As silver enters its fourth consecutive year of supply deficit, driven by heightened demand in the technology and renewable energy sectors, the precious metal has made significant strides, surpassing $30 an ounce to hit the highest level in more than a decade.

Closing 6.5% higher at $31.49 an ounce on Friday, the precious metal has soared 32% this year, outperforming gold and becoming one of the best-performing commodities of 2024.

Silver’s remarkable performance is driven by surging investor interest, a supportive macroeconomic backdrop, and a projected fourth consecutive annual market deficit.

The price surge gained momentum on Friday, bolstered by positive sentiment in broader metals markets. Despite outpacing gold, silver remains relatively affordable, making it an attractive option for investors.

The two precious metals often move in tandem due to their similar macro- and currency-hedging properties. With gold reaching record highs fueled by central bank purchases, retail interest in China, and renewed bets on lower U.S. interest rates, silver has followed suit with silver having substantial and increasing industrial applications.

Demand surge and market dynamics

Silver’s rally is not solely speculative; it has strong industrial demand backing its rise. The metal is crucial for solar panels, and robust growth in the renewable energy sector is expected to push silver usage to record levels this year, according to the Silver Institute.

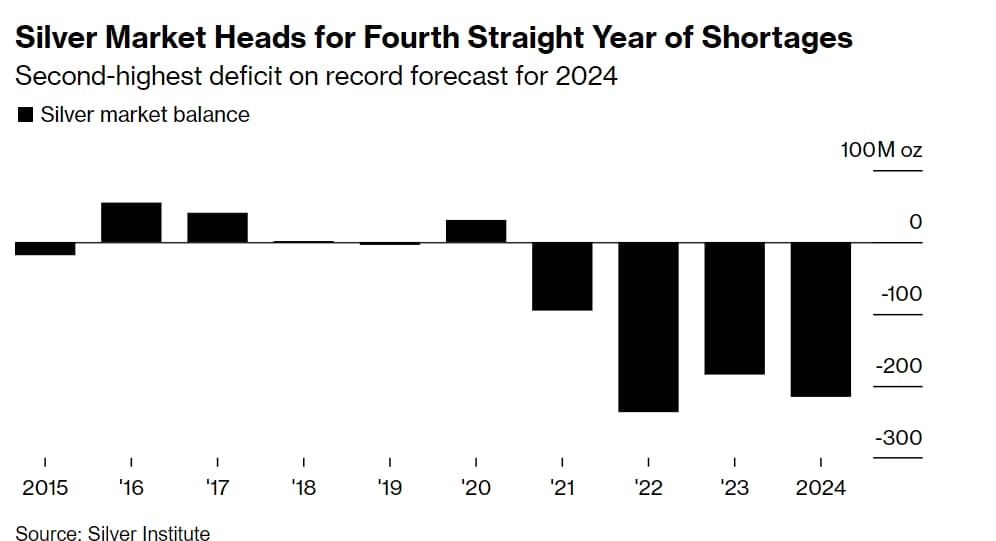

This growing industrial demand is leading to a fourth consecutive year of market deficit, with this year’s shortage projected to be the second largest on record.

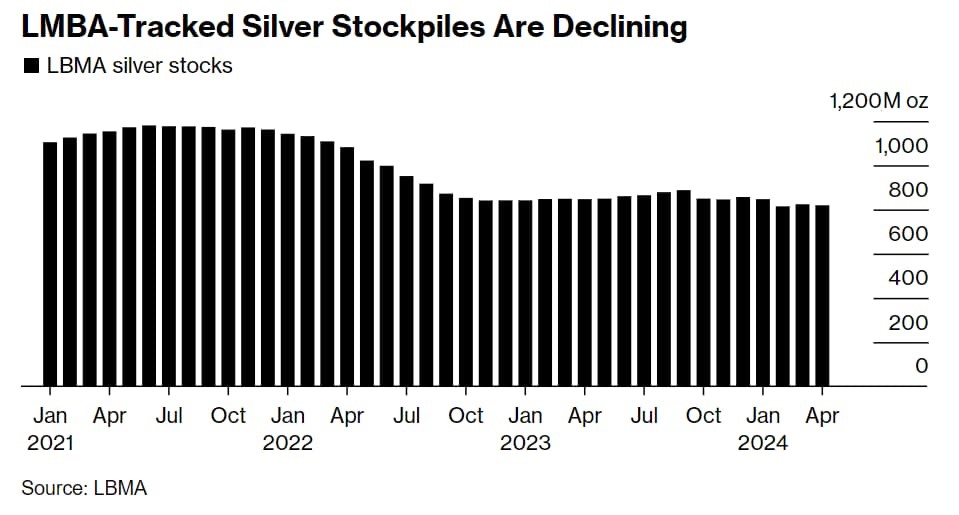

Industrial users, who typically rely on miners for supply, are increasingly turning to major inventories to meet their needs. Stockpiles tracked by the London Bullion Market Association fell to their second-lowest level on record in April.

According to a TD Securities research report, the availability of silver may soon take a sharp downward turn, and stockpiles could be depleted within the next two years if current demand continues.

To add to the optimistic outlook, Bloomberg’s senior commodities strategist Mike McGlone has shared a bullish perspective on silver, arguing it may only be a matter of time before the precious metal surpasses $30 per ounce, based on its previous action.

Additionally, U.S. economist Peter Schiff stated earlier that silver is performing better than Bitcoin as a hedge against geopolitical tensions.

Silver price analysis

Silver has posted a fresh multi-year high at $30.55. The 14-period Relative Strength Index (RSI) has shifted into the bullish range of 60.00-80.00, suggesting that bullish momentum has been triggered.

Year-to-date (YTD), silver has shown a pronounced increase of 32%, with its current price reflecting its dual appeal as both a monetary asset and a critical component in various industrial applications.

Given its substantial industrial demand, significant supply deficits, and strong price performance, silver appears poised to outperform gold by 2024.

This points to a significant window of opportunity for investors and industry stakeholders to capitalize on silver’s increasing indispensability in sustainable technologies.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.