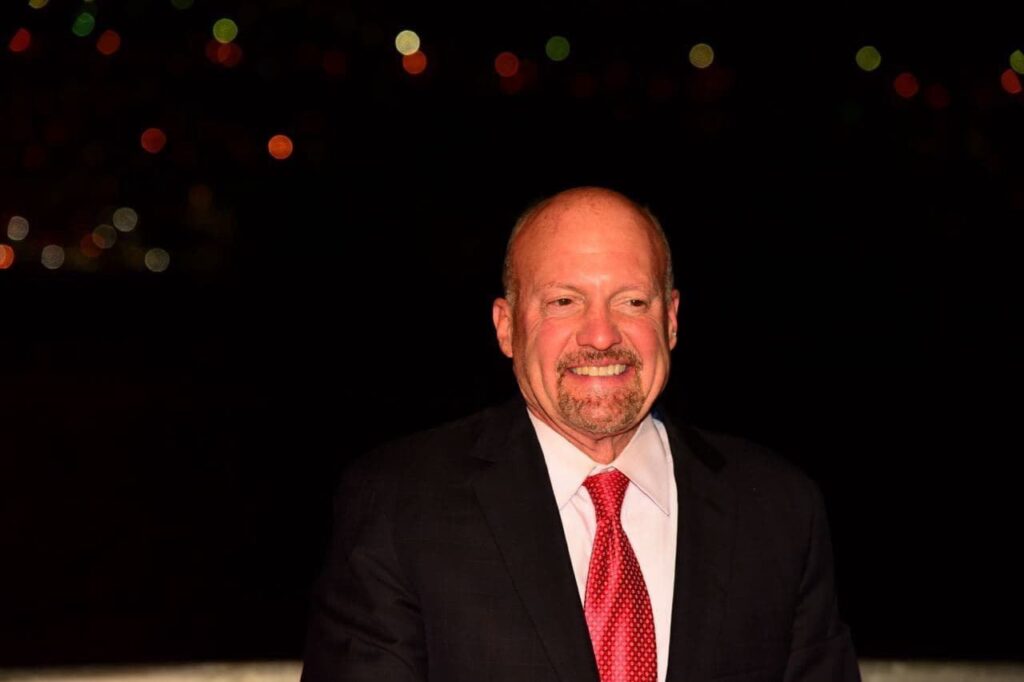

On November 28, 2023, Jim Cramer, the prominent investor and host of CNBC’s “Mad Money,” recommended his readers and listeners invest in the aeronautics giant Boeing (NYSE: BA).

At the time, he admitted that Boeing had some issues in the previous year but predicted that it would be smooth sailing going forward, even going so far as to say that 2024 will be the company’s year:

Ok, Boeing’s going higher. I think that this is their year. Last year, they had supply chain problems and a couple snafus with some planes. Now it seems to be clearer sailing…Buy the stock of Boeing.

For a time, Cramer was actually right as Boeing retained its upward momentum until mid-December and stayed level in the stock market all the way to the end of 2023 but, 2024 brought some significant changes.

Why is Boeing stock crashing in 2024?

In an unfortunate event for the company and for passengers, 2024 started with an emergency landing of Alaska Airlines Flight 1282 after a piece of the Boeing 737 MAX 9 airplane fell off mid-air.

While there were no casualties in that specific incident, it immediately reignited long-standing concerns about quality control at Boeing given that only five years earlier – in 2019 – a crash of an Ethiopian Airlines’ Boeing 737 MAX 8 killed all souls on board – 157 people.

What made the 2019 crash all the more worrying is that the disaster was caused by issues with the series of planes Boeing was aware of for a relatively long time but was fairly sluggish at fixing.

The immediate aftermath of the 2024 incident caused significant problems for the aeronautics giant as several important airplane deliveries were postponed, numerous aircraft were grounded as an FAA probe began, and a string of lawsuits by affected individuals and institutions was filed.

What makes the issues with Boeing particularly worrying is that it is one of the only two major aircraft manufacturers in the world – the other being Airbus (EPA: AIR).

How much is Boeing stock down since Cramer recommended buying?

Boeing shares were worth $222.37 when Cramer made his strong recommendation on November 28, meaning BA – given its press time price of $182.35 – fell as much as 17.997% since.

Traders who failed to act immediately on Cramer’s advice and instead bought at BA’s December peak of $264.27 are down even more – 31%.

Additionally, even after Boeing’s most recent troubles began in earnest, the “Mad Money” host again recommended the stock on January 24, saying that BA shares are already recovering and will continue rising due to it essentially being too big to fail.

BA stock declined 14.84% since the January recommendation – from $214.13 to $182.35.

Boeing stock price chart

While Boeing has been struggling in the stock market for years, 2024 marked a significant sharpening of the company’s decline. Year-to-date (YTD), BA shares are 27.57% in the red.

There is little silver lining in the more recent performance as it is down 10.34% in the last 30 days, and 9.14% on the weekly chart. Boeing’s latest close was also in the red – by 1.03% – and placed BA stock at $182.35.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.