The layer-1 cryptocurrency developed by former Meta (Facebook) engineers, Aptos (APT), may face a massive sell-off after April 12, Friday. That is due to a scheduled token unlock worth nearly $300 million, which may cause significant supply inflow to exchanges.

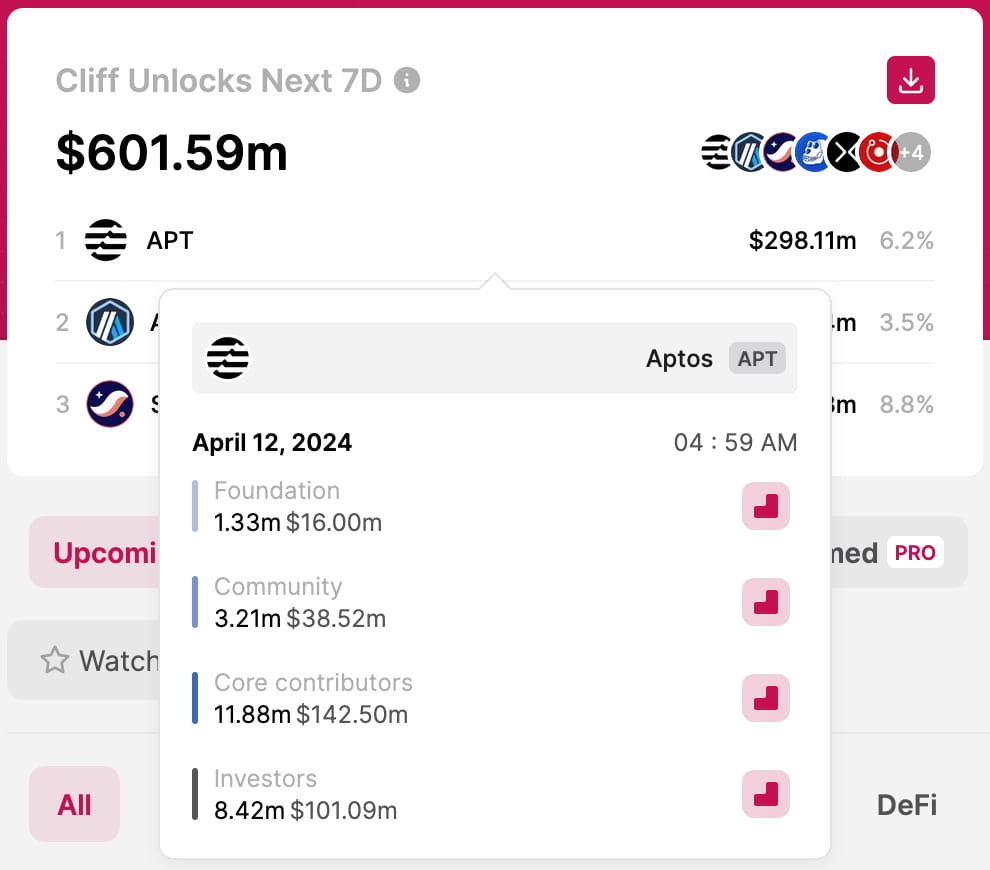

Notably, vesting contracts will unlock 24.84 million APT by the end of the week, worth $298.11 million. This, according to TokenUnlocksApp data, represents 6.2% of Aptos’s market capitalization, which evidences its event’s relevancy for cryptocurrency traders.

In particular, ‘Core Contributors’ and ‘Investors’ will receive 81.7% of the unlocked tokens, summing up to 20.3 million. These entities will receive 11.88 million and 8.42 million APT, respectively. Meanwhile, the ‘Foundation’ and the ‘Community’ will receive the remaining 4.54 million APT – 1.33 million and 3.21 million each.

Picks for you

Furthermore, this token unlock is nearly 50% of all the $601.59 million cliff unlocks for the next seven days. Cryptocurrencies like Arbitrum (ARB), Starknet (STRK), ApeCoin (APE), and Render Network (RNDR) make up the other half.

Aptos (APT) price analysis amid a $300 million token unlock

It is worth noting that Aptos traders already started selling off days before the reported token unlock. Interestingly, APT reached a local high of $19.34 per token on March 26, trading in a downtrend since then.

A key point for the cryptocurrency was between April 3 and 8, testing the 50-day exponential moving average (EMA) support. Aptos failed to hold this level around $13.5 and registered a drop, leading to current prices at $11.83.

Now, the token could be heading toward two spotted supports in its daily chart against the dollar. One is at around $9.50 and the following meets the psychological round number of $8.00.

Therefore, these isolated targets make for a potential price range APT could visit after the $300 million token unlock sell-off.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.