In a disappointing beginning to the year, Tesla’s (NASDAQ: TSLA) stock has seen a decline of -28.44% in value since January 1, with the potential for more losses appearing increasingly probable.

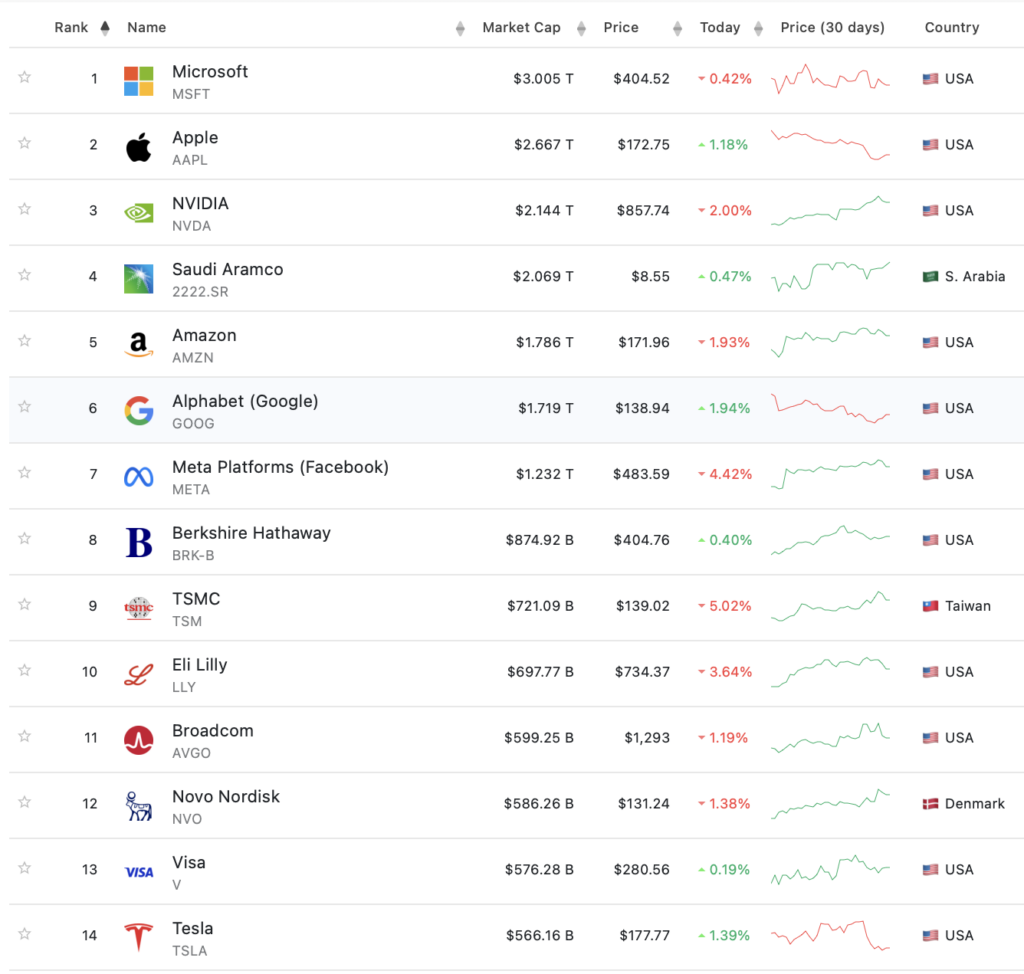

These losses have resulted in Tesla shedding over $200 billion in market capitalization during the same timeframe, bringing its current value down to $566 billion. Consequently, Tesla has dropped out of the top 10 companies by market capitalization, now holding the 14th position.

The lingering question is whether Tesla can reverse its fortunes or if TSLA supporters are in for a challenging journey ahead.

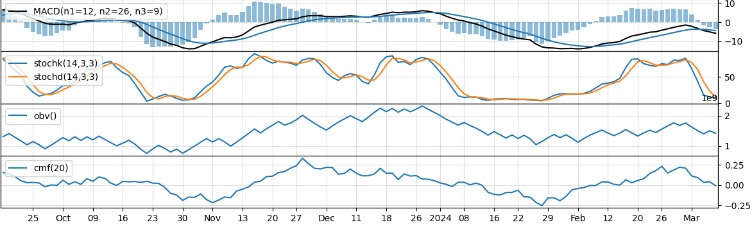

Technical analysis of TSLA stock

By scrutinizing the technical indicators for TSLA over the past five days, trends, momentum, volatility, and volume indicators offer a comprehensive overview of potential TSLA stock price movements in the upcoming days.

Considering the analysis of technical indicators, TSLA share price will likely continue to decline in the upcoming days. The overall trend, momentum, and volume signals collectively suggest a bearish path for Tesla stock.

Traders and investors are advised to proceed cautiously, potentially considering short positions or refraining from long positions until clear indications of a trend reversal emerge.

Analysts aren’t overly optimistic about TSLA stock

In addition to technical indicators, analyst sentiment considers real-world events, financials, and other pertinent factors that could impact TSLA stock. Unfortunately, there also appears to be a scarcity of positive news on this front.

Deutsche Bank lowered Tesla’s price target to $218 on March 11, anticipating significant misses in Q1 2024 deliveries and earnings. They attributed this to limited volume growth, profitability challenges from price reductions, and specific production issues.

Bernstein analyst Toni Sacconaghi reiterated a ‘Sell’ rating with a $150 price target on March 3.

Meanwhile, Citi analyst Itay Michaeli maintains a ‘Neutral’ rating with a $224 price target, waiting for a better entry point.

Technical indicators and analyst sentiment paint a grim picture for TSLA stock in the near future, advising investors to avoid it or to hold off until more promising “buy the dip” opportunities arise.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.