After a year of stabilization and great market performance, which saw index funds and stocks trade near their all-time highs or surpass them, 2024 looks optimistic for traders and investment analytics alike.

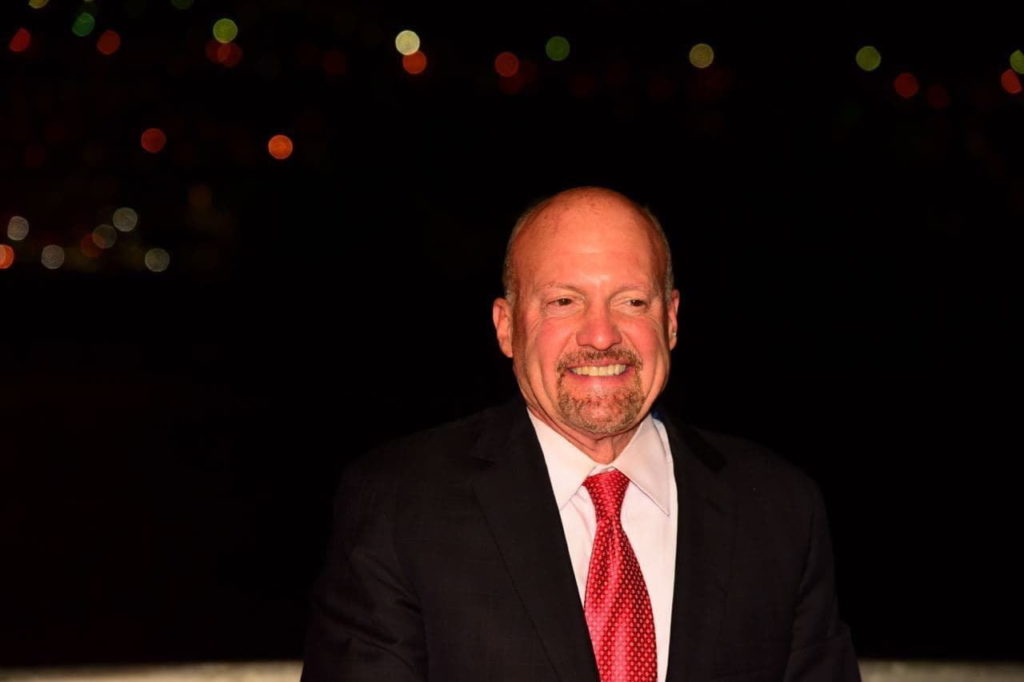

Amidst the static interest rates and the potential for multiple rate cuts in 2024 by the Federal Reserve (FED), Jim Cramer, known for his dynamic persona and outspoken perspectives on stocks and market dynamics, has offered his insights on the latest developments.

In a section of his popular show Lighting Round shared on X by stock reporter Wall Street Silver on December 28, Cramer weighed the positives and negatives and mentioned the recession.

“Powell seemed jubilant because we got a strong labor market where more people enter the workforce, which means wages will not soar. He didn’t say we got a soft landing, but we did indeed get a soft landing. So, with today’s news and interest rates at our feet, we now have the wind on our backs for some, not all, stocks.”

Twitter users are pessimistic about the 2024 market outlook

In a notable counter-trend movement gaining popularity, Cramer’s remarks have triggered bearish sentiments regarding the recession on X’s social platform.

“Oh, Christ… here comes the Great Depression 2.0,” responded one user.

“Cramer is the ultimate contra trade. This means we are “going down hard,” added another.

Surprisingly, Cramer didn’t shift his stance as he previously did in the past, with the most recent example of Bitcoin.

As a matter of fact, just a month ago, he agreed with the strategists from Bank of America, projecting the S&P 500 to reach 5,000 in 2024, by saying:

“Broadly speaking, I actually agree with Savita Subramanian at Bank of America that we could go to 5000 on the S&P,” he said. “But other than sentiment being way too negative, I’m non-committal about what could get us there, at least for now.”

Whether the popular trend of “reverse Cramer” will prove true once again and lead us to a year of economic downturn remains to be seen. One thing is sure: investors are not overly optimistic after these comments.