Dogecoin’s (DOGE) recent price action has caught the attention of traders and investors, with market analysts suggesting the meme coin could be on the brink of its ‘next uptrend’.

Notably, cryptocurrency trading expert Trader Tardigrade highlights that DOGE has successfully eased from its overbought levels, with the Relative Strength Index (RSI) on the daily chart returning to the neutral 50 zone.

This reset indicates the token has relieved its overbought pressure, paving the way for another potential leg upward. Historically, such RSI relief often precedes strong bullish movements, signaling a renewed momentum for the asset.

According to the expert, If DOGE sustains its current trajectory, it could target the critical $0.5 resistance level, a psychological barrier that, once breached, could open the door to further gains.

“Since DOGE pullback has occurred and the RSI overbought condition has eased back to 50, another Uptrend could happen at any time”- he noted

Meanwhile, the analyst previously indicated that DOGE’s bull run had “just begun,” citing signals from the Price Momentum Oscillator (PMO) indicator, as reported by Finbold

For traders, this presents a potential opportunity to capitalize on Dogecoin’s next move, while investors eyeing long-term growth may view this as an attractive entry point.

Key indicators point to increased network activity

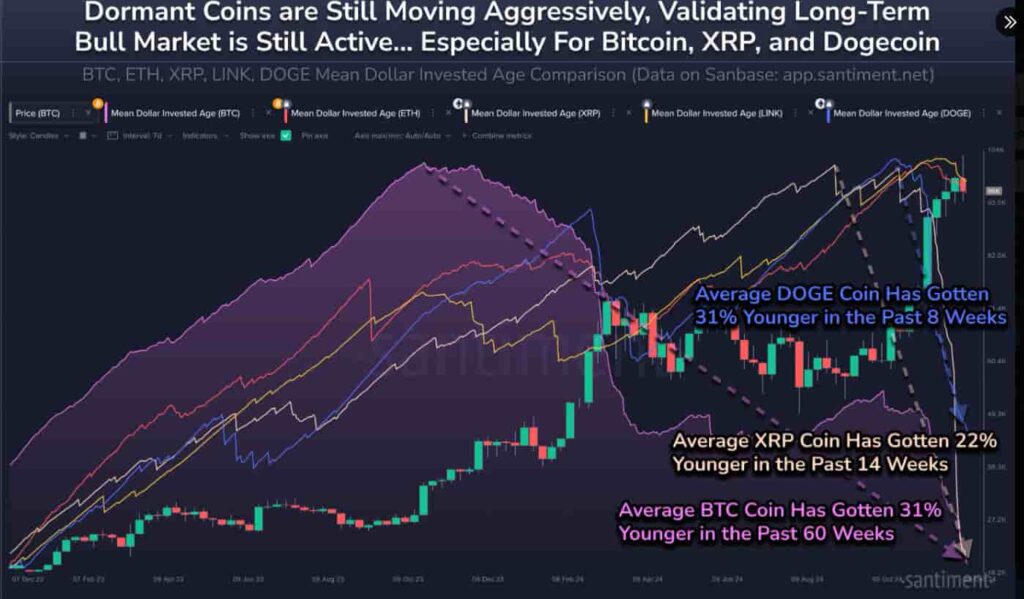

Further supporting this outlook, recent data from Santiment highlights a significant decline in Dogecoin’s Mean Dollar Invested Age, now at 370 days after dropping 31% over the past week, reflecting increased network activity among dormant wallets.

This surge in network participation, particularly from large stakeholders like whales, has historically aligned with the early stages of bullish cycles for cryptocurrencies.

Recent whale movements further reinforce the bullish narrative, with a transfer of over 61 million DOGE, worth $23.5 million, to Robinhood, followed by another transfer of 85.4 million DOGE, worth $32.9 million. Such large transactions can often increase the likelihood of heightened price volatility in the short term.

Long-term projections hint at a significant upside

Adding to this bullish perspective, crypto analyst Ali Martinez projects that Dogecoin is still in the ‘early stages of its bullish cycle.’

Martinez projects that DOGE could reach $3 during the current bull run, with long-term projections pointing to a potential rise as high as $18.

These predictions align with historical trends, where Dogecoin has repeatedly rallied within an ascending price channel, consistently targeting the upper boundary during bull markets.

Dogecoin price analysis

At press time, DOGE is trading at $0.42 with a daily gain of 2.95%, although it remains down by over 7% on the weekly chart.

Despite the recent dip, the reset in RSI provides Dogecoin with ample room for further upside, particularly with the critical $0.5 resistance level in sight.

As momentum builds and bullish indicators align, Dogecoin stands out as a key asset to watch in the volatile crypto market.

Featured image via Shutterstock