The electric vehicle (EV) industry has had a slow start to the year, with many of its major players facing difficulties and some teetering on the brink of bankruptcy. However, there seems to be a glimmer of hope for at least one of them, as Lucid (NASDAQ: LCID) stock jumped 5% in a single day following an announcement of a new deal.

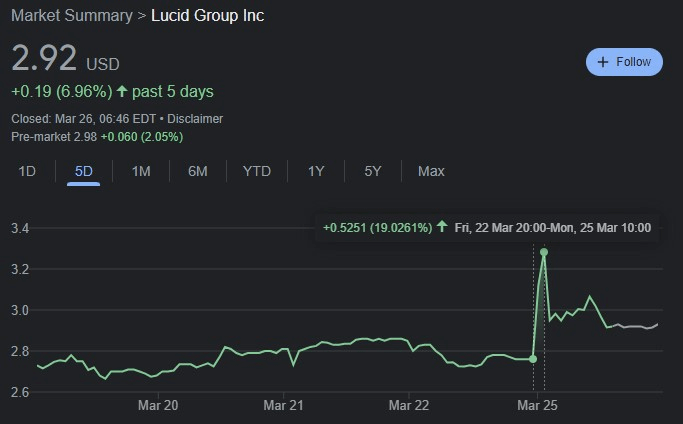

Precisely, Lucid is raising $1 billion in capital from an affiliate of Saudi Arabia’s Public Investment Fund, sending the shares of the luxury electric carmaker up nearly 20% in early trading before coming back down and settling on $2.92 at market close for a 5.42% daily gain.

After additional gain in the pre-market trading amounting to 2.74%, Lucid stock reached the $3 threshold.

Ayar Third Investment Company, a PIF affiliate, will buy $1 billion in convertible preferred stock and will be able to convert the preferred stock into about 280 million shares, according to a regulatory filing with the US securities regulator.

Can this investment stave off a heap of Lucid problems?

Despite the recent substantial investment, there is still a growing list of worrying factors with Lucid Group’s vehicle production remaining modest, hinting at a limited delivery volume (just 6,001 units in all of 2023).

CEO Peter Rawlinson openly acknowledged the company’s significant cash burn rate, estimated at around $1 billion per quarter, indicating a precarious cash position. With only $4.42 billion in cash reserves at the end of last year, the recent investment might not prove enough.

Interestingly, Lucid Group’s Arizona factory can manufacture 90,000 vehicles annually, a striking contrast to the anticipated production of only about 9,000 EVs in 2024. This glaring disparity suggests potential financial strain.

Other EV producers aren’t so lucky

Following the termination of talks with an unnamed automaker, Fisker (NYSE: FSR) revealed on March 25 that it is exploring strategic options. These options include in- or out-of-court restructurings, such as bankruptcy, as well as capital markets transactions.

Later in the day, the New York Stock Exchange announced its intention to delist Fisker’s stock due to ‘abnormally low’ price levels. This delisting requires the company to offer to buy back bonds due in 2026 and immediately settle other debts due in 2025, as outlined in a filing with the Securities and Exchange Commission (SEC).

The question remains whether the current investment is merely delaying the inevitable and whether Lucid will join Fisker as another failed attempt in EV production.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.