Nearly 16 years ago, Senator Sheldon Whitehouse received a closed-door briefing from the Bush administration about the impending financial crisis to shake the economy and crash the stock market.

Shortly thereafter, Whitehouse took action, selling $600,000 worth of Comcast (NASDAQ: CMCSA) stock of a leading 5G network provider and other holdings in his portfolio, thus avoiding significant losses during the 2008 financial crisis.

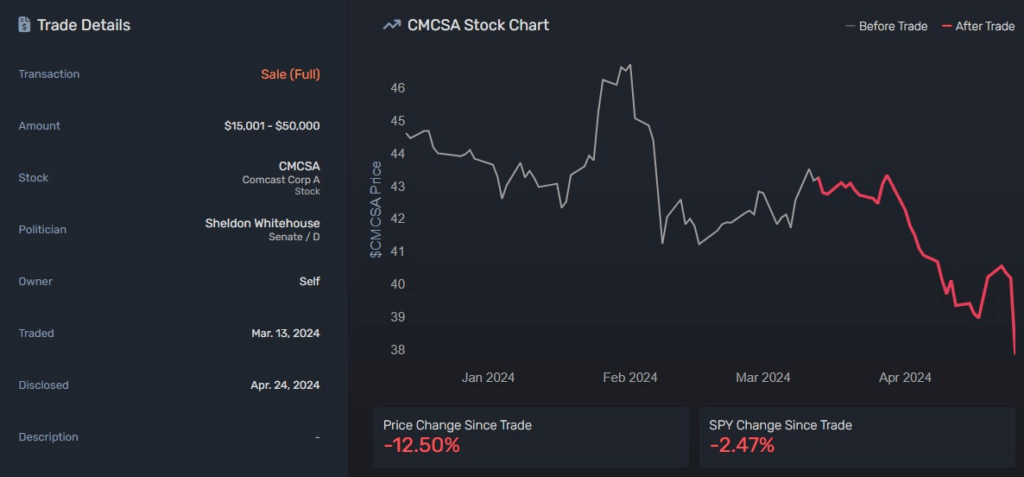

Fast-forward to the present: Senator Whitehouse recently divested his entire CMCSA stock holding valued at approximately $50,000 on March 13, with the trade filed on April 24. During this time frame, CMCSA shares plunged by 12.50%.

Picks for you

Now, traders might be worried if this was simply Whitehouse dumping the remaining CMSCA holdings in his portfolio or repeating a horrible scenario.

Perhaps CMSCA is just a member of a highly competitive industry

On April 25, Comcast exceeded analyst expectations for first-quarter revenue and profit, reporting $30.06 billion in revenue and $3.86 billion in net income, or earnings per share (EPS) of $0.97.

Despite this positive performance, shares declined due to ongoing declines in cable and broadband subscriber numbers.

The competitive internet landscape, with giants like Verizon (NYSE: VZ), T-Mobile (NASDAQ: TMUS), and AT&T (NYSE: T), adds pressure on Comcast.

Peacock, Comcast’s streaming service, grew with 34 million paid subscribers, up 55% from the previous year, and generated over $1 billion in revenue.

However, despite revenue growth, Peacock reported an adjusted EBITDA loss of $639 million for the quarter, highlighting ongoing challenges in profitability.

Whitehouse defends himself

One thing that might work in Whitehouse’s defense is the claim that he doesn’t control his portfolio, and that he has transferred this power over to a broker, which only acted defensively when he sold off CMSCA stock in 2008.

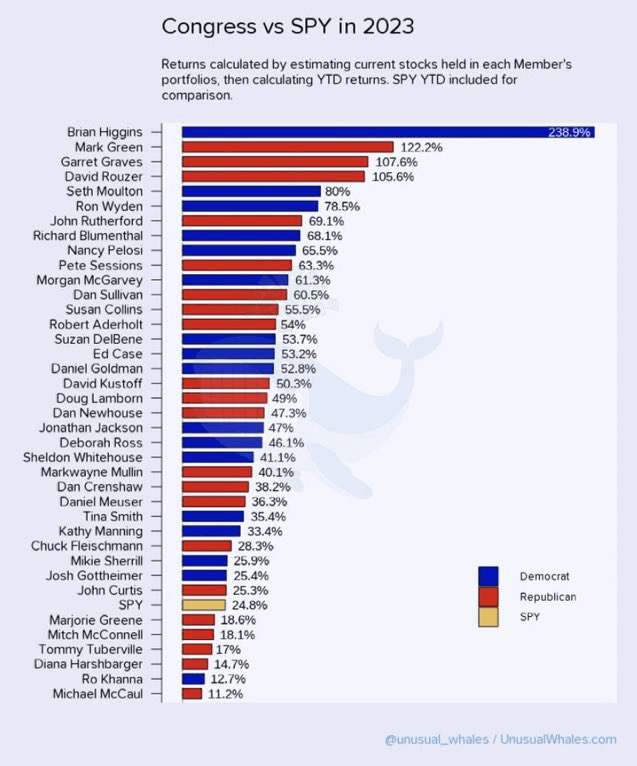

Whether true or not, Whitehouse’s portfolio boasted an impressive 41.1% return rate in 2023, making it quite successful and well above the average return of the S&P 500.

Maybe Whitehouse’s broker decided to sell CMSCA stock because of the competitive industry landscape, or perhaps the Senator shared some concerning information with them. Only time will reveal which scenario is true.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.