there is a prevailing bullish sentiment, with some citing ongoing geopolitical turmoil as catalysts for further growth. Historically, energy stocks have performed well during periods of economic strength, fueled by increased demand for energy to power the production of goods and services.