Nvidia (NASDAQ: NVDA) has recently seen increased insider trading activity, catching the attention of investors keen to understand the implications for the stock’s future performance.

Currently, Nvidia’s stock is attempting to reclaim the $110 resistance level. As of the close of markets on August 9, the stock was trading at $104, reflecting a 0.2% loss over the past 24 hours. However, on the weekly chart, NVDA is up 13%.

Key Nvidia price levels to watch

As the market prepares for the upcoming week, several key price levels have emerged as critical points to watch. Notably, according to an analysis shared by stock trading expert Vnkumar Trades in an X post on August 11, the $102.5 level is identified as a crucial support zone for Nvidia ahead of the August 12 market opening.

Should the stock price dip below this level, it could signal further downside potential, prompting a reevaluation of short-term bullish positions. Conversely, resistance levels are identified at $108, $110.2, and $113. The $108 level represents the first line of resistance, and a break above it could indicate a shift in momentum, potentially driving the stock higher.

The $110.2 level is particularly significant as it lies below the 50-day exponential moving average (EMA). A sustained move above this point could encourage bullish sentiment. At $113, the 50-day EMA serves as a critical barrier. If Nvidia’s stock price can close above this level, it may signal the beginning of a more extended rally, attracting additional buying interest.

Nvidia’s accelerating insider trading activity

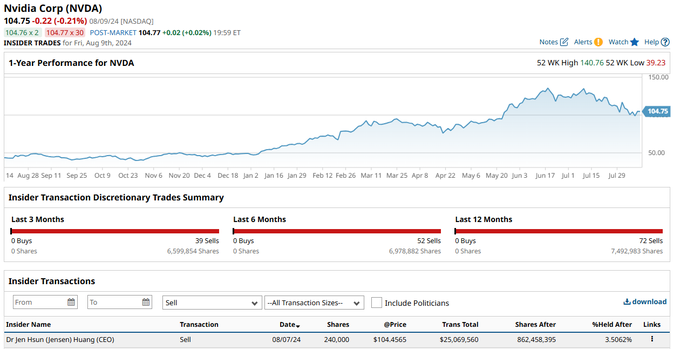

This analysis emerges as Nvidia continues to experience increased insider trading activity. Data provided by the charting platform TrendSpider in an X post on August 10 indicates that selling activity has accelerated in recent months, particularly during the stock’s peak around mid-2024.

Among the notable figures involved in trading the stock is CEO Jensen Huang. His latest transaction involved selling $25.1 million worth of Nvidia shares. This significant sale, executed on August 7, 2024, involved the sale of 240,000 shares at an average price of $104.4 each. This sale adds to a growing trend, with Huang having sold over $550 million in Nvidia shares over the past two months.

Over the last 12 months, there have been no insider buys but 72 sells, amounting to nearly 7.5 million shares. This pattern may indicate that insiders believe the stock has reached or is nearing its peak valuation.

While insider selling is common, the frequency and timing of these transactions raise questions about the confidence level among those closest to the company’s operations. Nvidia has seen substantial gains over the past year, driven by its dominance in the artificial intelligence (AI) and gaming sectors, pushing its stock to new highs. However, the accelerated pace of insider selling, especially during these high points, might signal concerns about sustainability or simply a strategy to lock in profits.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.