In a week marked by significant turbulence, ‘Magnificent Seven’ stocks experienced a notable decline, diverging sharply from their typically robust performance.

This downturn reflects broader market fluctuations and raises questions about the sustainability of their growth in the face of economic uncertainties.

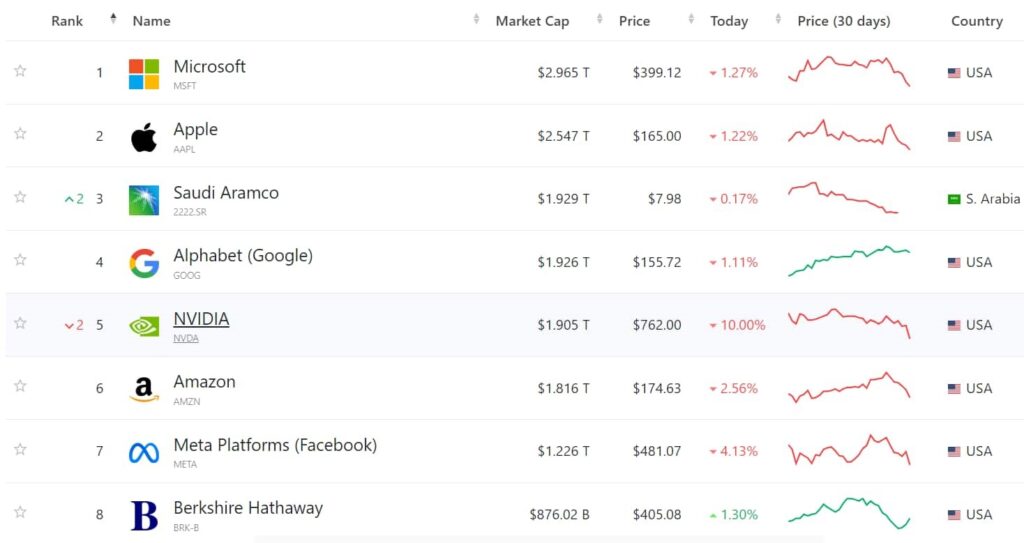

The group, comprising Meta Platforms (NASDAQ: META), Amazon (NASDAQ: AMZN), Apple (NASDAQ: AAPL), Netflix (NASDAQ: NFLX), Alphabet Inc (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT), and Nvidia (NASDAQ: NVDA), saw their values drop significantly.

While the broader indices like the Dow Jones Industrial Average managed a slight increase of 0.5% by week’s end, the Nasdaq Composite dropped by 5.5%, underscoring a tough week for tech stocks.

Company-specific setbacks and standouts

Tesla’s shares plummeted over 12% following a major recall of its Cybertruck model and disappointing first-quarter delivery figures, making it the biggest weekly percentage decliner. However, Apple, Microsoft, and Nvidia were larger contributors to the market-cap losses due to their substantially higher overall market values. Notably, Nvidia was the biggest market-cap loser, shedding almost $300 billion according to the data from Companies Market Cap

Nvidia, in particular, faced intense pressure, with its shares falling 13.6% this week as the broader semiconductor sector came under strain. This drop marked Nvidia’s worst weekly performance since a 16.1% decline on September 2, 2022, emphasizing the volatility faced by the semiconductor industry.

Netflix also saw an 11% drop after its decision to halt the reporting of detailed subscriber metrics post-2025, a move that sparked investor concerns over future growth visibility. Despite the overall downturn, Nvidia stood out positively earlier in the year, buoyed by ongoing strong demand for its AI and data center technologies, marking a 126% increase in year-over-year revenue.

U.S. economist Peter Schiff’s remarks highlight the significant disparities in performance between sectors:

The NASDAQ tanked 5.5% on the week, finishing with a 2% drop on Friday. In contrast, the Dow Jones rose 0.5% on Friday, eking out a tiny gain on the week. That’s a significant value/growth divergence.

Peter Schiff

This observation points to the ongoing volatility in growth stocks, particularly in the technology sector, as opposed to value stocks.

Year-to-Date performance analysis

Year-to-date, the performance of these tech giants has been a mixed bag, reflecting the challenges and uncertainties of the current economic environment. Tesla, for instance, has seen a significant decrease of 40% in its stock price, primarily due to operational issues and market sentiment.

On the other hand, Nvidia has shown remarkable resilience and growth year-to-date, attributed to its cutting-edge innovations and robust demand for AI technologies, which continue to drive its market value higher despite broader market pressures.

As the year progresses, the ‘Magnificent Seven’ will likely continue to face headwinds from both macroeconomic factors and sector-specific challenges. Their ability to adapt to these challenges will be critical in determining their position and performance in a rapidly changing market landscape.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.