Bitcoin (BTC) is once again flirting with the possibility of reclaiming a new record after successfully breaching the $65,000 resistance mark.

As the maiden cryptocurrency seemingly benefits from the euphoria around the latest United States inflation data, technical indicators suggest that a new record high for Bitcoin is on the horizon.

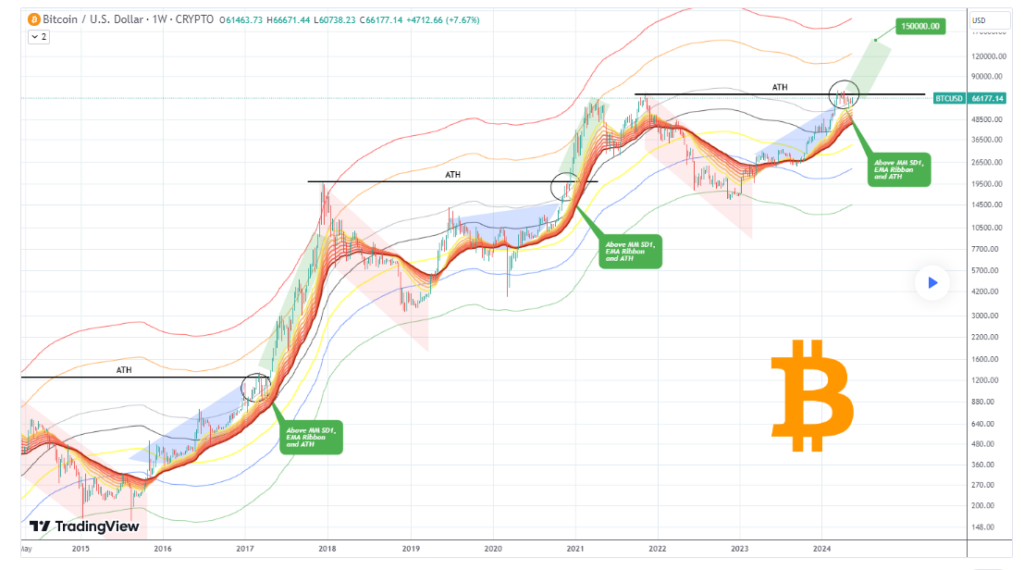

Particularly, in a TradingView post on May 16, crypto trading expert TradingShot suggested that Bitcoin might be in line to clinch the $150,000 target by August 2024.

The analyst pointed out that Bitcoin has shown signs of resurgence, buoyed by a recent 25% correction which the expert deemed as normal within bull cycles.

TradingShot also observed that Bitcoin had closed above the one-day moving average 50 (MA50) after two consecutive rejections, indicating that Bitcoin’s upward trajectory seems promising.

The trading expert also reviewed Bitcoin’s long-term chart, particularly the one-week timeframe, where the crypto appears to be at a cyclical stage. Historically, during similar cycles, Bitcoin has embarked on its most aggressive rallies.

Technical levels to watch out for

Therefore, TradingShot stated that Bitcoin’s recent bounce on the exponential moving average (EMA) ribbon, coupled with its recovery of the mayer multiple SD1, indicates positive momentum.

Drawing from these indicators, the analysts suggested that Bitcoin’s next target could be $150,000 by August.

“As you can see, BTC rebounded on the EMA Ribbon, after making a new All Time High (ATH) while also recovering the Mayer Multiple SD1 from above. When those parameters got met in the past, Bitcoin always touched at least the MMB SD2 from above. Based on that, the next Target on this run is $150,000,” the expert said.

Bitcoin’s breakout inevitable

On the other hand, another crypto expert, Michaël van de Poppe, suggested in a May 16 post on X (formerly Twitter) that an upwards trajectory for Bitcoin was inevitable based on its recent recovery.

He noted that Bitcoin’s steady rise would instill renewed confidence in the cryptocurrency markets. As Bitcoin continues its ascent, Poppe suggested that attention is shifting to altcoins, which are expected to benefit significantly from this positive market sentiment.

It’s worth noting that renewed interest in BTC comes after the latest inflation figures were released. According to the data, the core inflation rate fell to 3.8% year-on-year, its lowest level in three years.

These figures have ignited speculation that the Federal Reserve might finally enact an interest rate cut, with some market participants projecting that the cut might come as early as July.

In the meantime, the flagship digital asset continues to be buoyed by several bullish elements likely to sustain its momentum. For instance, CME Group, the world’s largest futures exchange, is reportedly planning to unveil Bitcoin trading to capitalize on the growing interest in the asset by Wall Street.

Bitcoin price analysis

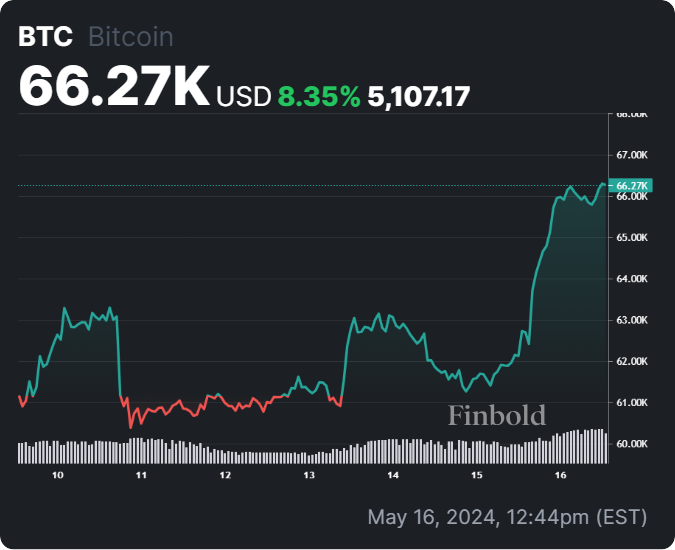

By press time, Bitcoin price today is trading at $66,270 with daily gains of almost 6%. On the weekly timeframe, BTC is up 8%.

Having breached the $65,000 resistance, Bitcoin is well-positioned to reach the $70,000 mark en route to a new all-time high. This trajectory will be aided if the historical post-halving rally kicks in.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.