With Nvidia’s (NASDAQ: NVDA) stock rallying massively in 2024, the trajectory has coincided with a period when the chipmaker’s insiders have been on a selling spree, offloading the highest number of shares in history.

Particularly, the insiders have sold over $1.8 billion worth of stock, or almost 11 million shares, in 2024, marking the highest level since 2020, data compiled by The Washington Service indicates.

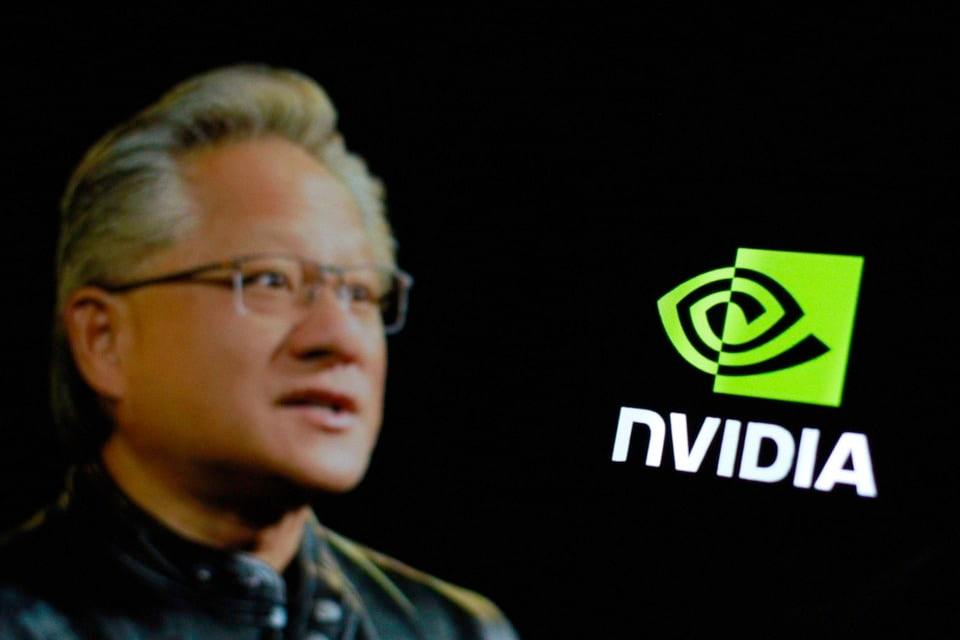

Despite the record sales, speculation remains that the executives and directors will likely sell more in the coming months. CEO Jensen Huang led the pack after completing a planned sale of over $700 million of NVDA shares.

After Huang’s sale, other insiders, led by Mark Stevens, a member of Nvidia’s board of directors, have also shown a notable uptick in selling their holdings. Stevens’ latest transaction involved $4,840,356. Other sellers include Tench Coxe, Nvidia’s third-largest shareholder and director, Chief Financial Officer Colette Kress, and Principal Accounting Officer Donald Robertson.

Concerns regarding Nvidia insider selling

Indeed, these sales have raised concerns regarding investor confidence in the company’s short-term outlook, considering that as the sales accelerated, Nvidia’s share price faced notable volatility alongside significant capital swings. The concerns were further elevated considering the recent misfortunes that hit the technology giant.

For instance, the technology giant has faced a possible antitrust investigation by the United States government, delays in the rollout of the highly anticipated Blackwell chips, and growing competition in the artificial intelligence (AI) semiconductor space.

In keeping up with the legal situation, Finbold reported that the Department of Justice (DOJ) and the Securities and Exchange Commission (SEC) accused Nvidia of misrepresenting the source of over $1 billion in GPU sales that were reportedly delivered to crypto miners.

What next for Nvidia stock?

Looking ahead, Nvidia stock has been on a roller coaster ride throughout 2024, with AI momentum elevating the company to emerge as the most valuable in the world at one point.

However, since mid-June, the stock has experienced a notable downturn, with concerns emerging regarding its ability to sustain the AI boom. At the moment, NVDA shares have resumed a bullish trajectory, seeking to build momentum above the $124 support level.

At the latest market close, the equity was trading at $124, ending the day up 1.6%. Over the past week, NVDA has rallied almost 6%.

Based on Nvidia’s latest value, stock trading expert Peter DiCarlo acknowledged in an X post on October 5 that the stock ended the week with notable strength. He noted that the stock confirmed higher highs on the weekly BX chart, signaling a positive breakout pattern.

Notably, Nvidia has formed a series of upward movements, reinforcing bullish sentiment. Prices consistently bounce off trend lines, suggesting stronger buyer interest.

According to the expert, the latest formation of higher highs raises the probability of a breakout above $150 by December, supported by tightening price action and positive-signaling momentum indicators.

Elsewhere, in another outlook for Nvidia, a trading expert with the pseudonym SBZung pointed out that the equity is showing a potential breakout from a crucial level at $125, suggesting a bullish target of $182. The expert presented multiple Fibonacci retracement levels as critical support and resistance points.

However, the analysis also pointed to possible downside risks. If the stock fails to hold its current support levels, it could fall toward $111, a critical 45% Fibonacci retracement level, with the next lower support marked at $108.

Meanwhile, some Wall Street analysts maintain that Nvidia could see more upside in the coming months. To this end, Phil Panaro, a former senior advisor at the Boston Consulting Group, suggested that the stock could rise to $800 by 2030. He cited the tech giant’s dominance in the AI space and the rollout of the Blackwell processors, factors he believes could drive the company’s revenue to $600 billion by 2030.

Already, the company is witnessing strong demand for its chips, a factor that Nvidia has admitted is causing tension among customers.