Amid the prevailing bullish sentiment engulfing the entire stock market, some experts are unable to ignore the possibility of an eventual end to this streak.

Despite many doomsayers’ predictions turning out to be nothing more than that, there’s a notable voice this time: Mike Wilson, an expert with a track record of accurate predictions, has weighed in.

Wilson, Morgan Stanley’s Chief Investment Officer, pointed out that the recent equity gains over the past five months have primarily been fueled by more lenient financial conditions and increased valuations rather than any significant improvement in fundamentals.

Picks for you

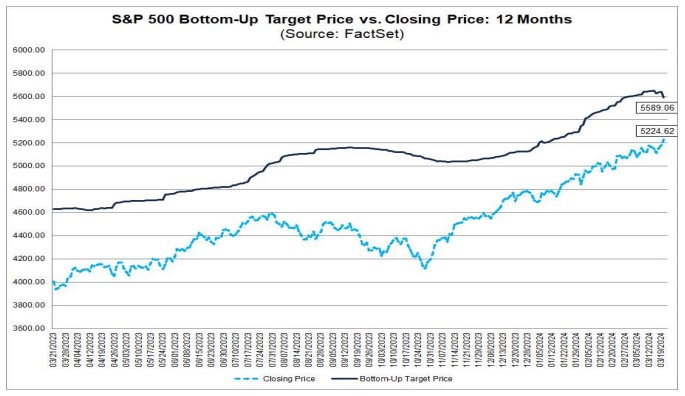

According to a note from Wilson’s team, they stated that further multiple expansion in the US is probably contingent on a rise in earnings expectations. They emphasized the difficulty in justifying the elevated valuations of indices solely based on fundamentals, as earnings forecasts for 2024 and 2025 have seen minimal changes during this period, and when these earnings don’t meet expectations, the stock market downturn will be inevitable.

Wilson seems to be onto something

Wilson’s assertions appear to be grounded in facts, and his perspective isn’t solely bearish talk.

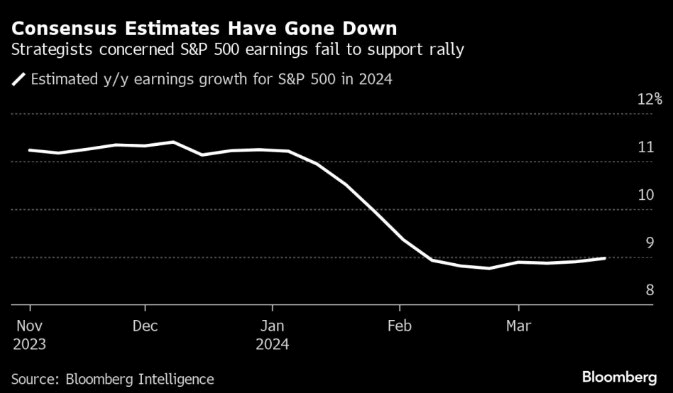

Data gathered by Bloomberg Intelligence reveals that consensus earnings estimates have been adjusted downward over the last five months. Analysts currently anticipate earnings-per-share to grow approximately 9% this year, down from the 11% forecasted at the beginning of November.

Despite the decline in profit estimates, US stocks have maintained their upward trajectory, buoyed by optimism surrounding potential rate cuts, advancements in artificial intelligence, and a fourth-quarter results season that surpassed expectations.

Wall Street’s institutions conflicted on S&P 500 outlook

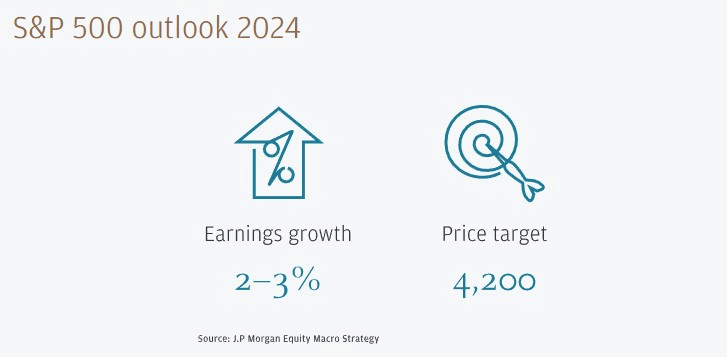

It’s important to highlight that JPMorgan (NYSE: JPM) stands out as one of the most pessimistic strategists among major Wall Street banks. Their projection suggests that the S&P 500 will conclude the year at 4,200 index points, indicating a 20% decrease from the most recent close.

Conversely, financial institutions like Goldman Sachs hold a more optimistic view. They anticipate the S&P 500 reaching 6,000 if mega-cap stocks demonstrate strong earnings and if real-world events align favorably.

A key concern for bearish strategists is the narrow scope of recent equity-market gains, primarily propelled by what’s been dubbed the ‘Magnificent Seven.’ Wilson noted that for the rally to sustain momentum from this point onward, the market will need to diversify and broaden its focus beyond these select few.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.