The recent Q2 stock holdings report on August 14 revealed that traders’ favorite investor, Warren Buffett, made significant changes to his portfolio, especially in his largest holding, Apple (NASDAQ: AAPL).

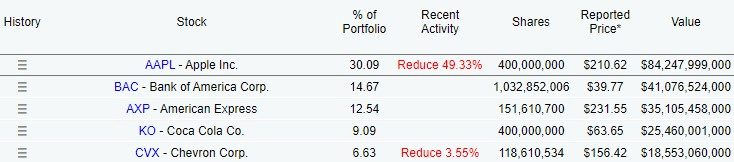

Namely, during the quarter lasting from March 30 to June 30, the CEO of Berkshire Hathway (NYSE: BRK.A) decided to significantly trim the largest position in the portfolio, Apple, by selling 49.33% of its shares, as reported by Finbold.

This reduction left Apple’s first spot unchanged but with a much smaller position: 400,000,000 shares, or 30.09% of the overall portfolio.

What made Buffett’ trim his Apple stock position?

Although it is hard to determine the precise reason “Oracle of Omaha” decided to cut his AAPL stake, there could be several potential reasons for him doing so.

One of the most speculated reasons is tax burdens, which Buffett himself hinted at the annual Berkshire Hathaway shareholder meeting.

If the capital gains tax were to increase in the future with the upcoming U.S. presidential elections, offloading shares now would mean that the gains would be taxed under the current, more profitable tax plan.

Another reason could be that Buffett thinks that the market could soon experience a correction, which would be an excellent opportunity to use his $280 billion cash pile to invest in other stocks, something his updated stock portfolio revealed.

How did Apple stock perform since the sale?

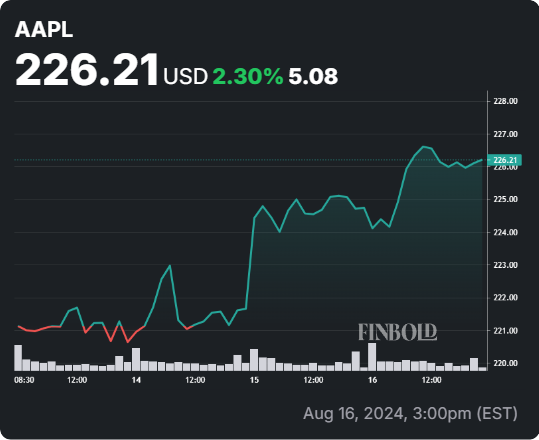

Although sales are not disclosed immediately but only after a two-month period, AAPL stock has performed well since June 30 and August 14.

Namely, since June 30, AAPL stock added 4.29% to its value, while the more recent period since August 14 saw it increase by 2.49%.

Currently, AAPL stock is trading at a valuation of $226.05 after adding 0.59% in the latest trading session on August 16, which continues the positive trend from the previous five trading days, where Apple shares gained 4.29%.

Since Buffett hinted that they already offloaded AAPL shares in May, this could mean an even larger gain for iPhone maker stock as it added over 23% to its value.

Despite this, Berkshire Hathaway’s founder managed to rake in over 500% profit on his initial investment in 2016, ensuring the trade’s profitability.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.