The controversial Representative of Georgia’s 14th congressional district, Marjorie Taylor Greene, has had mixed results when it comes to her stock market investments.

For most of 2024, the congresswoman was one of the most unsuccessful trades on Capitol Hill — to the point where some market commentators were even proposing an ‘inverse Marjorie’ strategy, referencing the infamous ‘inverse Cramer’ exchange-traded fund (ETF).

However, her fortunes changed for the better by the close of the year. The divisive U.S. politician made a pivot toward big tech stocks, and for a while, most of her new acquisitions saw impressive gains.

Moreover, MTG seems to have intensified her investments — as she bought roughly $400,000 worth of stocks in February alone. This time around, she seems to have mistimed the market.

Finbold’s congressional trading radar recently picked up a March 9 periodic transaction report. With resurgent worries regarding a potential recession, Marjorie Taylor Greene has updated her stock portfolio — and one of her newest picks has seen quite a significant move to the upside.

Receive Signals on US Congress Members' Stock Trades

Stay up-to-date on the trading activity of US Congress members. The signal triggers based on updates from the House disclosure reports, notifying you of their latest stock transactions.

Tech, Bitcoin, and discount retail — what Marjorie Taylor Greene has been buying

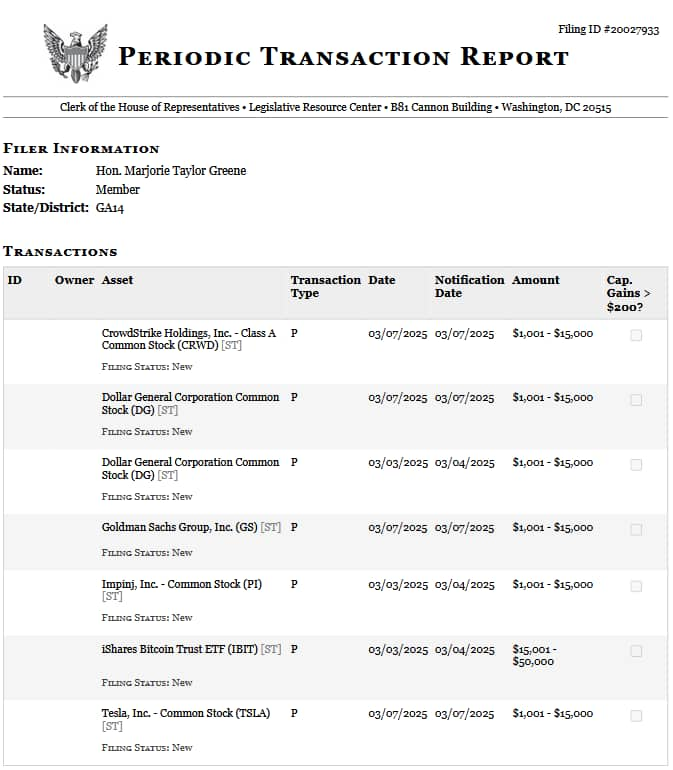

The Congresswoman purchased between $1,001 and $15,000 worth of Crowdstrike stock (NASDAQ: CRWD) and Tesla stock (NASDAQ: TSLA) on March 7. In addition, she invested the same amount into radio device and software company Impinj (NASDAQ: PI) and finance giant Goldman Sachs.

The Representative’s largest purchase, saw a $15,001 to $50,000 investment in the iShares Bitcoin Trust ETF (IBIT), which tracks the performance of Bitcoin (BTC) by directly holding the leading cryptocurrency.

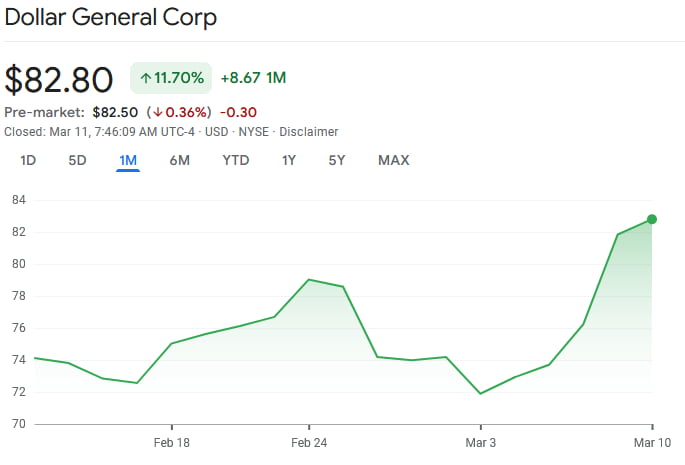

MTG successfully absorbed a recent DG stock surge

That was not the most interesting trade made by Marjorie Taylor Greene, however. The Congresswoman also bought Dollar General stock (NYSE: DG) on March 3 and March 7. Each trade was valued between $1,001 and $15,000.

At the time of the first purchase, DG stock was changing hands at a price of $71.89. By the time of her second acquisition, the price of Dollar General shares had increased to $81.84.

As of the time of writing on March 11, Dollar General stock was trading at $82.50 in the pre-market trading session. That equates to a 14.75% surge since her first purchase, and a 0.80% surge since her second. With both of the trades being of equal size, Marjorie Taylor Greene’s bet on the discount retailer has netted a 7.75% return on the whole — in a matter of days.

While investing in a discount retailer with a looming recession on the horizon isn’t particularly suspicious on its own, like all members of Congress, Greene possesses an informational edge over the general public — and the timing of her purchase is particularly auspicious.

Featured image via Shutterstock