Despite many members of the U.S. Congress recording profits on their stock trades, some, like Republican Congresswoman Marjorie Taylor Greene, continue to record negative performances in their stock portfolios.

On October 22, 2021, Marjorie Taylor Greene purchased shares in Digital World Acquisition Corp. (DWAC) shortly after the merger announcement. According to her official financial disclosure filings, the investment amounted to $50,000. On the day of her purchase, DWAC stock opened at $118.80 and closed at around $67.

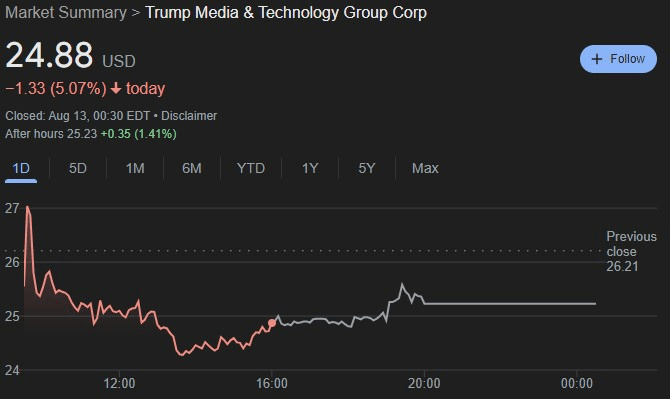

Considering that Trump Media (NASDAQ: DJT) stock has closed the latest trading session at $24.88, the Representative from Georgia’s investment might have now lost up to 79.06% on her initial investment.

What caused the slump in DJT stock price?

On August 9, after the markets closed, Trump Media reported its Q2 earnings report, which revealed a loss of $16.4 million in the previous quarter, mostly due to legal expenses from the merger with Digital World Acquisition Corp.

Furthermore, the company reported revenue of just $836,900, which is extremely low for a company with a market capitalization of $4.7 billion.

Former President Donald Trump‘s posting on X on August 12 might have further aided the decline in DJT stock price, which is considered a rival to his “Truth Social” after a nearly 3.5-year hiatus.

This news might have caused the slump in DJT stock price, which fell to its lowest valuation since April 16, two weeks after its initial public offering (IPO).

Greene recorded a loss on her other purchases as well

The example of Greene’s CrowdStrike (NASDAQ: CRWD) stock acquisition worth up to $15,000 is still fresh in traders’ minds after the purchase was conducted on June 24; it lost 34% of its value since, mainly due to the worldwide outage caused by a faulty update by CrowdStrike.

The Republican Congresswoman’s most recent purchase of Dell (NYSE: DELL) stock, which amounted to $15,000 on July 23, is also in the red after it fell 20.50%, a part of the broader trend that has seen a significant drawback in the technology sector.

Perhaps the largest loser in her stock portfolio is the acquisition of Intel (NASDAQ: INTC) stock on June 10, 2022, for up to $15,000. Since then, the stock has recorded a negative performance of 87.37%, mainly due to a struggle to capture a meaningful market share in the semiconductor sector and the most recent news of cutting 15,000 of its global workforce in an attempt to restructure.

Whether it is purely bad timing or not, Greene’s most recent purchases are mostly trading in the red right now, making her portfolio one of the weaker performers in the U.S. Congress.

Buy stocks now with eToro – trusted and advanced investment platform

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.