The stock price of Broadcom (NASDAQ: AVGO), a manufacturer of semiconductor and infrastructure software products, has experienced a positive start in 2024, primarily fueled by the hype surrounding artificial intelligence (AI).

While it hasn’t delivered an outstanding performance like some of its competitors, such as Nvidia (NASDAQ: NVDA), AVGO remains a focal point for investors, particularly in assessing how significantly AI will impact the company’s prospects.

Year-to-date, AVGO has surged by approximately 24%, currently trading at $1,350, reflecting a 115% increase over the past year.

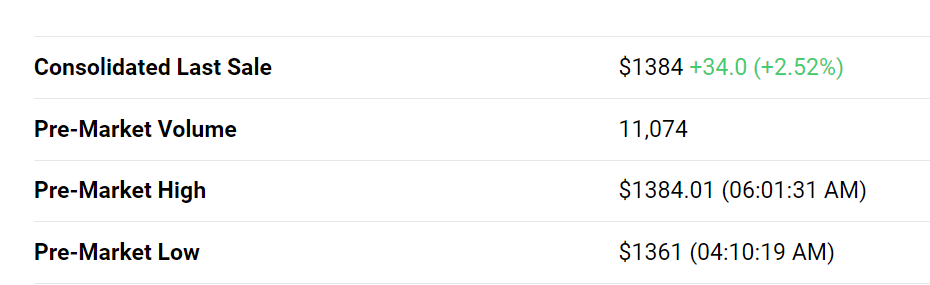

In the premarket on March 7, the stock exhibited positive gains of nearly 2.5%.

Despite benefiting from the AI surge, Broadcom remains susceptible to industry cycles, and the upcoming first quarter fiscal year 2024 could provide insights into what to anticipate. Broadcom is scheduled to announce its Q1 results after the bell on March 7.

Impact of Broadcom earning call

Ahead of the earnings call, analysts are projecting a year-over-year increase in both the top and bottom lines, with earnings per share of $10.42 on revenues of $11.72 billion. Last quarter, Broadcom reported revenues of $9.30 billion, up 4.1% year on year and in line with analyst expectations.

The semiconductor maker is expected to report a modest beat for its first-quarter results, driven by increasing AI sales and its cloud computing company VMware (NYSE: VMW) acquisition. Investors also expect the company to guide second-quarter revenue above market estimates.

Broadcom highlighted that generative AI revenue accounted for $1.5 billion in the latest quarter, constituting 20% of its semiconductor revenue or 16% of total revenue. This is a noteworthy figure, and the growth is partly attributed to the expanding use of AI accelerators within cloud infrastructure services.

Anticipating the upcoming Broadcom results, there exists a degree of ambiguity regarding expectations, given the company’s reliance on the projected growth of its revenue, particularly within the AI segment. It is essential to note that Broadcom is not traditionally associated with GPUs used in AI training, which are the primary computational demands for the technology. Instead, Broadcom’s strength lies in networking chips, which facilitate the collaboration of AI components.

The company has strategically introduced flagship products targeting the AI sector. For instance, in April 2023, Broadcom unveiled its Jericho3-AI fabric, specifically designed for high-performance connectivity in a 32,000 GPU cluster.

Wall Street’s take on AVGO

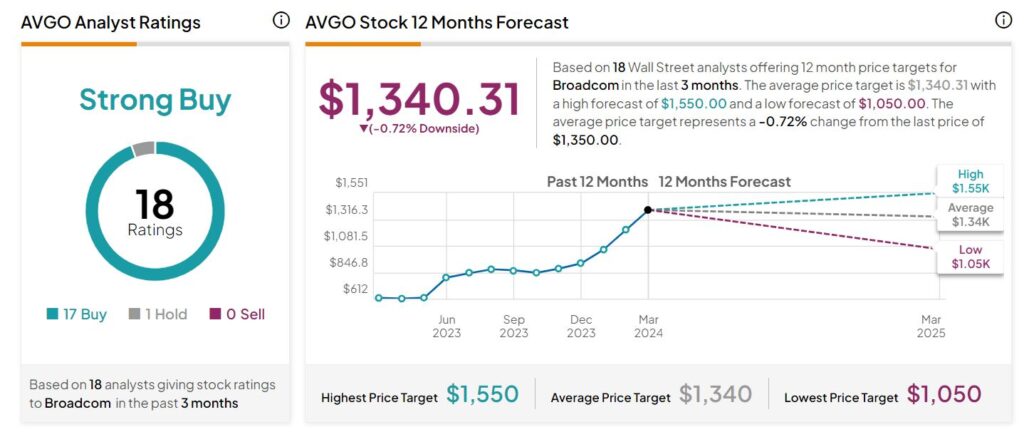

In the meantime, 18 Wall Street analysts at TipRanks see a minor downside to Broadcom stock but maintain a rating of ‘strong buy.’

Based on the stock’s last three months’ performance, AVGO is projected to trade at an average price of $1,340.31 in the next 12 months, representing a drop of 0.72% from the current valuation. The analysts set a high prediction of $1,550 and a low forecast of $1,050.

Given its positive long-term prospects, current indicators strongly suggest holding or buying Broadcom stock. Indeed, determining the AVGO’s trajectory after the earnings call poses a challenge. However, based on the performance of AI-related stocks in the market, it is likely that the Broadcom share price will respond positively to the results.

The optimistic long-term outlook is supported by factors such as Broadcom’s track record of consistently outperforming the market and its strategic position to capitalize on the growing AI market.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.