Summary

⚈ Over 2.17 million BTC, worth $210 billion, are still held at a loss.

⚈ BTC nears $97,000, with a 3.26% weekly gain and a possible $100K retest soon.

Bitcoin (BTC) staged a move past $90,000 on April 22 following significant inflows — most of which came from retail trading. While the leading cryptocurrency has approached $97,000 it has struggled to hold that level despite positive recent price action.

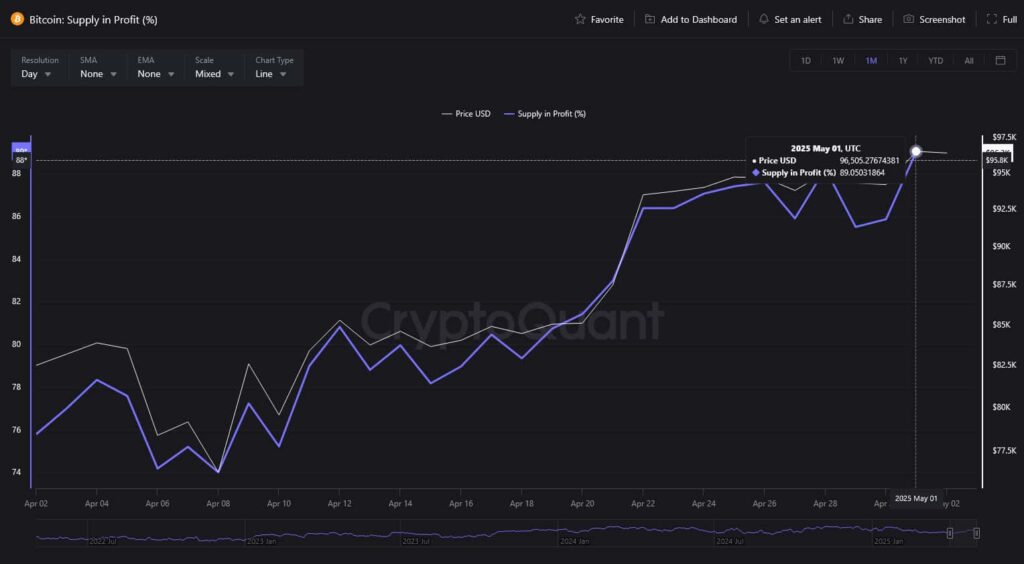

In tandem with the increase in price, the proportion of BTC supply currently being held at a loss has shrunk significantly — from nearly 25% in early April to 11% as of May 2, per data from market intelligence platform CryptoQuant analyzed by Finbold. Low levels such as these typically reduce selling pressure and supports bullish sentiment.

To be more precise, some 2,174,467 Bitcoins, worth a combined total of roughly $210.33 billion, are being held at a loss as of the time of writing.

Is Bitcoin’s supply held at loss shrinking a sign of market recovery?

Although still far off from an all-time low of 0.14% in terms of supply held at loss, this datapoint is another vote of confidence for BTC’s present rally. To the extent that profit-taking might be taking place, it hasn’t blunted upward momentum.

In the past week, Bitcoin prices have increased by 3.26%. The flagship cryptocurrency was changing hands at a price of $96,730 at the time of writing.

At current prices, a move to $100,000 would require a 3.38% rally. Barring significant negative developments, a retest of resistance is very likely going to occur soon.

Featured image via Shutterstock