In recent months, technology stocks have been the darling of the markets, driving record gains in indices such as the S&P 500.

Indeed, with the tech stock rally mainly attributed to elements like their ventures into artificial intelligence (AI), concerns are emerging that equities might not continue to enjoy the recent momentum.

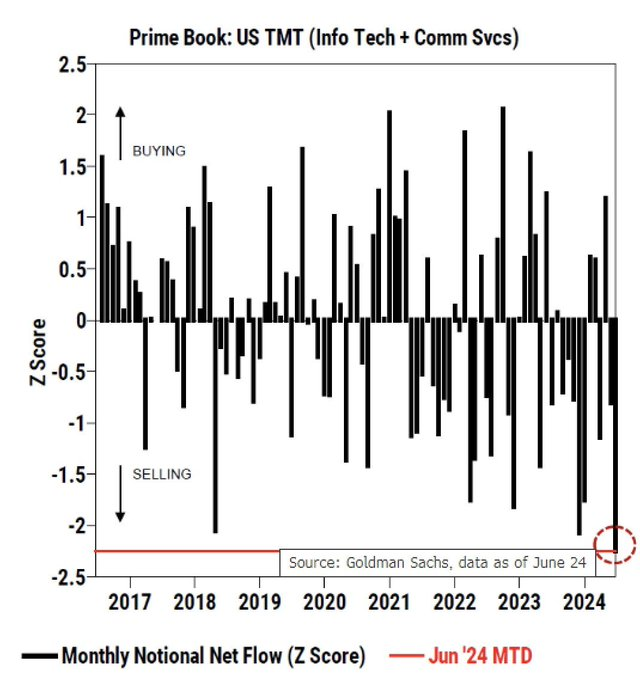

Specifically, data shared by the Michael Burry stock tracker in an X post on June 27 highlighted a concerning trend. The data referenced from a Goldman Sachs (NYSE: GS) report indicated that hedge funds are offloading technology stocks at an unprecedented rate.

“This is insane. Goldman Sachs just reported that hedge funds are aggressively offloading tech stocks at a rapid rate we haven’t seen in years. June is already a record month,” the post read.

Breakdown of selling activity

The data illustrated the monthly notional net flow (Z score) in the US Technology, Media, and Telecommunications (TMT) sector, encompassing both information technology and communication services. The data’s Z score measures the deviation from the mean net flow, offering insights into hedge funds’ trading behavior.

Key observations include the buying and selling trends, with the chart divided into two main sections: buying (above the zero line) and selling (below the zero line). The Z score ranges from -2.5 to 2.5. Over the years, there have been fluctuations in the buying and selling activities.

Notably, there were periods of aggressive buying around 2018 and 2020, with Z scores exceeding 1.5. The most alarming aspect of the chart is the pronounced selling activity observed in June 2024. The Z score plummeted to nearly -2.0, indicating a substantial increase in selling pressure.

Implication of hedge fund selling

The aggressive offloading of tech stocks by hedge funds raises concerns about a potential bubble burst in the technology sector. Several factors could be contributing to this trend: Valuation concerns with tech stocks reaching all-time highs in recent months may lead hedge funds to lock in profits, anticipating a market correction.

Macroeconomic factors such as rising interest rates, inflation, and geopolitical tensions could be prompting a shift away from high-risk tech stocks.

Additionally, investors might be reallocating funds to other sectors perceived as safer or undervalued, contributing to the sell-off in tech amid increasing uncertainty regarding the potential onset of a recession.

In the meantime, it is worth noting that such trading behavior has been witnessed in specific tech stocks that have been instrumental in leading the sector’s rally. For instance, as reported by Finbold, while the stock of semiconductor giant Nvidia (NASDAQ: NVDA) has seen an accelerating inflow of retail investors, it is also recording significant selling by company insiders. These elements potentially point to a possible correction in the equity.

Notably, Nvidia’s venture into the AI realm has driven increased investor interest, elevating the company to emerge as the world’s most valuable company in terms of market cap.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.