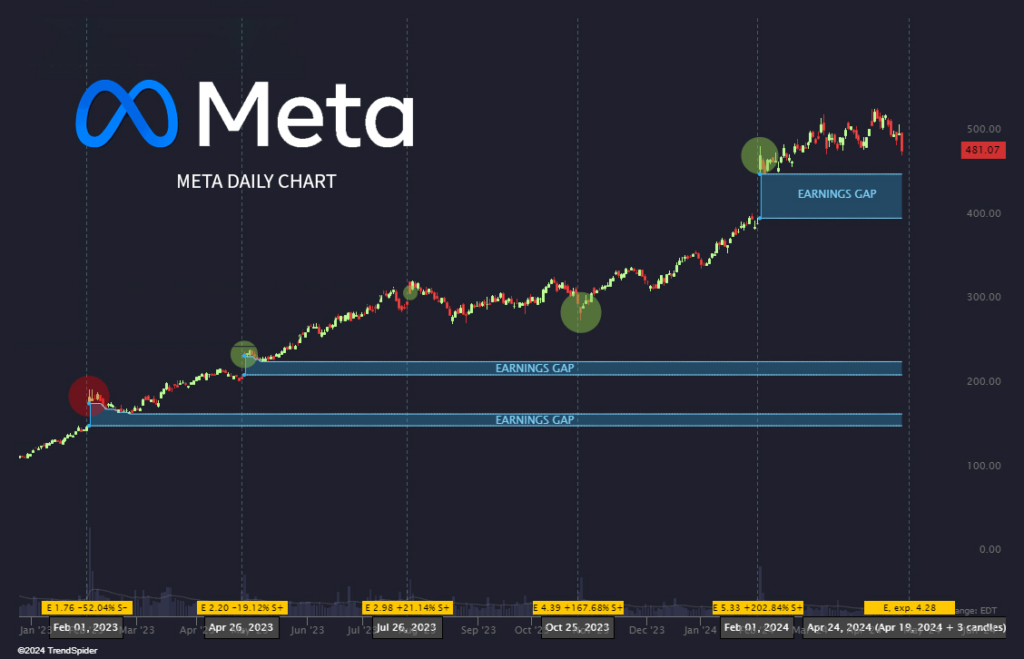

Meta Platforms (NASDAQ: META) stock delivered an impressive performance in the first quarter of 2024, soaring by nearly 39% and indicating potential for further growth this week owing to various upcoming events.

Additionally, historical data suggests a positive trend for META shares post-earnings, consistently boosting their valuation.

For instance, the most recent earnings report resulted in a substantial 21% increase in the stock price, underscoring Meta Platforms’ optimistic outlook.

The week of April 22 could also be fruitful for META stock, combined with Q1 earnings that are set to be released on April 24 after markets close.

Analysts are bullish on Q1 earnings for Meta

The upcoming earnings report from Meta Platforms is poised to unveil robust quarterly earnings of $4.32 per share, marking an impressive 63.6% surge from the same period last year. Analysts also forecast revenues of $36.25 billion, reflecting a solid 26.6% year-over-year growth.

With a 1% upward revision in the consensus earnings per share estimate over the past 30 days, analysts’ adjusted expectations underscore the importance of monitoring changes in earnings projections.

Investors closely analyze analysts’ forecasts for key metrics to gain deeper insights into Meta Platforms’ performance. Experts anticipate that revenue from Reality Labs, originally Oculus VR, will likely soar to $525.62 million, a substantial 55.1% increase from the previous year.

Family of Apps revenue is also expected to reach $35.89 billion, indicating a 26.8% year-over-year growth. If met or exceeded, this bullish outlook will likely positively impact the META stock.

TikTok ban would decrease competition and bring more users

On April 20, The House approved legislation in a 360-58 vote that would compel ByteDance, the China-based owner of TikTok, to sell the app to a buyer not controlled by a foreign adversary within 270 days.

TikTok and the Chinese government are unlikely to agree to these terms, which would lead to a ban and a flock of users from the US being forced to switch their allegiance to other social media apps, most notably Facebook and Instagram, both owned by Meta.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.