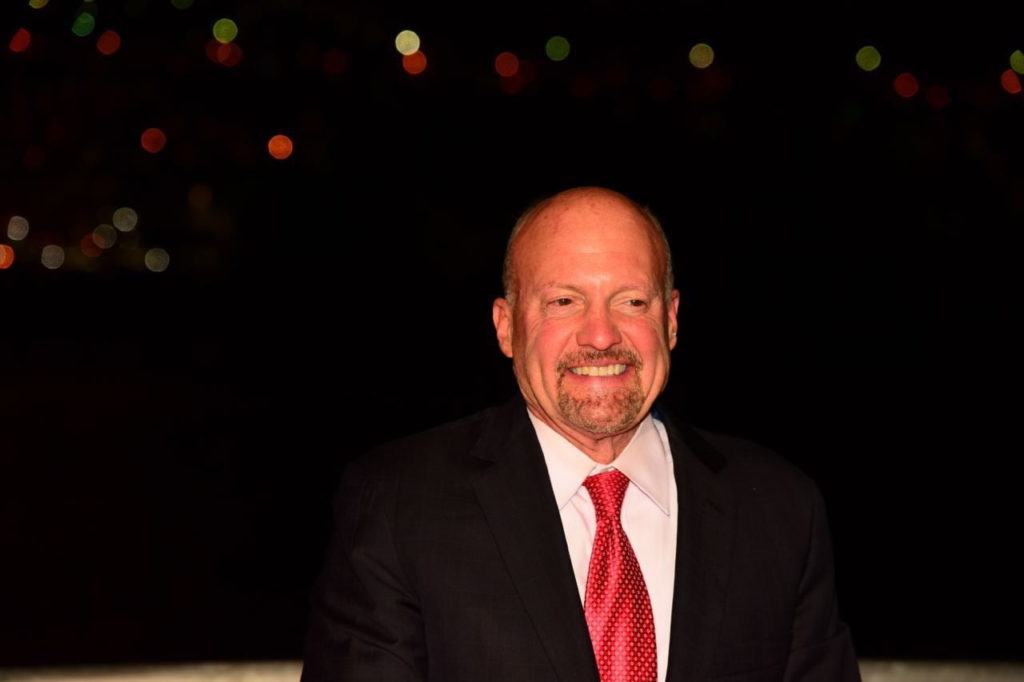

Jim Cramer recognized widely for his dynamic presence and bold takes on stocks and cryptocurrencies, brings a blend of entertainment and insight to the financial world.

Beyond his role steering the high-energy show “Mad Money” on CNBC, he has worn many hats, from orchestrating market strategies as a former hedge fund manager to penning his thoughts as an author.

In a tweet on X on November 3, stock reporter, Evan, shared Cramer’s another bold opinion that is likely to spark extensive debate on social media on Realty Income Corp (NYSE: O) stock, where he “still thinks it is a buy.”

Notably, the stock has experienced a negative yearly change of -22%.

Twitter calls for shorting on Realty Income stock after Cramer’s comments

In what seems to become a popular inverse trend, Cramer’s optimistic comments have sparked an avalanche of bearish comments against O’s stock.

“Time to close my position… why this one, Jim?” wrote one X user.

Similarly, another user commented, “That means.. another 50% drop. Maybe more! DCA in from below $25.”

Whether it is pure sarcasm or not, these comments draw their argument from Jim Cramer’s controversial opinions, turn out to be entirely off the mark, and end up working in reverse of the given prediction on the stock market.

His most notable recent misjudgments include Bitcoin (BTC), Nvidia (NASDAQ: NVIDIA), and Tesla (NASDAQ: TESLA). This led many investors to employ an “inverse Cramer” strategy, which is based on doing the opposite from the Mad Money’s host suggestions.

Realty Income price analysis

At the time of press, O’s stock is being traded at $50.03 per share, with a positive change of 4.25% in the past 24 hours, and has been priced as low as $48.75 in this same period. Moreover, Realty Income stock value experienced a negative yearly change of -22%.

But this time, Cramer might be right. With a portfolio of 13,118 commercial properties and a market cap of $34 billion, this REIT is expanding rapidly. Furthermore, it generates reliable cash dividends and has earned the name “The Monthly Dividend Company.”

Buy stocks now with Interactive Brokers – the most advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.