While machine learning and artificial intelligence (AI) algorithms have previously predicted an optimistic picture of significant gains for Solana (SOL), the current outlook seems to have taken a less optimistic turn.

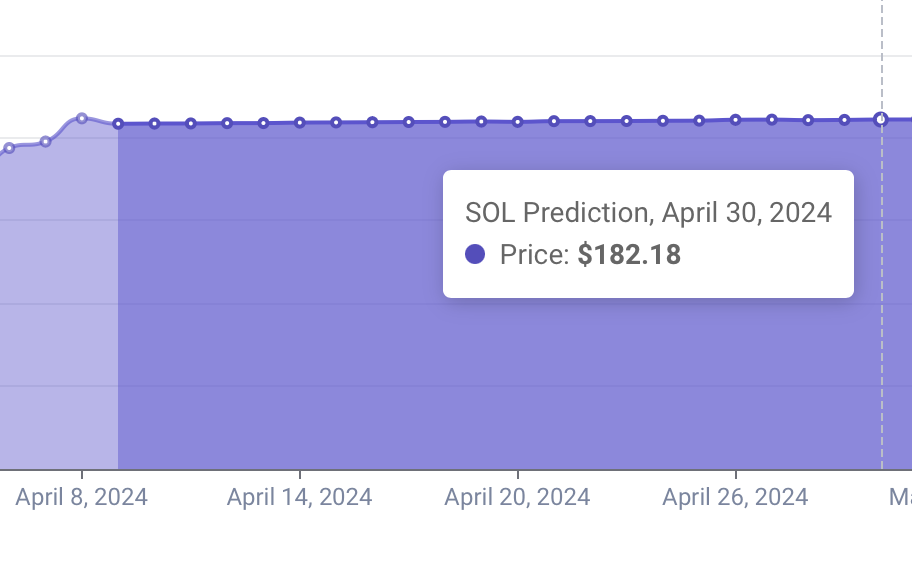

Forecasts for April 30 suggest only a small drop to $182.18. Such minimal change indicates a potential stall in Solana’s growth trajectory, even as the broader cryptocurrency market shows signs of rebounding.

Several factors could be contributing to this stagnation. A major concern is Solana’s ongoing struggle with network outages.

Over the past week, the Solana blockchain has been plagued by significant issues and congestion problems, issues that have long been a thorn in the network’s side.

The increasing number of users and their on-chain activity, particularly with the rise of meme coins and transactions on decentralized exchanges (DEXes), largely attributes to this congestion.

The combination of downgraded price predictions and persistent network issues raises serious concerns for Solana’s future trajectory.

Though unforeseen events or positive developments could still trigger a price surge before the end of April, based on current information, investors should brace themselves for a potentially flat, or even bearish, month for Solana.

Solana price analysis

At press time, Solana’s price sits at $183.40, facing the possibility of a stall in its growth trajectory. It’s down by a mere 0.09% for the day and by 7.70% over the past week.

However, it still maintains a 23.60% gain on the monthly chart, according to Finbold data.

The critical question looming is whether Solana can hold onto these gains. Recent network issues have reignited concerns, and persistent congestion without viable solutions could degrade investor confidence, potentially leading to a decline in price.

Can Solana regain investor confidence?

In the face of transaction failures and an unreliable network experience, users and investors are increasingly turning their attention to Solana’s competitors.

Notably, Solana’s recent market traction stemmed largely from Ethereum‘s poor user experience plagued by high fees and low scalability.

However, with Solana facing its own network difficulties, the question remains: can it regain investor confidence and solidify its position in the ever-evolving blockchain landscape?

The long-term effects of the congestion on SOL’s price remain to be seen. It’s worth noting that the asset has risen in price despite previous network outages.

Ultimately, the price trajectory will also depend on broader market sentiment, which can be difficult to predict.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.