After its recent earnings report fell short of expectations, leading to a sharp price decline and analysts’ lowering their predictions for the next 12 months, a popular artificial intelligence (AI) model has provided insights revealing when Amazon (NASDAQ: AMZN) stock could hit $250.

Indeed, Amazon stocks suffered their largest one-day price decline since April 2022 after reporting revenue of $146.68 billion instead of the expected $147.98 billion and projecting the third quarter profit between $154 billion and $158.5 billion, below the previously projected $158.24 billion.

ChatGPT’s Amazon stock price prediction: 2025

Hence, Finbold has tasked the OpenAI brainchild ChatGPT model, called GPT-4o, to analyze the available information and offer insights into when Amazon shares could achieve the price of $250, to which the chatbot offered several key ideas, from the viewpoint on August 9, 2024.

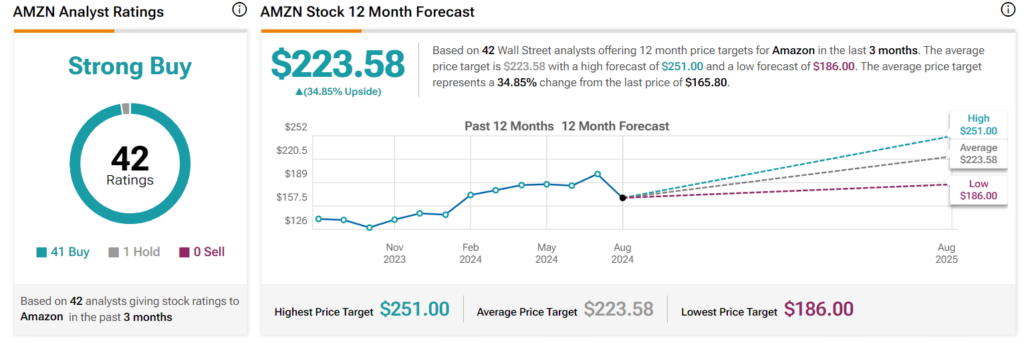

Specifically, the AI model relied primarily on analysts’ predictions “based on various models and expert opinions,” which it noted “vary significantly, with most not expecting an immediate rise to $250.” However, some of the more bullish prognoses place the $250 target within the next 12 months:

“The average 12-month stock price forecast from analysts is approximately $219, with some high-end predictions reaching $251. This suggests a potential within a year, although $250 is at the very high end of these estimates.”

Among the factors that could play a role in Amazon achieving the price of $250 within this time period, ChatGPT-4o has singled out the company’s growth and development, “notably in high-margin areas like Amazon Web Services (AWS) and advertising,” as well as “Amazon’s investments in AI and new technologies.”

Furthermore, it highlighted that certain technical analysis (TA) indicators “suggest a bullish pattern, indicating that the stock could trend upwards in the short term,” although warning that “these patterns don’t specifically target the $250 level.”

What market experts say

It is also important to note that Morgan Stanley (NYSE: MS) analysts, led by Brian Nowak, have removed AMZN stock as their ‘Top Pick,’ citing “disappointing and multi-faceted” results in a recent client note, highlighting particular concerns with Amazon’s retail operations.

On the other hand, Nowak believes that improvements in its ‘cost-to-serve’ metrics, or its efficacy in delivering products to customers, and advertising business will help Amazon offset the impact, at least in the longer term, stressing that:

“In our view, Amazon needs to demonstrate an ability to deliver growth and profitability (…) even as its product mix continues to shift toward lower margin items.”

For the moment, finance experts are holding onto their average Amazon price target of $223.58, as well as the ‘strong buy’ score, with only one analyst recommending to ‘hold’ and with no ‘sell’ calls for the next 12 months, according to the latest TipRanks information on August 9.

Amazon stock price analysis

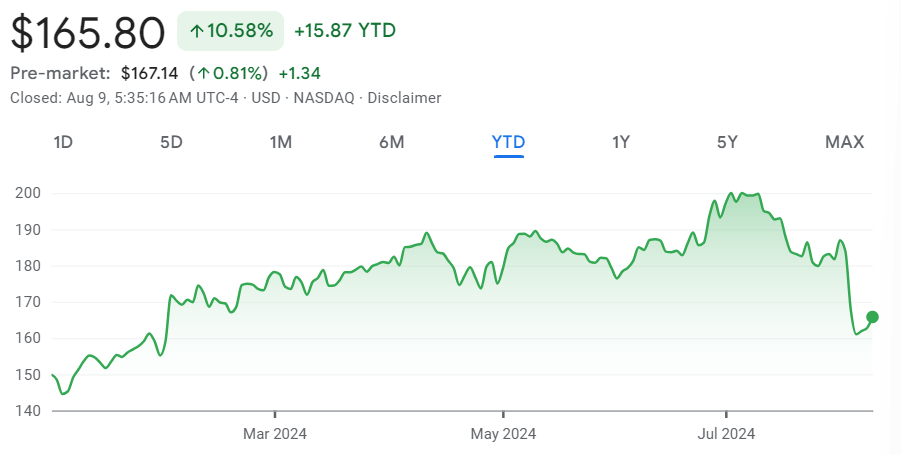

At press time, the price of Amazon stock stood at $165.80, recording an increase of 1.86% on the day, a 0.44% decline across the past week, adding up to the 16.83% drop on its monthly chart, and reducing its year-to-date (YTD) gains to 10.58%, as the recent data shows.

All things considered, Amazon stock could hit the price of $250 in the time frame suggested by the generative AI model, although it is a more optimistic scenario. That said, things in the stock market can sometimes take an unpredicted path, so doing one’s own research is critical when investing.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.