The technology world is currently focused on the upcoming Apple (NASDAQ: AAPL) event titled ‘It’s Glowtime,’ where the company is expected to unveil the iPhone 16.

Notably, considering the growing competition in the smartphone market, the Apple event is of significant interest as the company’s new product is likely to impact its stock price.

Regarding the tech giant’s stock, AAPL has had an impressive run in recent months, gaining over 30% in the last six months and up almost 20% year-to-date. By press time, the share price was $222.

AAPL’s reaction to Apple event

Although Apple’s stock is currently influenced by general market sentiment, there is anticipation that the event scheduled for September 9 will have a short-term effect on AAPL. In this context, an analysis shared by Trend Spider in an X post on September 6 highlighted what to expect.

According to the platform, there is a likelihood that the unveiling will turn into a historical ‘buy-the-news’ event for the stock. Indeed, this trend has been observed in other tech giant product releases.

For instance, Apple’s stock experienced an upward move following the company’s artificial intelligence (AI) event earlier this year. A similar trend may be anticipated if the iPhone 16 launch meets or exceeds market expectations.

Notably, the analysis indicated that with Apple’s stock currently trading at $222, there is significant resistance near the all-time high of $237. If the event generates positive sentiment and strong demand forecasts, AAPL could again challenge these highs.

At the moment, the stock’s critical support zone is between $200 and $210, which has historically acted as a base for bullish rallies. The price movement following the AI event has proven that Apple can bounce strongly off this zone when positive news aligns with market sentiment.

However, if Apple breaks above the resistance near $237, the path to new all-time highs could open up. Such a price move will likely need a catalyst, such as high iPhone 16 pre-order numbers, new features, or strong guidance regarding future product launches.

Wall Street issues AAPL outlook

Expectations are that Apple will release four models of the iPhone—the iPhone 16, the iPhone 16 Plus, the iPhone 16 Pro, and the iPhone 16 Pro Max. Notably, the phones are projected to come with major upgrades, especially on the hardware side, such as battery life and displays. Additionally, there will be interest in how the company integrates AI into its upcoming device.

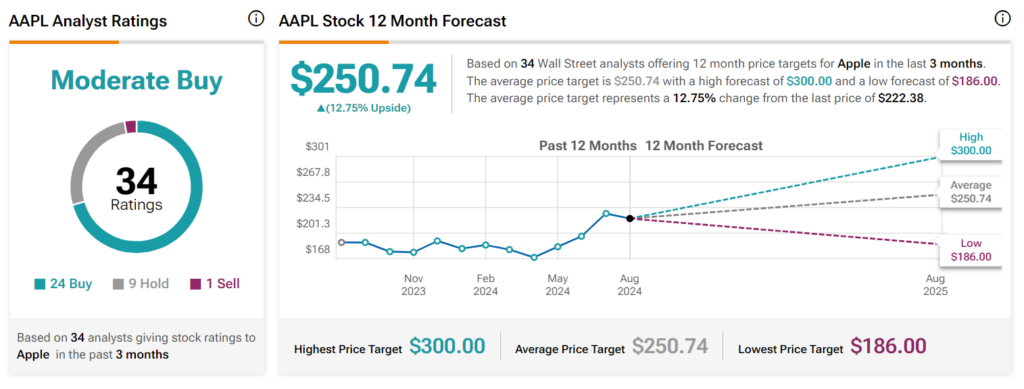

Besides the expected impact on the stock from the Apple event, Wall Street analysts at TipRanks anticipate that the company will sustain its bullish momentum over the next 12 months.

Notably, 34 analysts project that Apple will likely hit an average price target of $250, reflecting an increase of 12% from the current valuation. The experts have projected a high target of $300 and a low forecast of $186. Additionally, the majority of analysts, 24 out of 34, have issued a buy rating for the stock.

It’s worth noting that some of the analysts drawn from banking giant Bank of America (NYSE: BAC) maintained a ‘buy’ rating, noting that the upcoming iPhone 16 will likely inspire interest in AAPL. In this case, BoFA pointed out that the new phone series and the introduction of Apple Intelligence in the U.S. will usher in a software-driven, multi-year upgrade cycle.

Overall, although the sentiment around Apple is bullish, the stock remains susceptible to general macroeconomic developments, especially with the anticipated interest rate decisions by the Federal Reserve.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.