The cryptocurrency open interest volume has skyrocketed to record highs, bringing huge volatility to derivatives and spot markets. While traders bet on the outcome of cryptocurrencies like Bitcoin (BTC) and XRP, they leave positions behind, threatening liquidations.

In particular, the current bullish momentum has fueled traders’ greed and encouraged the opening of long positions. This trend is gaining strength, and multiple indicators suggest a long squeeze could be incoming for top-traded assets.

Finbold turned to different sources and found relevant long-squeeze alerts in the market, with special attention to the leading cryptocurrency, Bitcoin.

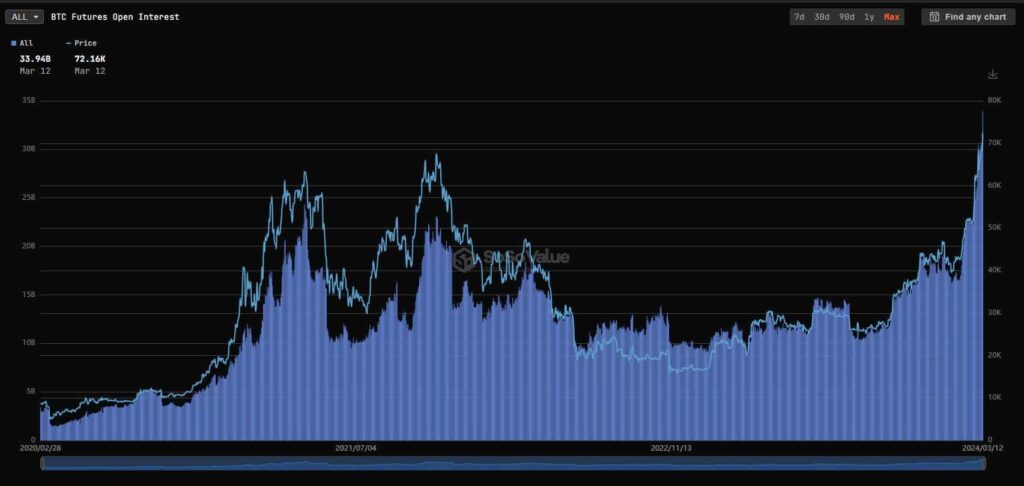

Bitcoin (BTC) open interest and funding rates at all-time highs

Notably, the well-known crypto journalist Colin Wu reported a record high of $33.94 billion in Bitcoin open contracts. This marks a new all-time high (ATH), more than $10 billion superior to the previous ATH of $23.04 billion of open interest in BTC.

On that note, Bitcoin reached the previous high in November 2021, right at the end of the last cycle’s rally.

Moreover, the leading cryptocurrency’s funding rate on major exchanges also made new highs. Therefore, such an inflated funding rate increases the threat of a long squeeze due to extreme imbalances.

Liquidity pools in CoinGlass’s monthly liquidation heatmap suggest $50,000 as a likely retracement target in the occurrence of a long squeeze. However, Bitcoin is shaping price support at $69,000, as the previous all-time high and resistance.

XRP

Looking at other cryptocurrencies’ liquidation status, XRP surges as the second-most likely crypto to long squeeze. Nevertheless, its liquidity pools are far smaller than Bitcoin’s; thus, non conclusive.

XRP could retrace to the $0.5 price level if market makers hunt these long positions.

In summary, Bitcoin and XRP traded at $73,000 and $0.685 by press time, respectively. Under the proper conditions, a long squeeze could cause both cryptocurrencies to fall to as low as $50,000 and $0.50.

Still, the crypto landscape is unpredictable and highly volatile, meaning this scenario can change anytime. Positive news and developments could keep these projects strong this week, fueling higher prices instead of lower ones. Investors must trade cautiously and avoid over-exposure in any direction.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.