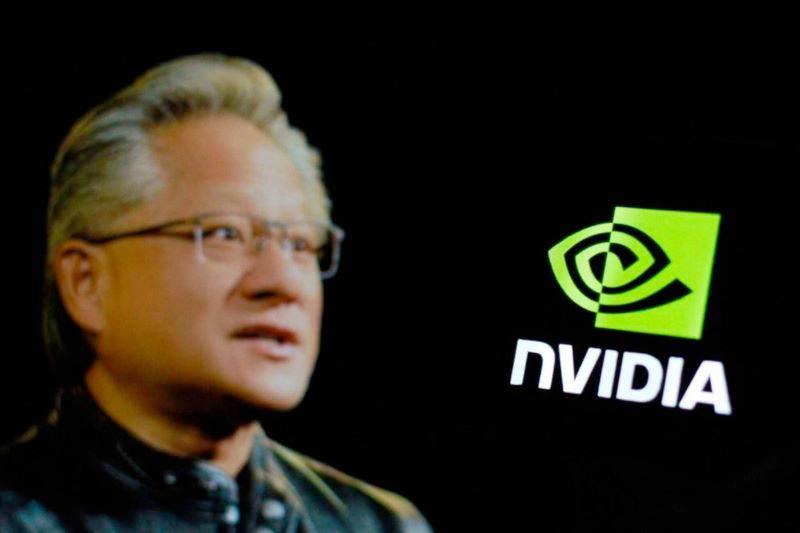

Nvidia (NASDAQ: NVDA) CEO Jensen Huang is accelerating the sale of his shares in the company at a time when the stock has witnessed volatility in recent weeks.

In the latest transaction, Huang sold $26.2 million of NVDA shares, bringing his total sales to over $104 million within 10 days, according to the Securities and Exchange Commission (SEC) filings.

Notably, Huang sold 960,000 shares between September 3 and September 11, 2024, covering four transactions, with sale prices ranging from $104 to $114 per share. The transactions generated over $104 million.

The executive’s offloading comes as Nvidia’s stock has been performing strongly, with a 52-week high of $140 and a current price of around $119.

Insider selling concerns

Despite the stock’s rally, insider selling might raise concerns, considering there have been no insider buys in the past year and 71 sales during the period. Interestingly, Huang and other insiders have been on a selling spree, getting rid of 6.87 million shares. At some point, insider trades accounted for 77% of the NVDA stock-selling frenzy, as Finbold reported in July.

The CEO’s consistent sales, especially following Nvidia’s growth in the artificial intelligence (AI) space, may fuel speculation that the stock has peaked. While insider selling doesn’t signal a decline, it may trigger questions about Huang’s outlook on the technology giant’s near-term outlook.

However, based on recent developments, Nvidia investors have every reason to be optimistic. For example, Huang has pointed out that the company’s chips are in strong demand, noting that customers are even concerned about whether the semiconductor giant can meet the supply.

In the meantime, Nvidia’s robust product pipeline, especially its anticipated Blackwell chips launch, is integral to this growing demand. The potential success of these chips could quell concerns about the stock’s bubble, considering that Nvidia stands to gain massive revenue. For instance, tech giants like Microsoft (NASDAQ: MSFT) and Meta Platforms (NASDAQ: META) have already placed orders worth billions of dollars.

Nvidia price analysis

After a rough start to September, NVDA began the second week of the month on a bullish note, recording gains of over 12% to trade at $119. Investors hope Nvidia can stabilize and reclaim the $120 resistance level as it seeks a new all-time high.

Looking ahead, stock market analyst Jake Wujastyk projected in a post on X on September 14 that Nvidia might be setting the stage for another price surge. He noted a recent Moving Average Convergence Divergence (MACD) crossover on the daily chart, which resembles a similar setup from mid-August, a period that preceded a sharp upward move.

A similar MACD crossover pushed Nvidia from the low $90s to over $130 per share within a few weeks.

If this pattern holds, Nvidia could experience another “face-ripping rally” in the coming week, potentially pushing the stock to new highs.

In summary, although Nvidia has seen increased insider selling, its outlook remains bullish as it continues to lead in its field. However, there is a need for caution, considering that Nvidia has seen its shares tumble in recent weeks after fears regarding the economy’s health and regulatory concerns around antitrust investigations.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.