Arthur Hayes is the co-founder of BitMex, a cryptocurrency investor, and an influencer with half a million followers on X. Recently bullish on Pendle (PENDLE), Hayes surprised the market by offloading over half his position far below the $10 target.

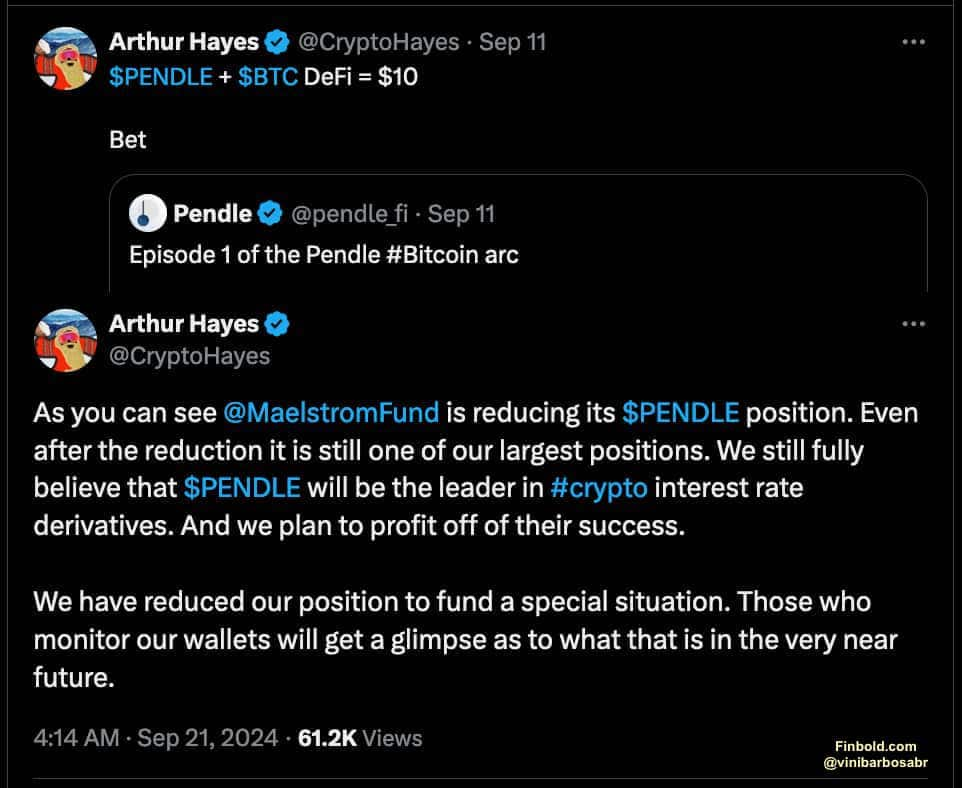

On September 11, Hayes made a bullish post on PENDLE, predicting a $10 target when integrated with Bitcoin (BTC) DeFi. Ten days later, however, he publicly disclosed that Maelstrom Fund, Arthur Hayes’s family office fund, was reducing its PENDLE position.

“As you can see Maelstrom Fund is reducing its PENDLE position. Even after the reduction it is still one of our largest positions. We still fully believe that PENDLE will be the leader in crypto interest rate derivatives. And we plan to profit off of their success. We have reduced our position to fund a special situation. Those who monitor our wallets will get a glimpse as to what that is in the very near future.”

– Arthur Hayes, on X

Notably, addresses linked to the investor had withdrawn all 1.65 million PENDLE from staking, depositing 918,556 to Binance. Lookonchain reported this activity a few minutes before Hayes’s public disclosure and a previous smaller sale on September 20.

Arthur Hayes sells $4.4 million worth of PENDLE after bullish post

In total, the investor sold 1.27 million PENDLE, worth $4.4 million, in two days – at around $3.46. This happened nine days after the bullish post forecasting the token would reach $10 when PENDLE was trading lower.

According to Lookonchain, this observed sale represents approximately 61% of the total holdings. As of reporting, Arthur Hayes still holds 820,000 PENDLE, worth $2.85 million, and represents Maelstron Fund’s largest position.

After disclosing the position reduction, one of Hayes’s followers commented he “shilled [PENDLE] for 30 minutes on stage” before dumping on his “exit liquidity.”

The investor is an active crypto businessman, publicly supporting different projects like Aptos (APT) or Ethena (ENA), as Finbold reported.

PENDLE price analysis

PENDLE is trading at $3.49 by press time, up 22.5% in the last 30 days. The decentralized finance derivative yield protocol crashed to $2.56 earlier this month but quickly recovered a few days later.

Interestingly, Hayes bullish-posted about the token during the first impulse and correction wave after the crash, with PENDLE priced between $3.23 and $3.09. His sales reportedly started once the asset crossed the $3.40 level for the second time, peaking at $3.72.

From lowest to highest, PENDLE surged by 20% since the investor predicted a $10 price target and partially offloaded holdings.

No matter the motivations, Arthur Hayes had to close over half of his fund’s positions below half his predicted target. This story is a cautionary tale for retail investors who blindly follow influencers and institutional calls. Proper research and solid planning are crucial to succeeding in finance markets, specifically in crypto.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.